Last I checked, HearUSA was set to perish on the railroad tracks because it couldn’t or wouldn’t pay its loans to Siemens.{{1}}[[1]]Despite conflicting reports, HearUSA claimed in its 2009 SEC Annual Report that “The Company repaid approximately $8.1 million of Siemens debt from the proceeds of this transaction during 2009, as required under the agreement with Siemens.”[[1]] True to form, HearUSA’s Central Office started screaming bloody murder, madly churning out PR in a frantic effort to attract a new champion. But, who would want it and why? Before we get to the screaming and gnashing of teeth, this post gives HearUSA a final once-over to see whether it was worth saving or not.{{2}}[[2]]All data in this post from HearUSA, Inc., SEC Annual Report, Form 10-K for Period Ending Dec 26, 2009. Filed March 26, 2010, unless otherwise noted.[[2]]

Demographics. HearUSA entered 2010 with 506 full-time and 97 part-time employees. Less than 1/3rd of those were audiologists and dispensers who manned 180 stores in 11 states{{3}}[[3]]43 centers in Florida, 13 in New Jersey, 29 in New York, 6 in Massachusetts, 8 in Ohio, 23 in Michigan, 7 in Missouri, 3 in Pennsylvania, 8 in North Carolina, 1 in South Carolina and 39 HEARx West centers in California.[[3]] Every office, including the Central Office, had a 10 year non-cancellable lease terminating in 2018. Besides the offices, HearingUSA had a network of 1900 providers in 49 states.

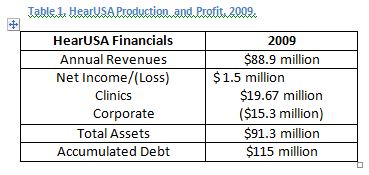

Financials. HearUSA always had good production numbers. (Table 1). Even in a bad revenue year like 2009, the clinics were profit centers. They generated close to $20 million net income on about 50,000 hearing aid sales, which produced 97% of total company revenues. At first glance, 2009 seems like a banner year because it is the only year in which the company showed a positive profit ($1.5 million). That singular event was accomplished only by selling $25 million in assets (Canadian stores) and the voracious Central Office continued its conspicuous consumption by posting over $15 million in losses. Thus, Central Office pretty much cancelled out clinic production.

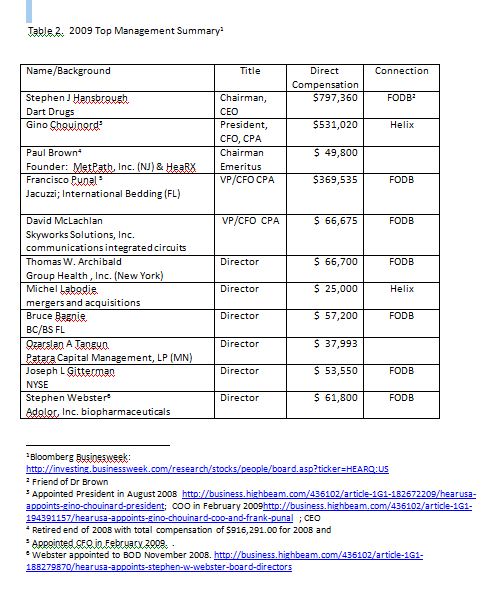

HearUSA attributed a $7.2 million revenue decline in 2009 (from 2008) to the poor economic climate. The good news is that HearUSA addressed this by instigating aggressive cost cutting for the first time– cutting costs by an equal amount. The bad news is that the $7.2 million was cut right out of the clinics’ hides: “staff reductions and temporary salary decreases… [which] were reversed for most employees in January 2010.” Wow — what a great way to build morale — reduce the pay of the only people in the organization that are paying their way. I can imagine how grateful they were when they got their old salaries back, especially since back at the Central Office, it was business as usual for top management. Those guys pulled down $2,116,633 in direct compensation alone in 2009 (Table 2). No recession there.

Stock and Value. In March 2010, there were 1,117 holders of HearUSA common stock, 43% of whom were insiders. Referring back to Table 1, a large amount of that $91 million in assets was vapor shares. The evanescence of those assets gave them pause, as noted in the SEC filing Risk section:

When the Company acquires a business, a substantial portion of the purchase price of the acquisition is allocated to goodwill …[difference in] the purchase price over the fair value of the net identifiable assets acquired. As of December 26, 2009, goodwill of $51.5 million represented 191% of the Company’s total stockholders’ equity… [and] customer files, non-competes and trade names, of $12.8 million represented 47% of the Company’s total stockholders’ equity.

So what do you think? Should HearUSA be untied from the railroad track, or would it be better off getting run over by the train? The debt is terrifying, as is the precarious nature of goodwill value and the omnipresent, rapacious Central Office. On the other hand, the valiant clinics and the big network look good. Maybe it’s worth saving if you can get it away from West Palm Beach?

Hard to tell, so I’ll finish this post with the words of Morris, the investor. Morris is a master of understatement and seems remarkably calm in the face of the powerful locomotive bearing down on HearUSA:

“It’s far from a dying business. It has been poorly managed.”

Photo Courtesy of locgov