This post is the beginning of a series that will pop up once in awhile on this site, with the intent of giving instruction on basic Economics concepts in small, hopefully palatable doses. Today’s concept is Decision Costs, which can be tallied up as either Accounting Costs or, more usefully, as Economic Costs.

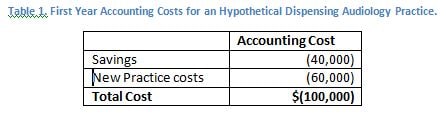

Say you’ve saved up $40,000 and plan to use it as start up for a private practice. Besides start up costs, you figure it will cost $60,000 to equip and staff the practice in your first year. The good news is that you own a building, so no worries about rent! Table 1 summaries your costs to open and run the practice for the first year, which come to $100,000. That’s how most of us think of it, and how your accountant will tally it up.

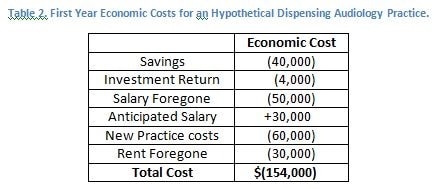

But the expenditures in Table 1 gloss over important decisions you had to make in which you decided to forego other opportunities, as shown in Table 2. Your first Cost Decision in Table 1– to use up savings– means you elected to forego interest on investment. Let’s pretend that we’re back in the good old days and you could count on 10% ROI, yielding $4,000 in annual interest on a $40K investment. Economists call that lost $4k an opportunity cost — the value you sacrificed by choosing to invest in your start up instead of the “next best thing” — in this case invested your savings in interest-bearing accounts.

Your second decision was to give up your day job and annual salary of $50,000. That’s not as bad as it looks, because you plan to draw $30,000 in salary from your new practice in year 1. Both of those are included in Table 2.

The third decision was to occupy your own building, for which you pay insurance and mortgage of $50,000/year. That choice means you have decided to forego $30,000 in rent that would have accrued from leasing it out for the year.

Wow – it costs more than you thought to strike out on your own. You’re down $154K instead of the $100K your accountant tallied. This is what is meant by Economic Cost – it’s not only what you shell out, it’s what it costs you to forego other choices. And don’t forget, the Economic View may be overly-optimistic if your cost/revenue predictions are off for the first year of practice. It’s not uncommon for new owners to forecast higher revenues and lower expenses than actually result in a start up.

One last thing: some of you are probably thinking I made an error (another not uncommon event) because I didn’t include the $50,000 for mortgage and insurance into the costs analyses. Hard to believe, but I didn’t make a mistake. Yes, the mortage and interest payments are costs, but they are not Accounting or Economic Costs.. That’s because you have to pay mortgage and insurance whether you rent out the building, occupy it yourself, or let it sit empty. Things that you have to pay no matter what are Sunk Costs and irrelevant. One way or other, that money is GONE, so it doesn’t get tallied in calculations of what future decisions will cost you. Sorry!

Photo courtesy of Rene Schlegel

Click here to jump to next post in Economics 101 Series

Thanks Holly-More posts like this please!

Thanks so much for providing feedback. I will put more of these in as time allows. Here’s a question for you: we’re thinking of creating a section of “classrooms” where instructional posts can be seen anytime, without having to search on a term and go back into individual editor’s archives. Do you like that idea? If so, do you think this post would be a candidate for a classroom? Thanks for reading and commenting. It helps us a lot.

I think that’s a great idea. Accounting and Econ principles can be fascinating yet difficult. I would love an easy way to revisit and review what I often read on the fly.

Thanks again, Holly!

Very useful analysis, an example that’s easy to follow and adapt. Thanks! Just a correction: In the second table, “Investment Return” should be ($4,000) rather than ($60,000), no? Which brings the Total Cost to ($154,000).

Thank you very much for finding and correcting my error. I’ve updated the table and text so things are now right. Probably more useful this way, right? This is an embarrassing but great example of why blogging is great — our errors are caught and corrected right away, which is a whole lot better than finding out you got the table wrong in a published book or article. Thanks so much and keep helping me get it straight.