by Brian Taylor, AuD

Nothing reflects the convergence of hearing aids and consumer audio devices like the flurry of new AI-driven features introduced at the recent Consumer Electronics Show in Las Vegas. At the annual Las Vegas event, said to be attended by nearly 200,000 persons, many of the mainstay hearing aid manufacturers showcased products that just a year ago you would not expect to be found in traditional hearing aids, including voice-activated Google assist and biosensors.

It was, after all, just a few short years ago that new product and feature splashes occurred at the annual meetings of professional organizations, like AAA in the spring and EUHA in the fall. Now that seems to be changing as hearing aid manufacturers are opting to unveil new products and features at the glitzier, consumer-oriented CES.

Some of the highlights from hearing aid manufacturers at this year’s CES included:

Resound Siri AI “smart hearing aid” that uses artificial intelligence (AI) to pair with Apple’s Siri assistant. The Linx Quattro uses AI to learn user preferences and settings over time, and automatically adjust them to the user’s listening environment. The listener can use Siri with commands like, “Siri, turn up the volume in both my ears” to adjust the devices. This marks a trend with hearing aid manufacturers as Oticon and Starkey have also introduced voice activated features.

Widex Energy Cell: Using technology to power electric cars, the fuel cell can be recharged in about 20 seconds and allows the hearing aid to be used for a full day on a single charge, the latest Widex product, Evoke, uses AI and machine learning to help patients optimize hearing aid performance in noise.

Starkey Livio AI: Building on its ability to track brain and body health, the Livio AI will soon have fall detection and alerts, a virtual assistant and heart rate monitoring.

While traditional hearing aid manufacturers are electing to exhibit new features at CES, the consumer audio industry, a seemingly robust combination of corporate giants and fledgling start-ups, is beginning to bring to market more sophisticated amplification devices that increasingly are resembling hearing aids. These consumer audio products run the gamut – some are inexpensive ear-worn PSAPs while others are as technically advanced as many hearing aids. Some of the consumer audio devices that fit into this category included:

BeHear: A personalized Bluetooth headset that resembles the Bose Hearphone, but is sold at a substantially lower price point.

Valencell: An embedded biometric sensor within a RIC hearing aid. Biometric sensor manufacturer, Valencell is a biometric sensor manufacturer and at CES they were demonstrating sensor that could be integrated into any hearing aid. According to the company, their optical-based sensor is capable of capturing activity levels, such as step count and caloric output). Other biometrics like heart rate, blood pressure and blood oxygenation can also be monitored.

Perhaps there is no better example of a direct-to-consumer audio company bringing amplification technology that once was offered only through the professional channel than Nuheara. An Australian company, Nuheara, introduced their IQ Boost into the American market and the UK’s National Health System in 2018. At CES this year, they launched the IQ Max, which from their marketing literature appears to a fit a wider range of hearing losses. Nuheara also launched a wireless TV streamer, a new point of sale hearing screening kiosk, called IQconnect, something they call IQstore, a subscription-based one-stop shop hearing service app.

Will CES 2019 Mark a New Trend?

We appear to be at the very beginning of a new era in hearing healthcare. One in which consumers have a choice in how they buy hearing devices, and the types of hearing devices they can buy.

A choice of where to buy is certainly not new. Several companies have sold hearing aids on-line and through the mail for years. Now, however, we are seeing companies like Blamey Saunders Hears and Listen Lively that package conventional hearing aids with some level of professional services delivered remotely.

The types of devices consumers can purchase — ear-worn products that have multitasking functionality – is ever-expanding and adding complexity to the clinical decision-making process.

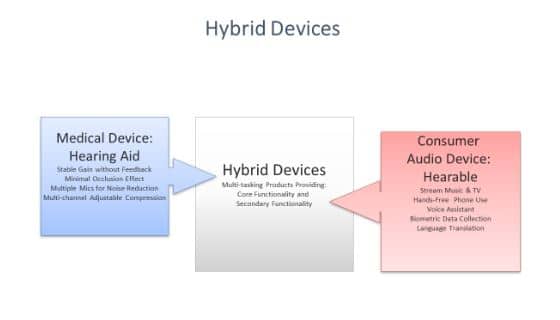

This convergence of technology is shown schematically in Exhibit 1 (below). One challenge for hearing care providers will be to juggle the multi-tasking functionality represented on both sides of Exhibit 1. Consumers and providers will be tasked with identifying the core functionality of a device while simultaneously grappling with other nice-to-have features that are also on-board the device. In some cases, the primary function might be amplification and the secondary function could be monitoring heart rate and falls. Or, the primary function could be listening to music and hand-free cell phone use while the secondary function is amplification. In either case, providers and consumers will have to decide on a lot more than the number of channels of compression that would work the best for the patient.

At a minimum, the availability of hybrid devices may require audiologists be well-versed in managing cardiovascular health and other systemic diseases. More broadly, audiologists will need to know how to select and troubleshoot a much wider range of devices that have amplification as either a primary or secondary feature.

Exhibit 1. The unique traits of hearing aids and consumer audio devices converging as hybrid devices. Each with a core functionality and several possible secondary functions

Yes, many of these nice-to-have biosensors and voice assistant features are cool and perhaps even useful, but we cannot allow the feature creep, no matter how well intended, of software designers and gadget gurus impede the practice of evidence-based, patient centered audiology. Let the AI-based hearing device algorithms address what can be mechanized but recognize that for the foreseeable future there are several aspects of problem solving and decision making that require the human touch of an audiologist.

As a profession we need to use this new technology in hybrid devices as a tool to help patients communicate and lead a better life, not be a slave to an ever-growing list of trendy features. We cannot become distracted or seduced by “consumer cool” by abandoning our primary responsibility: improving communication for those that have difficulty hearing.

Brian Taylor, AuD, is the director of clinical audiology for the Fuel Medical Group. He also serves as the editor of Audiology Practices, the quarterly journal of the Academy of Doctors of Audiology, and editor-in-chief of Hearing News Watch for HHTM. Brian has held a variety of positions within the industry, including stints with Amplifon (1999-2008) and Unitron (2008-2015). Dr. Taylor has more than 25 years of clinical, teaching and practice management experience. He has written and edited six textbooks, including the third edition of Audiology Practice Management, recently published by Thieme Press.

I can see a new interesting diversion by using a gadget to link with other health conditions. But before the consumer is swayed or fooled , we need to understand what is in the manufacturer’s logic. and the motivation. Hey, the population is rapidly expanding , so we can expect the market to be flooded with gimmicks. But there is the chance of one gimmick leading to a universal help.