LYNGE, DENMARK – WS Audiology (WSA) announced strong financial results for FY 2023/24, delivering 10% organic revenue growth and a 13% increase in EBITDA before special items, underscoring the company’s market expansion and product innovation.

Financial Performance

WSA reported organic revenue of EUR 2,637 million (USD 2,872 million), representing 10% growth compared to the previous year, with reported revenue growth of 7% impacted by unfavorable currency fluctuations. EBITDA before special items increased to EUR 542 million (USD 591 million), with the EBITDA margin improving by 1.1 percentage points to 20.6%.

Key growth drivers included the successful launch of the Signia IX platform and the introduction of Widex SmartRIC, which contributed to higher sales and average selling prices.

“It’s been a great year for WSA. We delivered on our guidance with strong organic revenue growth of 10% and solid margin expansion. We gained market share in all regions, and Signia IX continues to lead the way, delivering more than twice the speech enhancement benefit in noisy group conversations than the closest competitors.”

–Jan Makela, CEO of WSA

One-Time Adjustment

In July 2024, WSA adjusted the useful lives of certain intangible assets to align with medical device industry standards, resulting in a one-time net loss of EUR 1,197 million (USD 1,305 million). Makela reassured stakeholders, stating, “The net loss for the year due to the alignment of useful lives of certain intangible assets does not impact our current or future EBITDA, revenue streams, or cash flows.”

Regional and Quarterly Performance

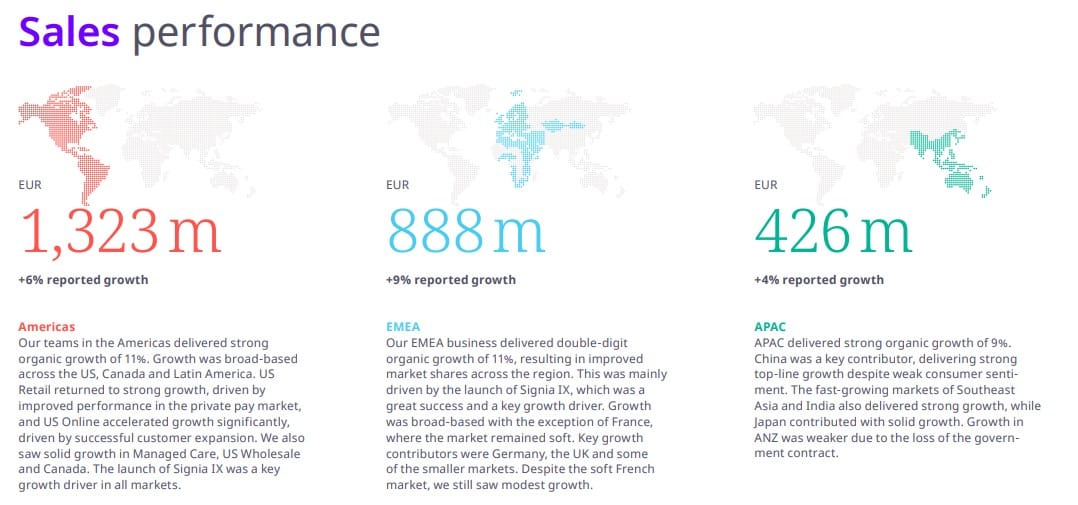

All regions contributed to growth:

- EMEA (Europe, Middle East, Africa): Organic growth of 11%, driven by the successful launch of Signia IX in Germany, the UK, and smaller markets.

- Americas: Achieved 11% organic growth, with strong contributions from US retail and online channels.

- APAC (Asia-Pacific): Delivered 9% organic growth, led by China and emerging markets in Southeast Asia and India.

In Q4, WSA recorded organic revenue growth of 10%, reaching EUR 658 million (USD 717 million). EBITDA before special items for the quarter was EUR 142 million (USD 154 million), reflecting a margin of 21.6%.

Future Outlook

Looking ahead, WSA forecasts organic revenue growth of 3-6% for FY 2024/25, supported by its robust product pipeline and upcoming launches. The EBITDA margin is expected to rise by 1-2 percentage points, driven by ongoing cost improvement programs and sustained growth.

WSA’s Annual Report 2023/24 and integrated Sustainability Statement can be found here.

About WS Audiology

Formed in 2019, through the merger of Sivantos and Widex, WS Audiology combines over 140 years’ experience in pioneering the use of technology to help people with hearing loss hear the sounds that make life wonderful. With truly differentiated brands like Widex, Signia, Rexton, Audio Service and Vibe, and with diverse assets across wholesale, retail, online, managed care and diagnostic solutions, we are active in over 130 markets. WS Audiology employs 12,500+ people and is privately owned by the Tøpholm and Westermann families and the Lundbeck Foundation, as well as funds under the management of EQT. As a global leader, our ambition is to unlock human potential by making wonderful sound part of everyone’s life.

Source: WSA