With 2023 coming to a close, one year of OTC under our belts, and managed care continuing to gain traction in many parts of the country, it’s a good time to look ahead to 2024 and examine how the market for hearing devices and professional services will continue to evolve.

One positive development in 2023 that should continue to advance over the next few years is how we view the market for hearing care services. Due to new research and fresh perspectives, we have access to much more nuanced views of the market for hearing care.

To fully appreciate our progress in better understanding the various market segments and how they might be of value to hearing care professionals, it helps to examine how market segmentation has evolved over the past decade.

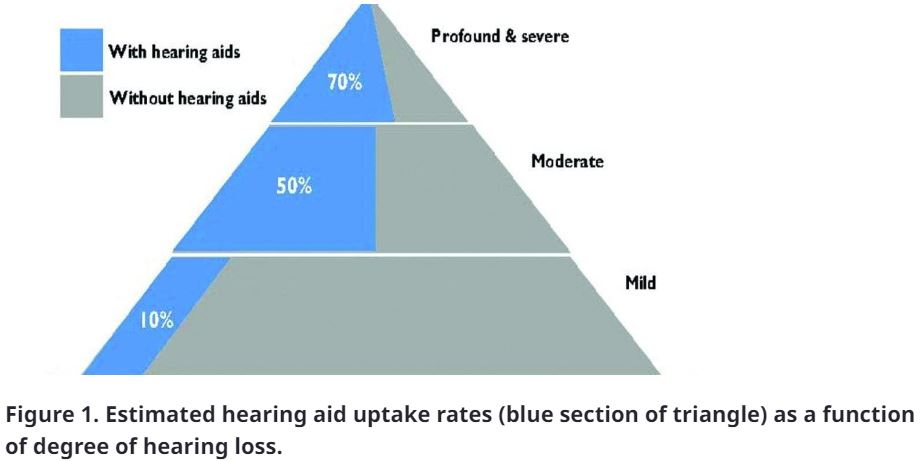

Let’s go back ten short years. It was the 2014 annual AAA meeting in Orlando, Florida (the final year of the legendary Trivia Bowl) and I was fortunate enough to be part of a panel hosted by Karl Strom and CareCredit. During that event, I discussed the slide shown in Figure 1. The consensus opinion is this little pyramid was first created by the late Bob Oliveira, CEO of Hearing Components in the 1990s. This much traveled pyramid still serves as a good, albeit crude way of understanding the untapped market for hearing devices.

For the unversed, what is illustrated in Figure 1 is an estimate of the number of hearing aid owners striated by degree of hearing loss. Unsurprisingly, people with mild hearing loss by far have the lowest rates of hearing aid use. Considering Bob Oliveira was talking about this challenge thirty years ago, combined with the fact that the schematic is still widely discussed at many state and national professional meetings today, underscores just how little hearing aid uptake rates have changed. Or perhaps it is our thinking about untapped markets and poor uptake rates that needs to change. Which brings us to perhaps a fresher approach to understanding the challenge, one first published about four years ago.

Although the data in Figure 1 is directionally correct, it doesn’t tell the whole story. In February 2020, Seminars in Hearing published an insightful article by Brent Edwards of NAL that built on Oliveira’s pyramid and helps us better understand the challenges associated with poor hearing aid uptake rates.

