The series on hearing aid pricing began in fall 2020 with a look at average nominal (Part 1) and inflation-adjusted (Part 2) wholesale costs. As we moved into 2021, readers were presented with findings for the average nominal (Part 3) and inflation-adjusted (Part 4) retail costs.

In the fifth, and final, installment of this series, we do the unthinkable and assess the markup ratio between nominal pricing retail and wholesale prices over time.

Cost-Plus Pricing and Markup Ratio

Of all the pricing strategies available, cost-plus pricing is the simplest strategy to employ because it (almost) guarantees that a business does not lose money on a sale. This pricing strategy is also commonly used in the hearing care space. Cost-plus pricing is based on knowing:

- The wholesale cost of the product or service (i.e., invoice price) and

- Determining how much margin, or markup, is needed to generate operating profit (i.e., revenue minus expenses).

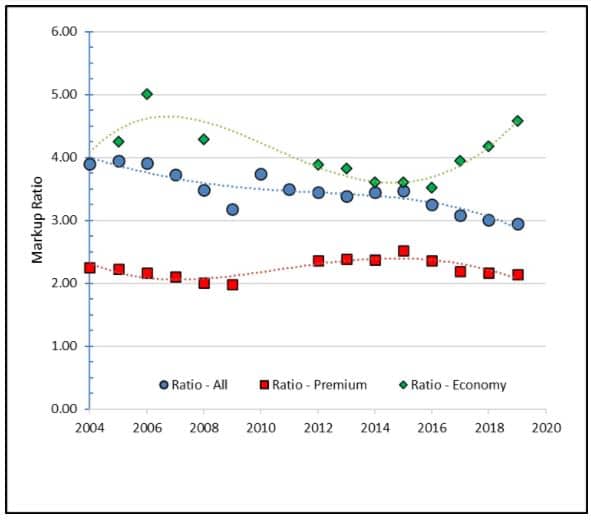

In this blog, the reader is provided with the markup ratio for average, premium, and economy-line products, which is determined by dividing the nominal retail price by the nominal wholesale price at a given point in time.

The data used to generate the markup ratios was adopted from pricing found in Parts 1 (i.e., wholesale) and 3 (i.e., retail) of this series.

Summary of Findings

Figure 1. Markup ratio (i.e., retail price divided by wholesale price), over time, for the all hearing aids (denoted by the blue circles), the average premium hearing aid (represented by the red squares), and the average economy-line hearing aid (designated by the green diamonds).

Average Hearing Aid

- For the average hearing aid, the markup ratio has decreased from 4x to 3x between 2004 and 2019.

- This decrease in markup ratio stems from a greater relative increase in wholesale prices compared to retail prices, although both wholesale and retail prices have increased.

- In 2004, the average retail price for a hearing aid was $1785 and the average wholesale invoice was $457, yielding a markup ratio of 3.91 (i.e., $1785/$457).

- In 2019, the average price for a hearing aid was $2284 and the average wholesale invoice was $774. The markup ratio for these data points is 2.95 (i.e., $2284/$774)

- The average markup ratio for a hearing aid—independent of technology tier—has remained between essentially between 3x and 4x. This ratio has steadily decreased over the past decade and we will continue to monitor whether this trend holds in future blogs.

- Analysis: The finding from this exercise indicates that the average provider is receiving a smaller margin (i.e., 3x instead of 4x) from overall hearing aid sales when we compare data over time.

Premium-Tier Hearing Aids

- For the average premium hearing aid, the markup ratio is relatively unchanged over time.

- The lack of gross changes in markup ratio stem from the fact that average retail prices have increased by only $59 between 2004 (i.e., $2842) and 2019 (i.e., $2901). Similarly, average wholesale prices have increased by a mere $97 during this same period (i.e., $1356-$1259).

- Analysis: The lack of substantial price increases at this technology tier are consistent with the inelastic demand in the hearing aid market (i.e., lower markup at higher price points), and a primary factor that supports the rationale for why this technology tier comprises the largest segment of units sold on an annual basis.

Economy-Tier Hearing Aids

- The highest markup ratio belongs to the economy-tier devices, ranging between 3.5x (in 2016) to 4.6x (in 2019).

- The variability in markup stems primarily from changes in retail pricing. Economy-tier devices have ranged from $1230 (in 2005) to $1666 (in 2012).

- Between 2005 and 2019, retail prices have increased by $264.

- Wholesale prices, on the other hand, show a $37 difference between 2005 ($289) and 2019 ($326).

- In 2016, wholesale prices peaked at $471 and retailed at a near-high price point of $1656. This markup ratio of 3.5 was also the lowest recorded for this tier using this dataset.

- Analysis: The larger markup noted for the economy-tier also supports the market’s inelastic demand structure. A post-hoc review of the percentages by tiers indicated that in 2019, the quantity-demanded for economy-line devices was roughly 3% less than the quantity demanded for the same tiered product in the years 2012-2016. In other words, these outcomes indicate that market demand—and, ultimately, operating profit—is higher when the retail price of economy-line products are increased, not decreased.

Summary

This blog concludes our assessment of hearing aid pricing for the short-term. We will continue to monitor these events and share information as it becomes available.

A special thanks to those partners who were willing to share data so that we could perform the analyses and provide the reader with outcomes.