If any investors believe that the SEC’s enforcement actions drove insider trading out of the markets, they are beyond mere legal help.{{1}}[[1]]http://www.professorbainbridge.com/professorbainbridgecom/2010/04/is-insider-trading-bad-if-so-why.html[[1]]

Back in April, we reported on possible insider trading in the hearing aid industry and promised some educational discussion of fiduciary duty and the stakeholder paradox in a follow-up post{{2}}[[2]]https://hearinghealthmatters.org/hearingeconomics/2011/hearing-aid-insider-trading-big-time-or-bush-league/[[2]]. It’s not stuff we get in graduate school, but it’s a good idea to at least know the terms now that many dispensers and audiologists are employed by multinational corporations that trade in hearing aids and the rest of us sell the products of those corporations. The following is a primer on terms, followed by a brief discussion of the stakeholder paradox.

1. Illegal insider trading occurs when someone big inside a publicly traded company buys or sells his/her shares in the company’s stock, based on “material non-public information.” “Big” means anyone who is a large shareholder (>10% of the stock), board member, in top management, or a key employee. Another kind of insider trading has to do with outright theft of company information (“misappropriation”) by an employee who then trades in any stock–not just the company’s–in hopes of profiting.

Inside trading is illegal in the US and some other countries because the insiders violate their fiduciary duty to the company’s shareholders by taking advantage of non-public information to try to make personal profits. For instance, the CEO of Little Hearing Aids knows the company is going to be purchased next week by Big Hearing Aids. The CEO buys a lot of Little Hearing Aid stock before the acquisition is announced. After the announcement, the stock of Little Hearing Aids soars and he makes a tidy profit at the expense of the company’s shareholders.

2. A fiduciary duty is the legal and ethical commitment the company has to its investors to act in their best interest when it comes to handling money and property. Note that “property” includes information. It’s a bit like the physician’s Hippocratic oath to “do no harm” to patients, but more stringent: “do everything you can to benefit the shareholders financially.”

It’s easy to understand fiduciary duty from our own small business experiences: say Little Hearing Aids takes on a partner who agrees to put all professional efforts toward building the company. But, you come in on Saturday and find the new partner selling hearing aids out the back door and pocketing the revenues. That partner is self-dealing and not observing his/her fiduciary duty to Little Hearing Aids. Solution: get rid of the partner and pursue legal action if Little Hearing Aids has been materially harmed. The same goes for big corporations and their shareholders, as the current situation at Sonova illustrates.

3. All terms above hinge on what’s called the economic theory of the firm. The idea is that companies owe a special fiduciary relationship to shareholders, without regard to the effects on others. All company activities must be aimed at benefiting the shareholders, so long as the activities are legal. Truly, it is a dog-eat-dog world according to this theory, but at least your dogs are on your side and friendly, unlike the insider trading dogs, who are on your side but want to bite you.

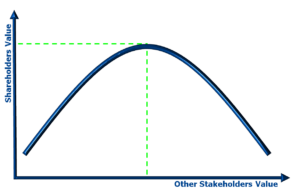

4. Economists never seem to agree, so naturally there is a flip side to consider: what about the “stakeholders” who are not shareholders such as suppliers, employees, patients, and next-door neighbors? What about societal needs in general? This is the stakeholder paradox{{3}}[[3]]Goodpaster, KE. Business ethics and stakeholder analysis. Business Ethics Quarterly. 1991.[[3]]: corporate decisions that take stakeholder needs (say for instance, the patients of a practice) into account are likely to violate the special fiduciary relationship owed to shareholders to maximize profitability. It may be the right and moral thing to do–especially if you are an audiologist adhering to ethical practice guidelines–but it is also “illegitimate” and perhaps legally indefensible for a corporate point of view. Paradox indeed!

Here’s a hypothetical example: Big Hearing Aid Co. has a duty to its stockholders to achieve stated corporate financial goals, one of which is to increase profitability. R&D advances enable Big Hearing Aid Co. to produce instruments for a fraction of former production costs. Simultaneously, society’s view of US hearing healthcare expands to include good hearing as an individual right. Here is the paradox: Big Hearing Aid Co. can decide to pass on the savings by selling its products for less. If it goes that direction, it can maintain its former profit margins but forego increased profitability. This approach satisfies the company’s patients and friends (stakeholders) by making hearing healthcare more affordable to more in society, but it fails to satisfy the fiduciary duty of the company to its shareholders to increase profitability. The approach is morally right, but illegitimate. Alternatively, Big Hearing Aids, Co. can take a price premium increase on its breakthrough in hearing aid technology, thus satisfying its shareholders but ignoring the hearing needs of all but a few well-heeled consumers. This approach demonstrates no regard for societal needs. It is legitimate, but morally wrong or at least subject to intense societal scrutiny.

In enlightened circles, the Stakeholder Paradox can be solved by using a dual management approach that acknowledges a special, but “partial,” fiduciary relationship owed to shareholders according to corporate law. At the same time, management also acknowledges certain impartial moral obligations to society in its decision making, insofar as societal economic and general well being are affected by the company’s pursuit of stated goals.

Applying this approach to our example, Big Hearing Aids Co. pursues higher profits to satisfy shareholders while investing some of the profits in provision of hearing aids to those in society without access to hearing healthcare. As one of many solutions, this approach also enables what is known as “consonance” in individual managers’ personal and corporate ethics – that is, the manager or audiologist can fit his/her mother-in-law with hearing aids at the company discount rate without facing the ethical dilemma that his/her employer is denying aids at reduced cost to other people’s mothers-in-law. (Just out of curiosity – has this ethical dilemma ever dawned on any of you out there that have fit a family member with hearing aids? I have to admit that it didn’t dawn on me, nor does it particularly bother me. I probably need more enlightenment).