A year ago, odds are low that the name “IntriCon” was tripping off the tongues of most Audiologists. That may not have changed much in the past year, but it is worth knowing about Intricon Corp., the “tiny” company that is the little engine that could and did: it is the manufacturing force driving big UHC’s subsidiary, Hi HealthInnovations. I’ll spend the next few posts on IntriCon. Full disclosure requires I first admit to love at first sight: IntriCon looks to be a well run, respectable, tightly-knit, focused, no-divas-allowed, shareholder-responsible, low-profile, gutsy company. If they ask me for a date, I’m giving up my day and night jobs. But, I’m not sitting by the phone waiting for an Intricon call: I’m not an engineer and engineering is what Intricon does 24/7.

IntriCon is a Pennsylvania corporation headquartered under various names since the 1970s in Arden Hills, Minnesota. It has a cool website featuring what looks like a KEMAR head and torso manikin that’s been working out hard at the gym. The website streams hip slogans that do a good job of defining the Intricon brand:

There’s small. And then there’s IntriCon.

Every body deserves superior quality.

Innovation drives us. Technology Defines us.

Three markets. One leader.

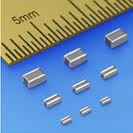

IntriCon does not do much in the way of self promotion. But perusing its sparse media coverage{{1}}[[1]]St. Anthony, N. Solid performance amplifies interest in tiny IntriCon; Word is getting around about the 30-year-old company, which makes amplifiers for hearing aids and wireless headsets. Minneapolis Star Tribune, October 30, 2007.[[1]] over the years, several phrases jump out that capture the IntriCon image and work seamlessly with its slogans. As examples: “solid performance” “innovative” “reinvention” “tiny” “core miniaturization” “smaller than a dime” “big company relationship” “just in time” “strategic decisions” “new distribution model.”

You get the idea: a little company makes tiny electronics that anticipate the needs of huge companies, supplies the big companies on an as-needed basis, and eventually grows into a full manufacturer that supplies and competes with big companies. That’s what happened and these posts will sketch out the IntriCon success story, starting today with a rough calendar of corporate events. The events involve a lot of reinvention and renaming, most of which is mentioned only in passing and does not have a material effect on the story.

As these authentic before and after pictures show, Intricon’s gone from the proverbial 90-pound weakling who gets sand kicked in his face to the heavy lifter that all the girls want to date. As the event calendar documents, as the going got long and tough, Intricon got tougher. My kind of guy.

1970s: Resistance Technology, a private company, is formed. It is located in Arden Hills, MN.

1977: Mark Gorder, EE MBA, joins the private company as a partner.

1983: Mark Gorder becomes President and CEO of RTI Technology, Inc. {{2}}[[2]] Eventually RTI Technology, Inc. becomes IntriCon, Inc., a subsidiary of IntriCon Corp.[[2]]

1996: RTI sells itself for $22.3 million– mainly in stock. It becomes a wholly owned subsidiary of Selas Corp, an American-European heating-equipment company. Two senior RTI partners cash out and Mark Gorder becomes a Director.

9/1/1997: Stock hits 2nd-to highest value: $13.13/share on volume of 215,600 (see chart).

2000: Mark Gorder becomes Selas President and COO.

2001: Mark Gorder named Selas CEO and President.

4/2005: Selas sell off the heating equipment businesses and renames itself Intricon with a new symbol on the American Stock Exchange: IIN. The stripped down company’s goal is to

“…reinvent ourselves from an electronic-component manufacturer to an integrated manufacturer of body-worn medical and electronics devices.”

June 2006: Stock jumps precipitously and continues to rise steadily for the next 2+ years (see chart).

May 2007: IntriCon enters an alliance with Advanced Medical Electronics Corp. of Minneapolis to develop new wireless products.

May 2007: Cash purchase of $4.5 million for specialized hearing aid component maker Tibbetts Industries — a 60-year-old company in Maine. {{3}}[[3]] INTRICON CORP. Article from: EDGAR Online-8-K Glimpse | October 12, 2007. SEC Form 8-K Report.[[3]]

2007: Reinventions under way but not quite integrated. Corporate reporting lists Intricon Corporation (Pennsylvania corporation), Resistance Technology, Inc. (“RTI)” (Minnesota corporation), RTI Electronics, Inc. “RTIE” (Delaware corporation), and Intricon Tibbetts Corp. (formerly TI Acquisition Corporation (Maine corporation). {{4}}[[4]]8-K: INTRICON CORP. Article from: EDGAR Online-8-K Glimpse | October 12, 2007. SEC Form 8-K Report.[[4]] Stock hits all-time high on 10/1/2007: $14.25/share on 165,500 volume (see chart).

