The Rant: “What gets me is that you see some of the Big 6 companies shipping most of their remaining production to China from the US and Europe. And yet we are still paying the same, even more in most cases. Something doesn’t add up! 6 companies+98% of global market= MONOPOLY!” comment on a previous post

The Economic Reply: ” Not really. 98% seems high. 6 companies makes it an OLIGOPOLY. If they collude on Price, it’s a CARTEL. But enough with the Capital Letter Screaming. …”

Price Makers make their own rules, especially Monopolists. Monopolies are against the rules in the US and EU, among other places, though definitions and legal tests vary widely among and within countries. Consider the pending Global Beer Monopoly if Grupo Modelo gets its way. Who knows how that will go down, so to speak, when it comes to Price, Quantity and distribution?

The hearing health industry has gone global, but lacks a true Monopolist, not to mention a good beer. For sure, our Big 6 constitute an Oligopoly and they may be moving toward Monopoly Power as consolidation continues. Even though we don’t have one, it’s easier to describe Price Maker economics using Monopoly (single firm) and then move on to Oligopoly.{{1}}[[1]]See Taylor & Weerapana’s Principles of Microeconomics (6th ed), for straightforward explanation. Errors in my translation from that text are due to my economic limitations, not those of the textbook.[[1]]

But first, a caveat to the Ranter. Whether you consider Price Makers “bad” or not depends on where you sit at the table. There is a big difference between economic modeling of Price Maker models and legal determinations of whether Price Maker behavior is actionable. The former is a theory of market behavior and efficiencies; the latter is a case-by-case analysis of intent to harm markets.

The Economic Monopoly Model

Skip today’s post and go to this great, comprehensive UK website. It has everything you need: definitions,{{2}}[[2]]UK and US regulations differ.[[2]] easy-to-understand graphs, and a wonderful video to walk you through the gamut of positive and negative economic scenarios faced by Monopolists. Negative? Yes. For example, it’s possible for Price Makers to experience negative profits. They have to watch costs just like the rest of us, which is why they manufacture in China and surrounding countries.

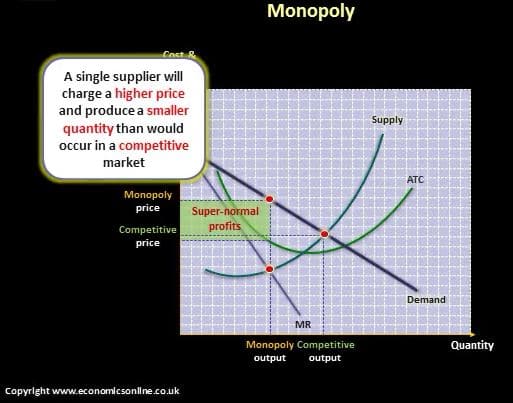

Here’s a snapshot from the aforementioned wonderful video, which I’ll go through in steps.

The graph in Fig 1 looks familiar for Price Takers

- There is a downward sloping Demand Curve — that desirable situation available to Price Makers but not to Price Takers.

- There is an upward sloping Supply Curve (doesn’t matter that it’s curved instead of linear).

- Supply and Demand intersect at a single point of Equilibrium, where the Market Clears (right-most red dot, Fig 1)

- At Equilibrium, efficient Price Takers meet full Demand at Market Price (D = P*) by producing on the margin (MC = MR = P*), yielding zero (“normal”) profit.{{3}}[[3]]Here’s the algebra.

[[3]]

[[3]]

The Graph in Fig 1 is Different for Price Makers

- MR is downward sloping for Price Makers, decreasing at twice the rate of the Demand Curve, meaning that volume is necessary but not sufficient incentive for these folks to produce.

- Efficient Price Makers produce on the margin, until their MR = MC, but not beyond{{4}}[[4]]MC curve isn’t shown in Fig 1, but trust me that it’s below the ATC curve in this region.[[4]] (bottom left red dot in Fig 1), but only for purposes of identifying the Quantity they will produce (Monopoly Output).

- Here’s the kicker: Monopoly Output points up to Price, which is whatever the Demand Curve will bear for that Quantity (top red dot).

Take Home

Monopolists produce less at a higher price than the Market demands in order to realize profit by ensuring that their Total Revenues (TR) exceed their Total Costs (TC). In econo-speak, the Market has not cleared, it is an inefficient Market because abnormal profits have accrued in some hands. But from the Monopolist’s point of view, the more abnormal profit garnered, the greater the firm’s performance.

Well that sounds pretty bad, doesn’t it? Maybe the Commentator’s Rant above is on target. On the other hand, it’s not as easy as it looks or everybody would be doing it, right? There’s only room at the top for one in a Monopoly and that one can’t get any shut-eye for fear of another firm sneaking up and grabbing the spotlight.

How do you get to the top? How do you stay on the top? How do you deal with wannabes? Who can you trust? Murder and piracy are out, leaving clever economics and positioning as the weapons of choice. To be continued….. but first, how about a Negro Modelo?

Thanks for the great explanation Holly! Whether or not it’s a Cartel, Monopoly or Oligopy, most of us realize that a lot of this is completely out of our hands and it’s debatable that there is truly a healthy price competition going on between these manufacturers; or whether or not there is price fixing going on.

Rather than think too much about it, I think I’d go for that Negro Modelo about now.

Oh thank you for saying that. I approach these “teaching” posts with great trepidation — how to summarize in a meaningful way in less than 1000 words and not lose the essence in the process. So glad it communicated to you and I appreciate the feedback.

For those of us that may have had trouble staying awake in our Freshman Econ 101 class, these “teaching” posts are great!