Our profession was treated last week to a timely and balanced discussion of unbundling by Robyn Cox PhD. She is one of audiology’s most reasoned thinkers, test creator extraordinaire, talented researcher, and a nice person to boot. Dr. Cox addressed concerns being raised in policy-making circles that traditional hearing aid dispensing models are pricing many consumers out of the market.

The article advocated unbundling services from product, cited recent lab research data and called for more and better evidence-based outcomes data to differentiate device technology levels. Hear! Hear! for Hearing Science.

Unlike the Hearing Science portions of the article, and of more concern today, was a basic economic assumption which was accepted at face value without supporting data:

I bet we could agree that many audiologists focus on selling as many high-cost premium hearing aids as possible in order to make a living.

We can’t agree, and shouldn’t agree, without checking the data. As it happens, Price has been Hearing Economics’ focus for over a year, so aggregate data is close at hand. Let’s start there and then consider in a later post why scrutiny of the assumption is important and not just quibbling.

Taking the Bet

Many people will take Dr. Cox’s bet. And I’ll bet they’ll lose, at least in the aggregate, but only if they’re willing to believe the data rather than their eyes, ears and rules of thumb.

That’s a big “If,” given the avalanche of ads for premium hearing aid products, the omnipresent $6K anchor price, the frequent likening of hearing aid salesmen to used car dealers, and the economically unsound but widespread assumption that Price rather than Marginal Price underlies Profit.

Belief bias is likely to prevail over valid arguments, especially when occasional data seems to prove the rule: e.g., an individual provider’s pricing sets higher margins for higher cost products.

Evidence of Varying Quality and Believability

I. Qualifying the data. Data are mainly cross-sectional, taken from industry surveys in which sampling is not random (e.g., skewed toward private practitioners).{{1}}[[1]]Refer to previous posts in the Pricing series for particulars.[[1]] VA effects are removed or adjusted, depending on data source. Time series but not panel data is available. Numbers and trends are linked to their development in previous posts, rather than reproducing all graphs in today’s post. Please click on links as needed.

II. Market segment and market growth of premium products since 2006.{{2}}[[2]]Karl Strom, HR 2013 Hearing Aid Dispenser Survey: Dispensing in the Age of Internet and Big Box Retailers. Hearing Review, 21(4), April 2014, p 23.[[2]]

- Premium hearing aid sales consistently comprise no more than 30% of the market, perhaps as low as 20%.

- An informal poll of industry experts several months ago suggests that “For the industry as a whole… more sales are migrating down–and not up–the value chain.”

Comment: This is not evidence against the bet, but it’s interesting nonetheless. Small, static market share and downward migration of new sales may be real world support of Dr. Cox’s lab-based research, which shows little difference in subjects’ preferences for premium, basic, or PSAP technologies.

Or those trends may “prove” that most Audiologists aren’t good at up-selling.

Or both.

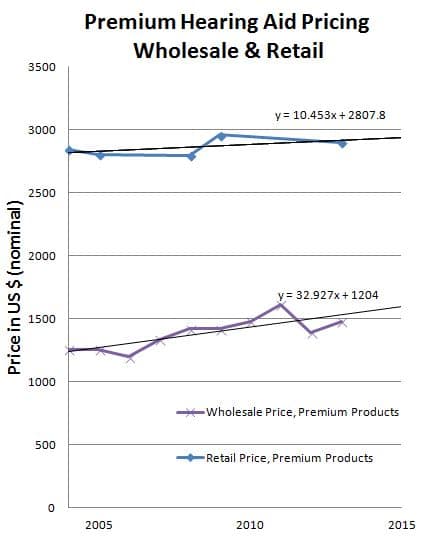

III. Wholesale and retail price trajectories of premium products are not tracking each other.

- Annual wholesale prices increased faster for premium products ($33/year, Fig 1) than in the general market ($23.70/year).

- Annual retail prices were flat for premium products ($10.5/yea, Fig 1) but increased for the market as a whole ($45/year increase).

Comment: This is indirect evidence against the bet. Audiologists who buy high and sell at last year’s prices may not make as good a living as others who buy lower and sell at this year’s prices. This is consistent with Karl Strom’s straw poll impression of downward sales migration.

IV. Percentage gross profit is lower for premium products.

- Percentage gross profit for premium instruments is 20%-25% below that of the market as a whole.

- Premium products are sold at x2 average markup; the general market has markups of 2.5-2.9.

Comment: This may or may not be evidence against the bet. On one hand, lower percentage markup on a high priced item may still mean more revenue than high percentage markup on low price items. That’s why Audiologists make a living by selling hearing aids, not by selling batteries or audiology tests.

On the other hand, it’s evidence against the bet if lower markup means fewer actual dollars realized per sale. That’s not the best strategy for making a living.

V. Dollar “markup” does not differ according to technology level.

- In nominal dollars, the range is $1300-$1500/aid (Fig 1) for premium priced technology.

- In nominal dollars, the range is $1300-$1500/aid for the general market.

Comment: This is evidence against the bet; evidence you can take to the bank. Audiologists, in general, realize the same gross profit (Price less Cost of Goods) regardless of the level of instrument sold. There is nothing to be gained, money-wise, by selling high end products over lower end products.

But this is also evidence in support of Dr. Cox’s advocacy of unbundling services from product. The data suggest that fitting services are relatively fixed, regardless of technology, so “markup” is not what’s really going on. We are already unbundling internally by calculating our service fee ($1300-1500) and adding it to invoice cost, independent of technology. Why not tell consumers that’s what we’re doing?

Really? The Devil is in the Details

Taken together, the data fail to support the notion that Audiologists survive by selling as much high end product as possible. With relatively fixed service fees and flat or falling premium retail pricing, it seems more likely that Audiologists are making a living by focusing on selling mid-level technology instruments with slightly higher margins to subsidize wholesale increases of premium products.

There are always a few who do buy low and sell high. There are always some who don’t mind their Cost of Goods and pass their higher costs onto consumers. Both those groups give Audiologists a bad name. But betting that Audiologists self-deal to make a living not only gives them a bad name but paints them into an unethical corner as well.

Before we assume that Bad Name Audiologists are the norm and before we do them the disservice of assuming that self-dealing is prevalent, it’s a good idea to vet the economic data as carefully as the hearing science data is vetted. Then we can come to conclusions worth betting on. Here! Here! for Economics.

Note: The data so far are averages and may not accurately reflect individual Audiologists’ purchasing and selling habits. Individual practice data is a less powerful form of evidence but it can serve as a rough crosscheck and partial validation of assumptions developed above. That’s the topic of a future post.

photo courtesy of gambling critic

(Editor’s note: This is Part 20 in the multi-year Hearing Aid Pricing series. Click here for Part 19 or Part 21).