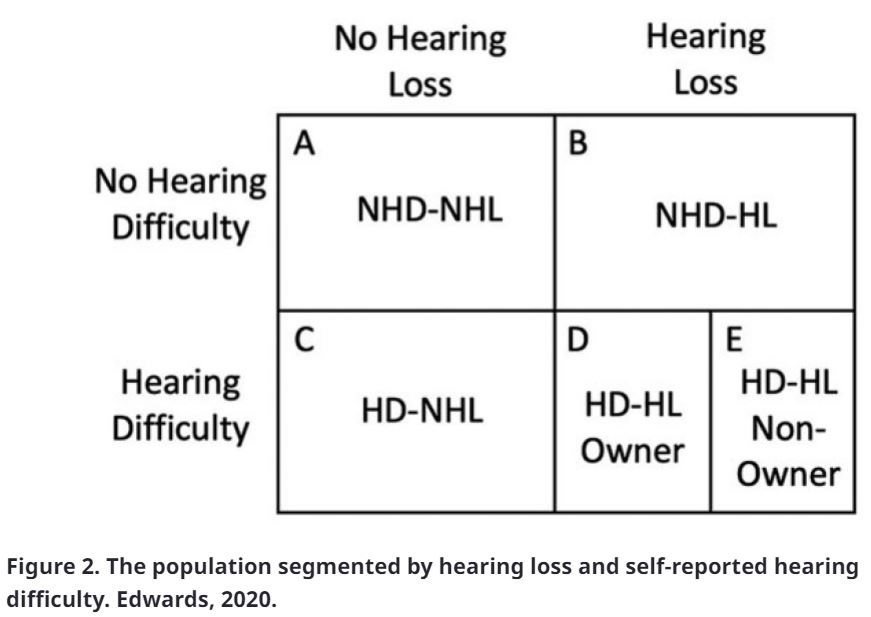

Using two variables, degree of hearing loss on the audiogram and self-reported hearing difficulties, Brent was able to shift the focus away from singular attention on the audiogram and degree of hearing loss by adding the individual’s own perception of their hearing difficulties to the mix. He devised the four-quadrant matrix, shown in Figure 2, as a way to fully capture the unmet need for hearing devices and professional services.

By thinking about persons with measured hearing loss on the audiogram and self-reported hearing difficulties as two separate yet overlapping categories of potential consumers, Edwards expanded our understanding of different segments of the market and how each individual’s perception of value differed — depending on the quadrant they fell into.

With OTC on the drawing board in 2020 when this article was published, Figure 2 helped us realize at the time that OTC and other direct-to-consumer devices and services would probably appeal to an untapped segment of the market that rejected in-person clinical care and medical grade hearing aids. It also helped us realize there were other segments of the market that would see value in devices like multitasking hearables/earbuds or other yet-to-be-defined products or services.

Today, although we are now more than a year removed from the FDA’s codification of OTC hearing aids, and despite ample evidence demonstrating their technical viability, uptake rates for OTC are mired in the low single digits while the uptake of prescriptive hearing aids remains unchanged.

Fortunately, some recent research, published in late 2023, has evolved beyond the more traditional medical model of care in which we view the consumer through the lens of their audiogram or hearing handicap score. Instead, this new bit of research relies on understanding the consumer archetypes of people who might be shopping around for hearing care.

First, it helps to know a little about customer archetypes. In short, they are a pattern of behaviors and attitudes that describe a group of consumers. More specifically, consumer archetypes are abstract, symbolic representations of various customer groups — highlighting their motivations, characteristics, and needs. Consumer archetypes are commonly generated by behemoths like Coca-Cola, Proctor & Gamble, and Nike to help them build their brands and develop messaging that resonates with distinctive market segments. By developing archetypes, businesses can identify target markets, understand the values of various market segments, and determine the most effective ways to communicate with each segment.

