by Kelli Marquardt, BS (applied mathematics and economics)

Post 1 and post 2 described the model, identification strategy, and data. Today’s post summarizes the results of the estimation from a regression equation using year fixed effects.1,2 Specifically, a two stage linear regression analysis for supply and demand is used:

- Stage 1: Estimates of wage by regressing wage on control and instrumental variables;

- Stage 2: Estimates of supply and demand by regressing quantity of audiologists on estimate of wage, control and instrumental variables, respectively.

Refer to the journal article for a full description of equations and estimates of the model using different fixed effect assumptions.

Results

First stage regression showed that both supply and demand-shifting instrumental variables hold some explanatory power. The F-statistic was 37.3 for number of programs, making it a strong instrument for wage.3 F-statistic for Costco was 5.48, making it a weaker instrument for demand; this was also the case for percent of population over 85 years. Ideally, a stronger instrument would be preferred, but given the limitations in the data, we claim that these are valid instruments for our preliminary analysis.

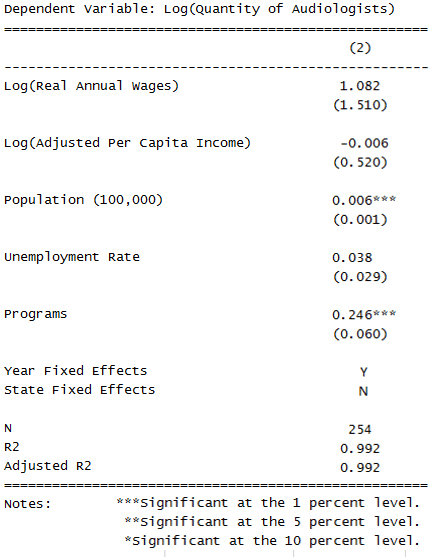

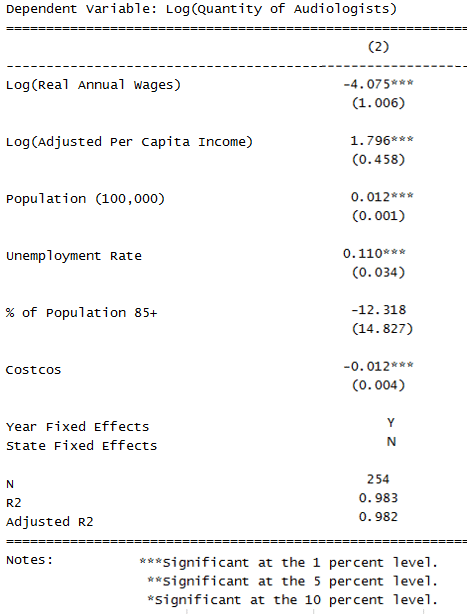

Second stage regressions show the results for estimating supply and demand (Tables 1 and 2, respectively).

Determinants of Supply

Table 1 shows that a 1% increase in real annual earnings leads to a 1.1% increase in quantity of audiologists supplied.4 The positive effect is consistent with economic theory that an increase in the wage is associated with an increase in the number of individuals willing to work for the wage.

Number of academic programs is the strongest determinant of supply. Potential new audiologists may be blocked from entering the market due to the limited number of audiology academic programs. This analysis is consistent with the findings of Windmill and Freeman (2013) that supply of audiologists is largely dependent on the academic programs and admittance and graduation rates.5

Determinants of Demand

Table 2 shows that a 1% increase in consumers’ income increases the quantity of audiologists demanded by 1%, suggesting that audiologists are a normal good. At the same time, there is a significant and positive effect of overall unemployment rate on quantity demanded. Though this paper does not explore this result, some recent research has found that demand for healthcare workers is countercyclical (Staiger et al, 2012).

Although Table 2 shows a large negative coefficient for Age>85 variable, the standard error is also very large and the effect is not significant. In the model, Age>85 has zero effect on demand.

Substitute Effect

The results for the demand estimates (Table 2) show that a 1% increase in real annual earnings leads to a -4.1% decrease in quantity demanded, which is consistent with economic theory that an increase in wage is associated with employers offering fewer audiology jobs in the market. The effect is large, which suggests the demand for audiologists is price elastic. This could be explained by the substitutes in labor demand (Hosford-Dunn, 2017c). Hearing aid dispensers earn on average $11,000 less per year in real wages than audiologists. If the wage for audiologists increases, employers may shift employment to hearing aid specialists in situations where the main duty is testing and fitting hearing aids.6

Costco Effect

Table 2 support that claim that the number of Costcos in a state decreases the quantity of audiologists demanded. Every additional Costco corresponds to a -.01% decrease in demand for audiologists, which seems quite small until it is put in context. Consider California, which had 880 audiologists in 2014. The model predicts attrition of 9 audiologists for each new Costco built in the state. In fact, the number of Costcos in California increased by one in 2015 and the number of audiologists decreased by 10.

We can infer the demand for hearing aids in particular has increased with the aging population, the advances in technology, and the decrease in the social stigma around hearing aids. Costco takes on this demand by opening up hearing centers in their stores to provide basic hearing tests and sell hearing aids. Whereas when people formerly would need to see an audiologist for these services and products, they can now obtain them at Costco. In addition, Costco may not prefer or be able to hire licensed audiologists (see Swearinger, 2017) when instead they may train and hire from within or hire hearing aid specialists. Therefore, as more Costcos open in a state, we might expect more people to prefer Costco for their basic hearing aid needs (Hosford-Dunn, 2017d,e,f) and thus experience a decrease in the demand for audiologists.

