Cochlear has reported its FY23 results, which showcase noteworthy growth and strategic advancements. The fiscal year witnessed a substantial 19% increase in sales revenue, reaching an all-time high of $1.9B (AUD). This growth was observed across all business units.

Cochlear’s cochlear implant units also saw a significant 16% rise, driven by a combination of factors including market expansion, increased clinical capacity, market share gains, and the resolution of surgeries delayed due to the pandemic. The introduction of the Cochlear™ Nucleus® 8 Sound Processor in the latter part of the second quarter contributed to robust demand for cochlear implant systems and sound processor upgrades in the latter part of the fiscal year.

Additionally, there are indications of an improved trend in adult referral rates, suggesting some effectiveness of Cochlear’s awareness and access initiatives.

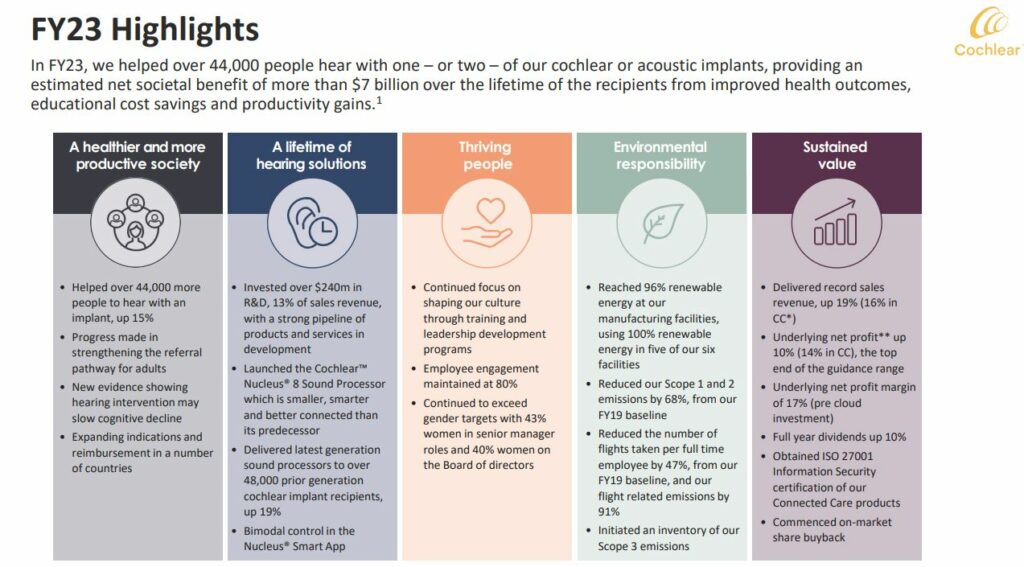

Key Highlights of Cochlear’s FY23 Performance:

- Sales Revenue Growth: Cochlear achieved an impressive 19% growth in sales revenue, amounting to $1,956 million. The second half of the fiscal year witnessed even stronger performance, with revenue up by 29%.

- Net Profit Insights: Statutory net profit increased by 4%, reaching $301 million. This growth occurred despite challenges related to innovation fund-related revaluation gains in FY22 and subsequent losses in FY23. Meanwhile, the underlying net profit saw a significant rise of 10%, totaling $305 million, aligning with the upper limit of the guided range.

- Dividend Distribution: Cochlear demonstrated its financial stability and commitment to shareholders through a substantial 21% increase in the final dividend. The final dividend stood at $1.75 per share, leading to full-year dividends of $3.30 per share.

- Share Buyback Initiative: The company initiated an on-market share buyback program in March, repurchasing $30 million in shares. This strategic move aims to gradually reduce the cash balance to approximately $200 million over the coming years.

- FY24 Outlook: Cochlear’s projections for FY24 anticipate an underlying net profit in the range of $355-375 million, marking a 16-23% increase compared to FY23. This growth is expected to be driven by a combination of revenue expansion and improved net profit margins.

A Healthier Society Through Improved Hearing

In FY23, over 44,000 individuals benefited from cochlear or acoustic implants, marking a 15% increase from the previous year.

This increase in implantations has been estimated to contribute a net societal benefit exceeding $7 billion over the recipients’ lifetimes, due to improved health outcomes, educational savings, and enhanced productivity.

Empowering Adults with Hearing Loss

The company has made substantial efforts to establish a streamlined process for diagnosing, referring, and treating adults eligible for hearing implants. Collaborating with global partners, Cochlear has developed guidelines that set the standard of care for adult hearing loss treatment. This initiative has garnered support from organizations such as the World Health Organization, advocating for enhanced hearing screening.

These guidelines, along with increased professional education, will ensure more adults receive timely treatment, fostering reconnection with life.

Cognitive Benefits of Hearing Intervention

Recent research conducted in July 2023 revealed a groundbreaking discovery: wearing hearing aids for three years can slow cognitive decline by 48% in older adults with mild to moderate hearing loss at higher risk of cognitive decline.

This finding emphasizes the broader impact of hearing loss and the necessity of addressing it to mitigate cognitive decline and dementia risks. Cochlear’s efforts in raising awareness and prioritizing treatment align well with this new evidence.

Expanding Indications and Global Reach

Cochlear reports that it has experienced success in expanding its indications and funding across various countries.

Initiatives include the expansion of cochlear implant coverage in the US for individuals with moderate-to-profound hearing loss, adoption of universal newborn hearing screening in emerging markets, and obtaining funding for cochlear implants and innovative technologies in countries such as Australia, New Zealand, Canada, Argentina, Mexico, and the Netherlands.

Proposed Oticon Medical Acquisition

In June, the UK Competition and Markets Authority (CMA) approved Cochlear’s acquisition of Oticon Medical’s cochlear implants business, finding no competition concerns. However, the acquisition of Oticon Medical’s bone conduction implants business was prohibited. Cochlear and Demant are collaborating on the transfer of Oticon Medical’s cochlear implant business to Cochlear, ensuring continued support for around 20,000 cochlear implant recipients.

Cochlear aims to integrate Oticon Medical’s cochlear implant recipients into their community and work with Demant for a seamless transition. Plans include developing next-generation sound processors and services for these users to benefit from Cochlear’s technology platform over time.

While the cochlear implant acquisition advances, Cochlear’s bid for Oticon Medical’s acoustics business was unsuccessful. Despite this, Cochlear will still provide its technology to potential customers, given its compatibility with Oticon Medical’s Ponto acoustic implants.

The completion of the transaction depends on customary closing conditions and further approvals from regulatory bodies like the Australian Competition and Consumer Commission and the European Commission. The deal is anticipated to close by December 2023. Cochlear clarifies it won’t assume liability for issues related to Oticon Medical’s Neuro Zti cochlear implant corrective action from October 2021.

Looking Ahead

As Cochlear looks toward the future, it remains confident in its growth opportunities and strategy. With a robust outlook for FY24, Cochlear anticipates a 16-23% increase in underlying net profit, driven by strong demand for its products and services.

Source: Cochlear