Last week’s post raised the curtain on average wholesale and retail hearing aid pricing with the data in Figure 1, but it did not address average retail price of premium instruments. That’s a crucial part of the Price puzzle because that’s where most of the wholesale increase is occurring. Two big questions were left unanswered:

- How much of the higher cost of premium goods is being passed on to consumers?

- Which consumers are paying for the higher costs?

Premium Pricing

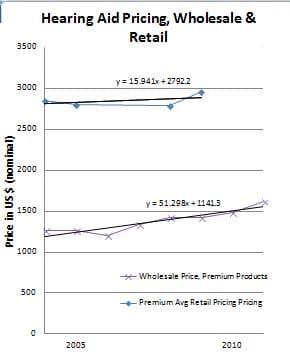

The data are sparse and tricky to compare, but Figure 2 takes a stab at it. Once again, premium wholesale price is shown as a function of time. Average retail price data (such as it is) is now the top curve.{{1}}[[1]]Retail premium price data extracted from the Hearing Review 2006 Dispenser Survey and a 2010 Hearing Journal Dispenser Survey.[[1]] More data would help make this Figure more convincing and allow more detailed discussion, but this much can be said:

- The retail function is flat over time, showing a markup of about $1500/aid.

- Gross profit margins are about 50%, ranging from 49%-56% range.

- Markup is roughly keystone: 2x, not the 5x claimed on the Internet.

Go For the Gold

I derive several conclusions from Figures 1 and 2, which I think are supportable and worthy of consumers’ attention:

- The anchor price of $6000/pair, though not reflective of average pricing, is not far off of retail pricing of premium hearing aids since 2004. As Figure 2 shows, $6K for two is a tad high, but not by much. In terms of anchor bias, that means consumers derive a small bargain perception when they purchase premium instruments and possibly a large bargain perception when they are fitted with lower technology instruments.

- Premium hearing aids are a better deal than lower technology instruments in terms of features and cost because the gross profit margin on premium instruments is 20%-25% lower than for lower technology instruments. In plain words, increasing wholesale costs of premium instruments are spread to all consumers.

- Licensed retailers realized the same gross profit (Price less Cost of Goods) regardless of the level of instrument sold, which means “markup” is not what’s going on, whether it’s 2x or 5x. In theory, this suggests that fitting services are relatively fixed, regardless of technology.

Whoa, Nelly!

Consumers and internet sales folk are likely to ignore most of what’s been said in this and last week’s post by cherry-picking the 70%-75% profit as “evidence” that Audiologists and dispensers are ripping off consumers and resorting to wheelbarrows to haul money to the bank. Do not go there. It is a cheap trick and not true. We’re talking gross profit, not net profit. And, if you want to quibble, it’s more like 50% for the 1/3 of fittings that are premium products. Regardless of the number, most of the “profits” do not go home with the Audiologist, as we’ll discuss next time and as previously explained in an Accounting 101 post.

Those elusive “rational” consumers of Economic lore will like this post and continue their successful habits. They will consume premium hearing aid products on an as-needed basis, knowing that they are getting the most bang for their buck and relying on their providers for ongoing fitting services included in the price. As a rational Audiologist, let me enter a personal note here: those are the patients I want in my practice.

Some audiologists and dispensers will dislike this and last week’s post because they pull open the curtain and reveal the mechanisms of our practices; a few may be encouraged to unbundle in the name of transparency. Better we offer up our business practices for scrutiny than leave it to others who are happy to spread the false word that we’re fitting low-technology products at high-end prices, using 5x markup. No doubt there are a few who do buy low and sell high. There are also some who don’t mind their Cost of Goods and pass their higher costs onto consumers. Both those groups give Audiologists a bad name in the short run. But the averages tell us that the majority of us are fitting with margins that cover our costs, allow us to stay in business, and encourage us to fit appropriate technology on a patient-by-patient basis.

Next post will go into that by addressing unbundling.

(editor’s note: this is Part 9 in the multi-year Hearing Aid Pricing series. Click here for Part 8 or Part 10).