Conclusions

Recent investigations by Windmill and Freeman (2013; 2017) and Hosford-Dunn (2017a,b,c) find that future demand for audiologists will outnumber the supply. The analysis in this pilot study, on the other hand, uses a similar data set but assumes that markets clear- i.e. observations reflect market equilibrium. Estimating the equations for supply and demand using instrumental variables and two stage least squares regression technique produces these findings:

- Supply of audiologists to the labor market is relatively price inelastic.

- Demand for audiologists is price elastic. A 1% increase in wage leads to a 4% decrease in quantity demanded.

- More Costcos in each state leads to a decrease in quantity of audiologists demanded. We argue that this negative effect is due to the fact that Costco Hearing Centers have become a substitute in the market for hearing aids.

- The number of audiology training programs has a much higher significant effect on quantity supplied than any of the other variables, which supports Windmill and Freeman’s (2013) conclusion that we need growth in academic programs in order to grow the profession.

- Demand for hearing based services is growing, but the demand for audiologists as provider of choice may not be growing at the same rate, due to Costco’s entrance into the hearing aid market.

Limitations to the Study

The data collected for this analysis includes many more variables that could be included in the analysis on quantity supplied (e.g., wages for substitute careers; number of applications to training programs; percentage of students receiving funding; highest education; distribution of workplace; retirement rates; audiology unemployment rates). A richer dataset allows relaxation of the assumption that markets clear and also allows more accurate estimates for price elasticities and estimates of other determinants of supply and demand for the audiology labor market.

Footnotes

- 1Fixed effects are a means of correcting for bias of the estimate by controlling cross-sectional variation for unobserved heterogeneity (e.g., preferences could change over the years due to variables not specified by vectors in the model and hence appearing in the error term). See Bogard (2014) for an intuitive explanation of fixed effects.

- 2In addition to the model with state fixed effects, we also compared models without fixed effects and with year and state fixed effects. Including state fixed effects reduced explanatory power of the model, due to the lack in variation across time in the number of school programs available per state. See the full article for additional regression results.

- 3As a rule of thumb, a strong instrument should have an F-statistic of at least 10.

- 4Using the percentage of population of 85 years or older and the number of Costcos as instruments for wage.

- 5See Windmill and Freeman (2013) for a discussion on how to combat this potential issue.

- 6Since the profession of Hearing Aid Specialists is fairly new, BLS does not have enough data on wages and quantity to include this in our analysis.

References

Hosford-Dunn, H, 2017a. New Year’s Resolution: Demand an Audiologist. Jan 3, Hearing Economics, HearingHealthMatters.org.

Hosford-Dunn, H, 2017b. How much and how low, Audiology workforce part 2. Jan 10, Hearing Economics, HearingHealthMatters.org.

Hosford-Dunn, H, 2017c. Supply and demand in the audiology labor market, part 4. Feb 21, Hearing Economics, HearingHealthMatters.org.

Hosford-Dunn, H, 2017d. Costco growth – get your hot dogs and hearing aids here! Apr 4, Hearing Economics, HearingHealthMatters.org.

Hosford-Dunn, H, 2017e. Costco’s business model: Build it and they will come. Apr 12, Hearing Economics, HearingHealthMatters.org.

Hosford-Dunn, H, 2017f. The Costco way: Ya gotta eat and ya oughta hear. May 17, Hearing Economics, HearingHealthMatters.org.

Staiger, DO, Auerbach, DI and Buerhaus, PI, 2012. “Registered nurse labor supply and the recession—are we in a bubble?.” New England Journal of Medicine, 366(16), pp.1463- 1465.

Swearinger, G. April 18, 2017. Ftc Workshop Transcript Now Hear This: Competition, Innovation, and Consumer Protection Issues in Hearing Health Care. Federal Trade Commission.

Windmill, IM and Freeman, BA, 2013. “Demand for audiology services: 30-yr projections and impact on academic programs.” Journal of the American Academy of Audiology, 24(5), pp.407-416.

Windmill, IM and Freeman, BA. 2017. Demand an audiologist, but will there by one available? Hearing Economics, HearingHealthMatters.org.

Collaborators

The authors wish to thank Neil diSarno and Sarah Slater from the American Speech-Language-Hearing Association; Ian Windmill and Barry Freeman from the American Audiology Association; and Carole Rogin from the Hearing Industries of America. They, and the groups they represent, contributed extensive data and perspectives to the project. We also wish to thank Harvey Abrams for his encouragement and assistance at each step of the study from its inception.

Kelli Marquardt is an Economics PhD Candidate at the University of Arizona. After growing up in Colorado, she attended the University of Dayton and received a Bachelors of Science in Applied Mathematics and Economics in 2016. She has completed her first year in the University of Arizona Economics PhD program and plans for future research in the fields of labor and health economics. Between classes and research, Kelli also works as an teaching assistant and will teach her first college course this summer.

feature image from Bureau of Labor Statistics

In 1979 as we were fighting for the right of audiologists to dispense hearing aids (I was sued at one point by the Arizona Hearing Aid Association, the organization of traditional dispensers as I attacked their state’s licensing procedures and I won. Later I was sued by the Hearing Industries Association as I worked to get a federal regulation through that would control dispensing at the expense of traditional dispensers. That federal regulation failed due to negative spillover from a Supreme Court action on a regulation of funeral homes.

At that point I gave up hope that the traditional hearing aid dispenser, now referred to as a hearing aid specialist, would become extinct. I instead wondered if in the future once audiologists were permitted to dispense hearing aids it would be possible for the public to distinguish between hearing aid dispensers and audiologists, especially since the federal rules allowing one to skirt a physician by signing a waiver went into effect. This study with it’s Costco Effect proves my point. One Cosco is worth 9 to 10 audiologists,.