Time and space limits in the last Siemens post forced the future to be postponed. The future is now as Hearing Economics continues to clear its desk. Spoiler: nobody agrees yet on what the future holds for Siemens Audiology or its rascally stepchild Hearing USA.

Siemens Makes a Run for It

On May 7, 2014, Siemens announced that its Audiology business would be listed as a publicly traded company.{{1}}[[1]]If for no other reason than to keep it all in one place, here’s the full text of the announcement from US President Scott Davis, for anyone who cares to read it:

May 7, 2014

Dear Valued Customer and Business Partner,Today, Siemens AG announced that Siemens Audiology will become a publicly traded company. This is exciting news for our customers and business partners for several reasons, including greater management focus on audiology, increased flexibility to meet your needs, and entrepreneurial freedom to respond to changing market conditions.

- The hearing aid industry represents a very attractive market whose growth is driven by global demographics, technological innovations and the ever increasing requirements for the highest quality hearing care.

- Siemens Audiology has demonstrated a strong and improving performance record in this market, stemming from our compelling micon platform and the ubiquitous Siemens brand having the highest recognition among hearing care providers and patients.

- Though we’ve been an important contributor to the success of Siemens AG, we can better realize our full industry potential as an independent company. For example:

- All relevant hearing instrument manufacturers are industry “pure plays” that are either publicly listed or privately owned, and not part of a large conglomerate.

- Our go-to-market strategies and customer requirements are unique to the hearing industry, compared to other Siemens AG businesses such as power generation and distribution.

- The growth areas of the hearing industry are very different from other Siemens AG businesses and have little synergies with these.

I hope that you, our valued customer and business partner, share my excitement for the decision to list Siemens Audiology as a publicly traded company. This allows us to build on the natural strengths of our business, further focus our management attention, and invest into the most promising growth areas of the hearing industry.

Most importantly, I want to emphasize that this transition will not affect how we do business with you: We will continue to further improve in order to remain your preferred partner of choice. We are confident that we will be able to serve you even better upon completion of our listing as a publicly traded stock.

On behalf of the Siemens Audiology team, we look forward to continue building our success together. Please feel free to ask your Siemens representative or myself if you have any questions or comments.

Best Regards,

Scott Davis

CEO

Siemens Hearing Instruments [[1]] “Going public” is another way of saying that Siemens wants to get out of its investment by selling. Figs 1 and 2 are snapshots from Siemens’ business overview on May 7.

Note that “Going Public with Audiology” is the top priority in Siemens Healthcare business (Fig 1). There was speculation in 2013 that Siemens might take the entire Healthcare sector public, but only Audiology ended up on the block.

Getting shown the door is probably the only time that the teeny-tiny Audiology section ever made the pages of a Siemens report. Audiology is 1 of 5 sections of Siemens Healthcare, many pay grades below MRI machines. Siemens won’t miss it.

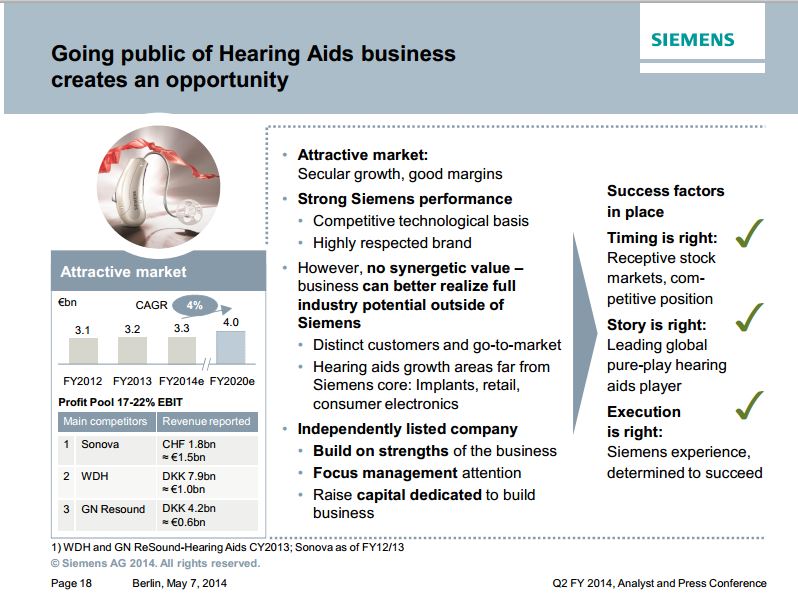

Fig 2 spins the proposed divestment, touting Audiology as a “leading global pure play hearing aid player.” Is that a good thing? What with the rest of the Big 6 working hard at forward integration, it’s difficult to know how being a pure play is an enticement in today’s market. Whatever. Siemens notes that hearing aids are “far” from its core business. Time to sell.

