Are Audiologists being “squeezed” by hearing aid manufacturers? Are hearing aid consumers being “gouged” by Audiologists and dispensers? Are the squeezed and the gouged going home and kicking their dogs?

Loaded verbs raise blood pressures but Hearing Economics insists on careful evaluation of available data before agreeing that it’s a war out there. This requires tiny steps and lots of time, not to mention big assumptions based on incomplete data. No one said Economics is fun but it does strive to remain calm, wash away the hype, and mine for morsels of truth.

Today’s truth: quit kicking your dog. Please read on.

The Wholesale Scene

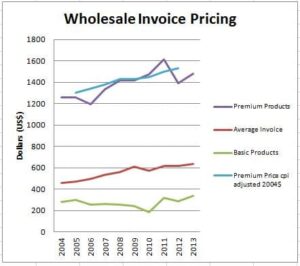

Last week’s post estimated “representative” hearing aid wholesale pricing to Audiologists and hearing aid dispensers, shown again here as Figure 1. The take-homes from that data and previous posts were that, since 2004,

- wholesale pricing tracked inflation for premium products and overall average sales;

- premium product sales continued to comprise about 1/3 of the overall market;

- low-end wholesale pricing remained steady–consistently falling lower than inflation-adjusted pricing.

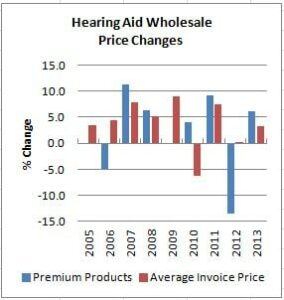

Figure 2 simply restates the data of Fig 1 as a function of average percentage change over time, which allows us to consider those squeezed Audiologists who claim their percentage Cost of Goods is going through the ceiling. One Squeezee sent in her numbers with this comment:

If this trend [of the past 5-10 years) holds up, hearing aids may take the cake on unsustainable price increases!

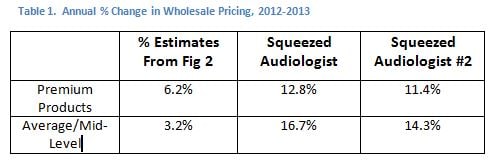

Now why would she say that when Figure 2 shows decreasing, even occasionally negative, percentage change in wholesale pricing over time? She says it because, in her case, it’s true and it’s probably not sustainable. Compare her reported wholesale changes in Table 1 (center column) to those of another Audiologist and to data from Fig 2.

Both reporting Audiologists come from large, multi-office practices that are considered successful. One of them “benefits” from membership in a business management company, the other takes advantage of periodic bulk purchasing to bring down wholesale costs. Yet, both report COG percent increases that are at least double what we’d expect.

Data of varying quality and differing sources are hard to compare, so take Table 1 with a grain of salt. Nevertheless, I think there are a few take-homes from Fig 2 and Table 1 when it comes to the wholesale cost of hearing aids:

- Some Audiologists are being squeezed, but not by market forces. It could be a math problem. Audiology training programs do not teach the formula for calculating annual % change and it’s easier than you’d think to mess it up.{{1}}[[1]]% Change from Year 1 to Year 2: 100 * (Year2$ – Year1$)/Year1$.[[1]]

- Assuming they are calculating correctly, the squeezing may come from business management groups, which themselves function as middle men and have to do some markup to cover the business management value adds.

- Or, the squeezing may emanate from within. Success does not breed a compelling desire to pore over numbers after the doors close each night. “Successful” Audiologists and dispensers may pay more because they can, rather than attending carefully to cost control, as they should.

Fait Accompli — Everybody Suffers, Including the Dog

One way or the other, higher wholesale costs are passed on to consumers. This is illustrated by at least one business management company’s recommended prices, which reportedly exceed the upper limit of retail price ranges posted recently on the website of one of the Big 6 manufacturers. Understandably, Audiologists in that group may feel squeezed and their patients may feel gouged. Some in both groups may go home and take it out on the family dog.

That’s not right. It behooves us to protect our businesses, our patients and our dogs by controlling costs and offering defensible prices to consumers. Manufacturers, other practitioners and some buying groups manage to do this, as the figures and table attest. Taken together, they comprise the Market by which you will be judged by consumers. Transparency will win out, ultimately.

The next step is to compare wholesale to retail data to figure out if hearing aid markups are as high as internet operators claim. That will be the next step in this series.

Finally, don’t forget that wholesale pricing is just one squeeze factor. Today’s discussion has nothing to do with factors such as insurance adjustments, regulated prices, billing headaches, and wage demands. Those, together with the wholesale/retail discussion, will lead eventually to the big Bundling question.

(editor’s note: this is Part 7 in the multi-year Hearing Aid Pricing series. Click here for Part 6 or Part 8)