No, TG does not stand for Thanksgiving, but happy Thanksgiving anyway to those readers in the USA. As we join together, let us give a moment of silence to remember HearUSA.

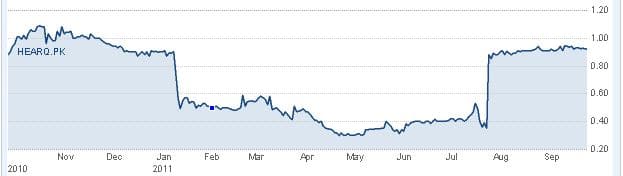

When it’s all said and done, you’re just another number and HearUSA’s number turned out to be #11-23341-EPK. The graphic story is shown above. The blow-by-blow account follows.

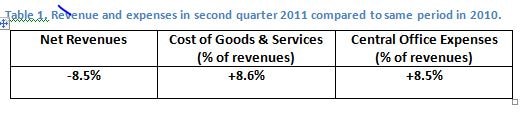

HearUSA’s last summer was spent languishing in bankruptcy as it watched revenues drop and expenses rise (Table 1) as outlined in its 2nd quarter SEC report. AARP commitments raised costs of goods and services. Central Office expenses (20% of revenues) flowed out to attorneys and bankruptcy proceedings instead of up to top brass. HearUSA chopped $51.9 million off goodwill equity as a pre-tax impairment charge due to the bankruptcy disruption. What a way to go.

On the other side of the bankruptcy, Siemens and William Demant were practicing approach-avoidance maneuvers. William Demant’s stalking horse bid excluded Siemens payables ($4.7 million) and Siemens debt ($31.5 million). That meant Siemens had to show up eventually, like it or not. Meanwhile, William Demant was considering Table 1-type data and grappling with the pros and cons of its stalking horse status.

Good Thing: you get to set the basic price.

Bad Thing: you’re stuck with that price at auction if nobody else bids, even if the asset value of the company is less than you thought.

7/25/2011{{1}}[[1]]Bandell B. Siemens submits bid for HearUSA assets. South Florida Business Journal. July 27, 2011.[[1]]: Siemens broke its summer silence by trumping William Demant with a $75.5 million bid–but only $7.5 million was in cash. Creditors and stock holders objected vociferously. HearUSA attorneys objected on the grounds that auction procedures require a competing bid of not less than $72.5 million in cash.{{2}}[[2]]This is where the stalking horse bid was strategic for HearUSA.[[2]]

7/25/11{{3}}[[3]]HearUSA Receives Competing Bid From an Affiliate of Siemens for Substantially All of its Assets. Bankruptcy News & Analysis. July 25, 2011.[[3]]: Somewhere, somehow, the Siemens bid morphed into a revised one from its newly created subsidiary, Audiology Distribution LLC. The bid jumped to $97.574 million, with cash up to about $29 million.{{4}}[[4]]If I seem vague, it’s only because it is just really, really hard to figure out exact timing and how much cash was involved.[[4]] The rest was carved out into a $30.7 million “credit bid” and $37.242 million in “equivalent consideration.” Those categories covered previous debts to Siemens, costs of running HearUSA during bankruptcy period, HearUSA liabilities, “cure costs” of patching HearUSA up so it could run after bankruptcy, and a quid pro quo for the Siemens supplier contract that was rejected when HearUSA declared bankruptcy.

7/29/11{{5}}[[5]]Bandell, B. Siemens wins bidding for HearUSA. South Florida Business Journal. August 1, 2011.[[5]]: Auction Day. Siemens beat out William Demant for the prize,{{6}}[[6]]Danish William Demant fails to win bidding for HearUSA. Nordic Business Report. August 2, 2011.[[6]] though it is unclear that Demant wanted this prize enough to up its original bid. If that’s so, I remain confused as to why Siemens raised its bid to somewhere in the vicinity of $109 to $129 million, depending on where it’s reported. But they did and that was that: an Asset Purchase Agreement was signed and the auction was approved the following Monday, August 1.

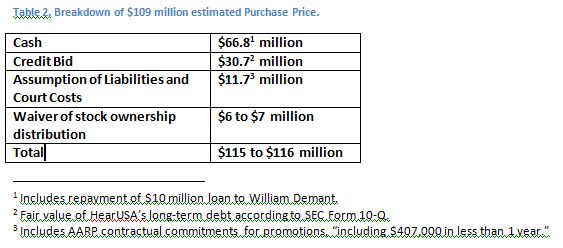

8/17/11: The Bankruptcy Court issued the sale order with an estimated Purchase Price of $109 million.

8/27/11: HearUSA reported expenditures of $2.174 million on bankruptcy professionals and another $95,006 on consultants for the month ending 8/27.{{7}}[[7]]For we mere mortals, monthly expenditures like this drive us nuts. I use that as my excuse for lifting this post’s title from a Pynchon novel that describes an absurd Southern California universe inhabited by visionaries, conspiracies, long-gone millionaires, and law firms such as Warpe, Wistfull, Kubitschek and McMingus). [[7]]

9/07/11{{8}}[[8]]FORM 8-K: HEARUSA FILES CURRENT REPORT. US Fed News Service, September 16, 2011[[8]]: HearUSA’s SEC 8-K report acknowledged the $109 million Purchase Price, broken down into what adds up to about $115 million (Table 2). Is it just me, or does this make you crazy too?

9/09/11: Gino Chouinard, interim CEO, and Frank Punal, CFO, were terminated as part of the Purchase Agreement.

9/13/11: HearUSA changed its name to HUSA Liquidating Corporation. NOTE: “HUSA” is just another name for Heineken according to a search on business names. The HearUSA name went to Siemens as part of the Purchase Agreement.

9/15/11: HearUSA announced that the sale had closed at an aggregate Purchase Price now up to $129 million, including $71 million in cash. The skyrocketing sale price can’t help but make me wonder if the old HearUSA PR machine wasn’t cranked up one last time: try as I might, I cannot get any combination of reported numbers to add up to $129 million.

11/15/11: HUSA filed its first Debtor’s Operating Report — a 60 page document for the period July 31-August 27{{9}}[[9]]Debtor’s Operating Report, July 31-Aug 27, 2011. Case 11-23341-EPK, Doc 546. Filed 11/15/11. Pp 1-60. US Bankruptcy Court, Southern Dist of Florida.[[9]]. Attachment 8, wryly entitled Significant Development During Report Period, sums it all up from HearUSA’s perspective:

“…the contested sale hearing was held. The court entered its order approving the sale of substantially all of the Debtor’s assets …. the Debtor conducted numerous conferences and prepared for the closing…[and] the transition of the business operations to the Purchaser.”

And so the years of shouting it out ended in a whimper and HearUSA was no more.

From my perspective, this 21-post series detailed the ways in which poor cost accounting and top-heavy management took the juice out of the HEARx vision. As much as I poked holes at it, I find that in the end I have come around. HearUSA is just a number now. But its vision helped put Audiology on the map and it created jobs, probably creating more hearing aid wearers in the process. For better or worse, it was instrumental in changing product distribution channels in our industry. For better or worse, it got the attention of managed care groups and AARP. Both effects may result in job creation and market expansion, pushing technical innovation and being pushed in return.

I find myself reiterating the hope expressed in post 8, that future good management of what remains will resurrect parts of the vision in an audiology-friendly fashion that creates professional jobs, expands hearing health care, encourages technical innovation, and optimizes the communication abilities of more people with hearing problems.

Photo courtesy of williamkentinc.