Recent posts leave little doubt that Siemens is on the right track. David Kirkwood posted an analyst’s view that Siemens is most at risk of the Big 6 in the US market, what with Rexton’s rapid one-year decline (65% to 47%) at Costco and further downward trending predicted as Phonak ascends in that market.

Besides which, Siemens would rather bet on growth of the offshore wind industry than hearing aid growth. The Audiology sale announcement was made on the same day that Siemens announced it was moving its power-generating operations headquarters to the US. Too bad Siemens didn’t read Kirkwood’s report of potential deleterious effects of wind turbine noise on hearing. They might have seen an opportunity for sales synergy, with increasing hearing aid sales in areas serviced by wind turbines.

SOBs and Cattle Rattles

No word yet on a suggested opening bid (SOB), though readers may recall that an attempted sale in 2010 went to a second round of bidding but Siemens shut it down when bids didn’t hit a reported target of $2.7 billion. There was speculation then that a triumvirate of European retailers (Geers and Amplifon) and an unnamed private investment firm might make the purchase, “creat(ing) a globally integrated hearing aid manufacturer/distributor generating about $2.11 billion in annual sales.”

Three years later, in late August 2013, one of the Usual Suspects appeared on the scene to broker a deal. Valentin Chapero Rueda, formerly of Sonova, formerly of Siemens, latterly of Valamero Holding AG (a Swiss start-up investment company) was working to broker a deal in which a private investment company would make the purchase and Mr. Chapero would provide leadership. That has yet to happen, but no one has said it won’t.

The private investment company remains anonymous, though it’s worth mentioning that Kolberg Kravis Roberts & Co. LP (KKR) was in the second round running back in 2010. KKR bought Panasonic Healthcare in October 2013 and finalized the deal on April 3 of this year. From comments (below) that came in after this was posted, it appears that Panasonic’s hearing aid business did not go to KKR so maybe that player is no longer looking to get into the hearing aid business? Those who are better informed than the notes on my desk are urged to continue contributing to this discussion and improving this and future posts.

Who Indeed?

As usual when it comes to Siemens and HearUSA, there is more on the desk than can fit into a single post. The future will continue but not for several weeks. Tune in for speculation, gossip, and insider commentary from Deep Throats about who wants and who doesn’t want Siemens. And there’s always HearUSA to keep the pot boiling, if not encourage buyers.

photos courtesy of green book blog and basement rejects

Do you know how an IPO works?

In general terms, but not an expert. I’m uncertain whether this will be an IPO or not. What do you know? Please share.

CThomas: “Do you know how an IPO works?”

Author: “In general terms, but not an expert. I’m uncertain whether this will be an IPO or not. What do you know? Please share.”

It was pretty clearly stated in first sentence of the document that you cited below:

“May 7, 2014

Dear Valued Customer and Business Partner,Today, Siemens AG announced that Siemens Audiology will become a publicly traded company…”

Which, of all documents cited, is the only one listed that quotes an actual Company employee (their CEO). The rest are speculators, and the most recent of said speculators dates back to 2010.

I can’t tell whether your article is seething with contempt or sarcasm, but I don’t see how this IPO is a bad thing (unless stock prices plummet after opening). The only non publicly traded “Big 6” company left is Starkey. So the rest of them have been through this at some point; Phonak, Oticon, GN, etc.

“The Audiology sale announcement was made on the same day that Siemens announced it was moving its power-generating operations headquarters to the US. Too bad Siemens didn’t read David Kirkwood’s report of potential deleterious effects of wind turbine noise on hearing. They might have seen an opportunity for sales synergy, with increasing hearing aid sales in areas serviced by wind turbines.”

Who says they didn’t?:

https://www.ewea.org/events/workshops/wp-content/uploads/2012/12/EWEA-Noise-Workshop-Oxford-2012-1-1-Stefan-Oerlemans.pdf

Note that this WAS a couple of years ago, and maybe they’ve seen even more improvement. But the key term that caught my attention was *offshore*. So the Michigan study, valuable and informative as it is, doesn’t really apply to Siemens in the case you cited because it’s OFFSHORE:

https://www.nytimes.com/2014/05/08/business/energy-environment/us-awards-3-wind-power-grants.html?ref=todayspaper

Naturally, the Devil’s advocate in me did a little digging and found that Siemens was also granted a large contract to supply onshore turbines in Iowa. However, “…literature review on perceived health effects of wind turbines was conducted in December 2009 by a scientific advisory panel for AWEA and the Canadian Wind Energy Association. Following review, analysis, and discussion of current knowledge, the panel reached consensus on the following conclusions:

*There is no evidence that the audible or sub-audible sounds emitted by wind turbines have any direct adverse physiological effects.