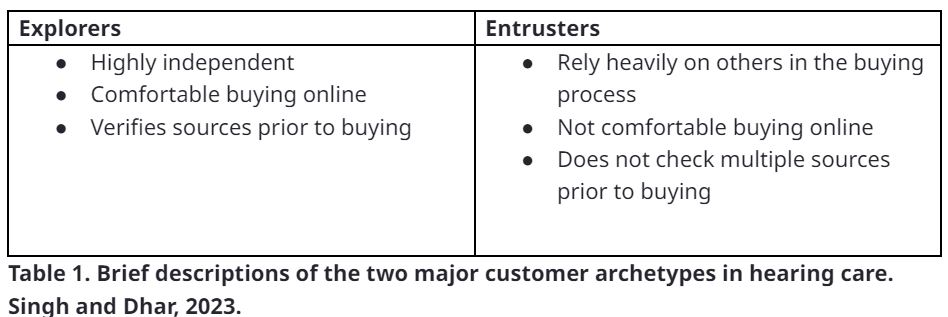

In an open access December 2023 AJA article, Singh and Dhar, maybe for the first time in our profession, applied customer archetypes research to hearing care. They found there are two unique consumer archetypes in hearing healthcare: Explorers and Entrusters.

Table 1 describes some of the important characteristics of each of these archetypes.

Interestingly, according to their research, both Explorers and Entrusters have a strong preference for in-person delivery pathway as 84% of both groups preferred in-person pathway to online/direct-to-consumer care. Their reliance on the in-person pathway for care delivery probably reflects both a lack of knowledge and trust in the OTC channel. Some time and effort building this channel in a responsible way could yield some real improvements in uptake rates, especially among the Explorer archetype who might come to value the OTC channel in time.

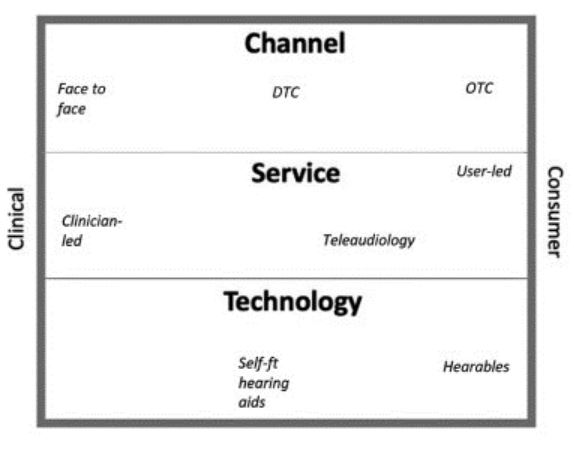

Oddly enough, another 2023 article mentions customer archetypes. And it too helps us gain a deeper understanding of the untapped market for hearing devices and the professional services that often accompany them. Their framework, illustrated in Figure 3, shows there are three elements of hearing care: Technology (hearing devices), Service (assistance, counseling) and Channel (the way in which technology and service is delivered). All three of these elements exist independent of each other and exist on a continuum with clinic-driven care on one side and consumer-led, self-directed care on the other.

This framework allows us to see how technology, service and channels can be mixed and matched, depending on the needs or wishes of the person with hearing difficulty. For example, someone could begin their journey with the purchase of OTC devices on-line and eventually find their way into a clinic for an assortment of professional, counseling-related services.

The authors suggest there are eight archetypes of solutions that stem from this framework. A topic that will be the focus of an upcoming article published here.

Figure 3. The hearing care framework created by Brice, Saunders & Edwards, Seminars in Hearing Vol 44, No. 3, page 222.

When customer archetypes data is combined with our knowledge of the more medically oriented four-box approach shown in Figure 2, we have a much more nuanced view of hearing care. A more refined approach to understanding the diverse market for hearing care products and services will enable us eventually to devise more effective clinical and business strategies. Strategies that improve the uptake rates of hearing devices and create more customer value in various types of services. Let’s hope 2024 brings even more fresh thinking to improving how we address the unmet need of hearing loss in adults.

Given the more nuanced view of the market that is emerging, there is certainly room at the table for prescriptive hearing aids, over-the-counter (OTC) hearing aids and the direct-to-consumer (DTC) acquisition of products and services.

About the Author

Brian Taylor, AuD, is the senior director of audiology for Signia. He is also the editor of Audiology Practices, a quarterly journal of the Academy of Doctors of Audiology, editor-at-large for Hearing Health and Technology Matters and adjunct instructor at the University of Wisconsin.