Editor’s Note: The last time Hearing Economics discussed hearing aid pricing was 2016, when then Section Editor, Holly Hosford-Dunn, provided readers with a comprehensive assessment of the market in a seven-part series.

Starting with today’s blog on wholesale pricing (in a nominal sense), the aim is to build on Holly’s earlier work and share current trends in a multi-part series over the next few months.

–Amyn M. Amlani, PhD

Calibration

Before diving into the chasm of figures and numbers, I take this opportunity to calibrate the reader to several aspects related to the wholesale data. The caveats written in 2013 and 2016, paraphrased below, remain true today:

- The categorical lines that separate hearing aid tiers—Economy to Mid-Level to Premium—are somewhat blurred given variations across product lines, manufacturer interpretation of technology tiers, and price points adopted by the market.

- The dataset is truly a sample, provided by a small faction to whom I am beholden. (There is no pricing data—not one morsel—provided by or adopted from Audigy for obvious employment reasons.)

- Prices reported are for a single-unit purchase with no additional discounts.

- There is no data available prior to 2004.

- Transparency is king.

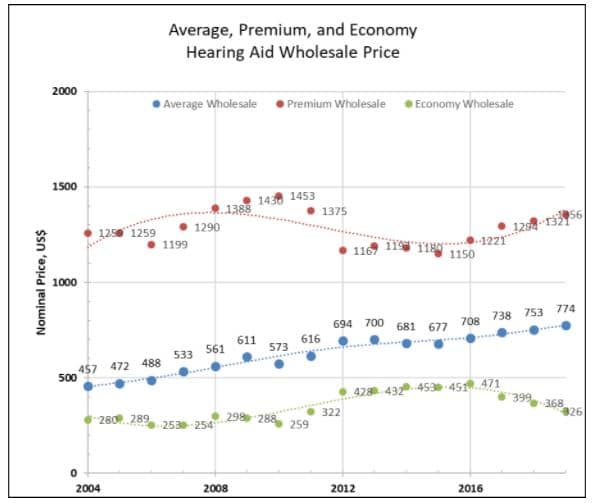

Figure 1. Nominal wholesale hearing aid prices, in US dollars, for average (blue filled circles), premium-tiered (red filled circles), and economy-tiered (green filled circles) product lines.

Premium-Tier Wholesale Pricing

- Premium products are depicted as red filled circles in Figure 1.

- Comparisons are derived using nominal comparisons (i.e., not adjusted for inflation).

- In 2004, providers paid an average of $1259 for a premium-tiered product. In 2019, a markedly more advanced, premium-tiered product was available for the average wholesale price of $1356.

- The nominal difference in wholesale price between 2019 and 2004 is $97. Over a 16-year span, this difference equates to just over a $6 per year increase.

- Over time, the wholesale pricing for premium-tiered hearing aids is nonlinear, reaching a peak of $1453 in 2010, and a low of $1150 in 2015.

- Wholesale prices began rising in 2016 when a single unit could be acquired for $1221. In 2019, a single unit averages $1356.

- In 2019, the nominal wholesale price has increased by $206 per unit compared to the average price in 2015.

- This increase in pricing is not surprising, given technological advances in Bluetooth connectivity, rechargeability, artificial intelligence, and the transformation of hearing aids to track the user’s health and wellness.

- In Part 2 of this series, we will assess whether providers are accounting for this increase in cost of goods (COGS) in their retail pricing.

Economy-Tier Wholesale Pricing

- Economy products are depicted as green filled circles in Figure 1.

- Comparisons are derived using nominal comparisons (i.e., not adjusted for inflation).

- The wholesale pricing for economy hearing aids is also nonlinear, reaching a peak of $471 in 2016, and a low of $253 in 2006.

- The astute reader will note that economy-tiered pricing patterns are inverse to premium-tiered pricing patterns. That is:

- As economy-tiered pricing increases, premium-tiered pricing decreases, and as economy-tiered pricing decreases, premium-tiered pricing increases.

- These pricing patterns are essentially synchronized in time.

- The astute reader will note that economy-tiered pricing patterns are inverse to premium-tiered pricing patterns. That is:

- Economy-tiered products in 2019 cost a nominal average of $46 more per unit than in 2004.

- Since 2016, when a single-unit product cost $471, single-unit prices have dropped nominally by $145 in 2019.

- In Part 2 of this series, this decrease in COGS is expected to yield increased revenue for the practice.

- It is assumed that wholesale costs for this tier were reduced—and are expected to be reduced in the future—in order for the provider to compete with direct-to-consumer products.

Average Hearing Aid Wholesale Pricing

- The average wholesale price for a hearing aid is depicted by blue filled circles in Figure 1.

- Comparisons are derived using nominal comparisons (i.e., not adjusted for inflation).

- The average wholesale price includes all product tiers (e.g., Economy, Economy-Premium, Mid-Level, Advanced, Premium).

- Since 2004, the average wholesale price of hearing aids increases in a rather linear manner.

- Premium-tiered vs. Average Wholesale Cost

- In 2004, the nominal difference in wholesale cost between a premium-tiered product and the average hearing aid yielded $802.

- In 2019, the nominal difference in wholesale cost between a premium-tiered product and the average hearing aid is narrowed to $582.

- The narrowing of price differences between premium-tiered and the average hearing aid over time suggests that the wholesale cost of mid-tiered devices has increased markedly.

- This was an unexpected finding and data to substantiate this outcome has been requested.

- Average Wholesale Cost vs. Economy-Tiered

- In 2004, the nominal difference in wholesale cost between the average hearing aid and an economy-tiered product was $177.

- In 2019, the nominal difference in wholesale cost between the average hearing aid and an economy-tiered product ballooned to $448.

- This nominal difference of $271 supports the earlier claim that COGS for mid-level products are driving up the average wholesale price of hearing aids.

- Again, an unexpected finding that I hope to assess in an upcoming blog.

Summary

In Part 1, the reader was provided a glimpse of nominal hearing aid wholesale pricing trends for premium- and economy-tiered products, as well as for the average hearing aid. Findings indicate an inverse pricing relationship between premium- and economy-tiered products, as well as a linear increase in the average wholesale cost of hearing aids. The latter finding is conjectured to be driven by wholesale pricing increases in the mid-tiered products.

In Part 2 of this series, wholesale prices will be compared yet again, this time adjusted for inflation.