Astute readers may have noticed Hearing Economics’ attempts to slip in Economics education on the sly. Today’s post fits right into the Economics 202 series, initiating a discussion of how interest rates affect the economy (a macro concept) and our very own practices (a micro concept). Craig Castelli (bio below) describes the situation for practice sellers and buyers in times of so-called “easy money.”

But first, a short foray into Econ 202. We’re in a time of easy money due to the US Government’s expansionary monetary policy aimed at increasing the money supply to bring down interest rates to encourage businesses to invest and expand, thereby boosting consumption (GDP). The good news about easy money is that practice buyers can borrow at low rates, will do so, and will buy practices for higher prices than in times of monetary contraction. That’s good news for those wanting to sell and looks to be the scenario for at least the rest of this year, based on the Fed’s recent decision to keep interest rates low.

The bad news about easy money is that even though sellers are likely to be able to sell, and sell for more money, the money they receive has less value: there’s not much point in saving it because interest rates are so low and it’s likely that the present money will be worth more in the future as GDP rises, monetary policy tightens, and interest rates rise. It’s literally a time of easy come and easy go. It’s also a time of potential “asset bubbles” where practice prices could suddenly plummet in the same way we saw housing prices drop in 2008.

Understanding the relationship between interest rates and present value of money is important for those considering selling or buying practices.

Read on for Castelli’s take on what’s happening now and what to expect in the future.

——————————————

Present Situation

Last summer we discussed the role of interest rates in mergers and acquisitions (M&A) primarily from the standpoint of acquisition activity. We think now is a good time to reprise the subject, only this time we’ll focus on their relationship with practice values.

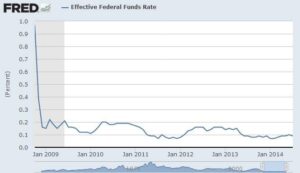

Interest rates and valuations have an inverse relationship; the lower the interest rate, the higher the value. We’ve witnessed record highs for practice valuations the past few years, and there is no doubt they’ve been aided by the low interest rate environment in which we’ve lived since the recession.While mortgage rates and 30-year treasury rates have risen, both the Prime Rate and the Federal Funds Rate have remained unchanged since 2008 (Figure 1). Many large corporations can borrow at rates slightly above the Federal Funds Rate, effectively making capital available to them for free.

In analyzing practice values, those at the high end of the range are influenced by hearing aid manufacturers that either purchased the practice directly or funded a third-party acquirer. While it’s commonly believed that manufacturers are paying cash for practices – and they do make hefty cash payments at closing – in reality they utilize leverage (e.g., debt) to fuel their transactions.

Future Expectations

As borrowing becomes more expensive, valuations begin to feel pressure as buyers can no longer afford to pay as much. Simply put, the more they have to spend on interest, the less they have left over for principal payments. Think of the last time you bought (or re-financed) a house. An interest rate change of only 1%-2% can result in a swing of several hundred dollars a month in your mortgage payments – and that’s on a 30-year mortgage. Imagine the impact on a 5-, 7-, or 10-year note.Everyone wonders how long acquisition activity and valuations will remain at their current levels. While there are several contributing factors, interest rates play a critical role in the overall M&A landscape. Interest rates are certain to rise; the only question is when. Last week, the Federal Reserve suggested that rates would remain near zero for the foreseeable future, meaning that no change is likely before the end of this year.When rates begin to rise, they are likely to do so gradually, but steadily. The impact may be felt as early as 2015 or as late as 2017. Regardless, as it happens, buyers will no longer be able to afford the multiples they are paying today.

Bottom line: If you’re contemplating a transaction as either a buyer or a seller, the longer you wait the tougher the environment will become.

Craig Castelli is the Founder and CEO of Caber Hill Advisors, a leading business brokerage firm that helps current and future business owners buy, sell, and grow companies. Mr. Castelli has over a decade of experience in the hearing healthcare industry and has advised hundreds of private practice owners during his career.

images courtesy of business2community