2007/2008: Intricon Tibbetts lays off “a number of its employees, including a large contingent of workers over the age of 50.”

4/2009: Salaries of officers and employees are reduced temporarily by 5% to 20%, with executives taking the biggest hits.{{5}}[[5]]Continued: CEO paywatch: A peek inside the proxies. Minneapolis Star Tribune, June 26, 2010. [[5]] Stock hits low of $2.60/share on July 1 on low trading volume of 37,080 (see chart).

7/29/2008: 5-year strategic alliance with Dynamic Hearing (Melbourne, Australia) that gives Intricon license to develop body-worn devices and an optional exclusive license for hearing aid products.

8/13/2009: IntriCon purchases Datrix– cardiac equipment supplier in Escondido, CA– for $2.5 million.

12/29/09: Intricon, Corp. liquidates all assets of RTI Electronics Inc (Anaheim CA) – a “non-core” electronics business.{{6}}[[6]]Company News. Minneapolis Star Tribune. January 5, 2010. [[6]]

6/2010: Intricon Corp. announces it has sold RTI Electronics, Inc., to an affiliate of Shackleton Equity Partners (LA).

2011: Indonesian subsidiary established; manufacturing begins in 10/2011.

3rd Qtr 2011: Lease agreement for a manufacturing facility in Batam, Indonesia “to increase the Company’s low cost manufacturing presence in Asia [by] transferring labor intensive product assembly to the facility.”

10/2011: Manufacturing agreement with hi HealthInnovations to provide, “a suite of high-tech, lower-cost hearing devices.” {{7}}[[7]]Medical Device Daily, October 4, 2011.[[7]] Stock almost doubles from beginning of October to beginning of November (see chart).

11/21/2011: Intricon rated week’s “biggest loser” in Minnesota 100 Index with stock dropping 10.1%.

4th Qtr 2011: Company posts annual and quarterly losses. Revenues about the same as 4th qtr 2010.

3/19/2012: Intricon Corp. sells assets of RTI Electronics (Anaheim, Calif) to API Technologies Corp for $2.6 million. {{7}}[[7]] Mergers & Acquisitions, Minneapolis Star Tribune, 3/22/2011.[[7]]

1st Qtr, 2012: 1st qtr net sales in hearing health business up 39.5% compared to the 1st qtr , “primarily driven by sales to hi HealthInnovations.” Intricon’s in the black.

Looking over the stock history, it’s been a bumpy ride for this gutsy little company that took financial risks when their stock was down, narrowed their goals to specialize, and reduced salaries when things were tight. No doubt, they had a vision and they stuck with it. But what exactly, you may ask, is that vision? What does Itricon DO? That question will be taken up in the next post.

photos courtesy of electronic specifier and gras and reuters

Today they are modern, little and distinct. Most people will not even notice you are wearing them. Advanced technology is also featured highly by them. Some items are so small they are utilized entirely within the ear, making them invisible to the rest of the world. Phonak’s Lyric type is among the most popular unseen hearing aids. It is worn inside the ear around the clock and requires no handling. They are available with options including wireless and water-resistant technology. hearingloss-hearingaids.com

You said: …market value as “around $75 mil” on sales of $50 mil. At that time, IntriCon employed 625 people and manufactured in Minnesota and Singapore. Fast forward to now, when the company’s market value on the NASDAQ is $36 mil and annual sales in 2011 were around $57 mil ($21+ mil in hearing health). Really I have no idea what the drop in market value means, if anything.

Response: Holly, you are exceptionally bright so I am certain you are trying to see who is paying attention (me!). In this case the market value does mean a lot. The market value is a layman’s way of saying the market cap, or the the number of shares outstanding multiplied by the current price per share. In a down market, many companies have had their hard earned market value (cap) shaved (can you say Facebook?) because of loss revenue, earnings or confidence by investors/market makers.

Now looking forward to where you are going with all this research…

thanks for the “bright” comment, though it is undeserved in this case. As for where I’m going, I’m just noodling around finding out about IntriCon and sharing with other audiologists — most of whom, like me, don’t know where their hearing aids are coming from. Really appreciate the concise help you gave on this one. Keep it up, please!

Thanks, Holly for all the information – both humorous and not-so! In 36 years as an audiologist, I’ve never seen Kemar looking so buff.

When the hHI news came out, we all DID wonder what in the heck was Intricon – you’ve given us a lot of information and that is always good. BTW, our personal favorite was also the LOON. Your comment about fitting the Loons made me laugh out loud in our office.

Personally — and it sounds like you would agree — I think our profession/industry is a better place now that we have Loons. Thanks for your comments, and for reading this section!