*The ground-borne vibrations from wind turbines are too weak to be detected by, or to affect, humans.

*The sounds emitted by wind turbines are not unique. There is no reason to believe, based on the levels and frequencies of the sounds and the panel’s experience with sound exposures in occupational settings, that the sounds from wind turbines could plausibly have direct adverse health consequences.”

https://awea.files.cms-plus.com/FileDownloads/pdfs/AWEA_and_CanWEA_Sound_White_Paper.pdf

Expert Panelists:

W. David Colby, M.D.

Chatham-Kent Medical Officer of Health (Acting); Associate

Professor, Schulich School of Medicine & Dentistry, University of Western Ontario

Robert Dobie, M.D.

Clinical Professor, University of Texas, San Antonio; Clinical

Professor, University of California, Davis

Geoff Leventhall, Ph.D

Consultant in Noise Vibration and Acoustics, UK

David M. Lipscomb, Ph.D

President, Correct Service, Inc.

Robert J. McCunney, M.D.

Research Scientist, Massachusetts Institute of Technology

Department of Biological Engineering; Staff Physician, Massachusetts General Hospital

Pulmonary Division; Harvard Medical School

Michael T. Seilo, Ph.D

Professor of Audiology, Western Washington University

But I digress, as that’s deviating far and away from my point in general, which is this. It’s easy in the audiology industry to want to beat up the big, bad manufacturers. But facts are facts, and utilizing a forum such as this to disseminate misinformation is irresponsible at best. I would expect someone to do some research and not rely on so much industry scuttlebutt before posting an article, which is clearly an opinion piece veiled in stale facts and poor conjecture. An IPO does not necessarily mean a company is performing poorly, or that it is “not wanted.” It does not necessarily mean a company is for sale, other than that SHARES of it are for sale, with a majority stakeholder somewhere. Which, if I were a gambling man, I would assume would be Siemens AG, much the way William Damant is the majority stakeholder in Oticon. Oticon, being the “pure play” player in the conglomeration while the rest of the William Damant business units gobble up market share in their particular areas: Bernafon as a B player in hearing aids and the Costco channel, American Hearing Aid Associates as a buying group/practice management consulting service, Sonic Innovations as a hearing instrument manufacturer, Gordon Stowe as an equipment dealer, providing instrumentation from GSI, Interacoustics, Maico and MedRex whom they ALSO own. Add ACCUQUEST (800+ retail dispensing locations to my best estimate) and Avada that we’re forced to compete with in addition to Hearing Life, and you quickly see that becoming publicly traded can be a very desirable thing.Or not. But my goal here is not to come to Siemens defense, but rather point out that I can’t really take an article like this seriously when, coming from a CFO the simple difference between a company listing an IPO and being “for sale” as a corporate entity cannot be discerned, even when it’s clearly stated in a letter provided by the CEO of that company and cited as one of your sources. In fact, when a rep from another company came to my office a few days ago, that’s all he wanted to talk about. I found it curious that this rep was so focused on this event rather than their own product that I turned to a Siemens employee for some clarification. Turns out, they seem to know a little bit more about their own company than the company-bashing competitor who, incidentally, wanted to know nothing about what I fit or what the goals of my practice were. That rep is no longer welcome back in my office, by the way. How can I trust someone who has no clue what they’re talking about, and who behaves in such an unprofessional manner?

Thanks Jason, for the effort you spent researching. I’m sorry you read this as “seething” with contempt, which is and never has been the position of HHTM toward anyone or any honest efforts in our industry. For the record, I’m quite fond of Siemens and think they’ve done an admirable job over the years of handling a business that is far from their core business and getting farther by the minute. Selling Siemens Audiology is not a bad thing, it’s just a hard thing to do.

I wouldn’t take this post as a report of facts–it is clearly stated twice that this series is about clearing my desk of all sorts of views, information and just plain gossip that has filtered in over the years since the Siemens/HearUSA purchase occurred. It’s not thinly veiled and it’s not opinion, it’s just clearing and tidying up. Siemens may indeed do a Facebook-like IPO but time will tell, as it has in the past with this particular section of this particular company. Others far more knowledgeable than I am are not seeing it quite that way. Their “views” (not seething but realistic) will be reported next in the series and readers can take them for whatever they are worth. I am referring your offshore research efforts to David Kirkwood, who wrote on the wind turbine effects some time ago.

I believe Widex is also privately held. I’ll be happy for you to correct me on that as well.

Rest assured that I am CFO in name only, somebody’s got to do the books and I’m the only one willing to do it. The world is safe. As for trusting me, I wouldn’t. I always rely on the advice of our faculty head at Stanford: “Never Trust Your Mother.”

Correction, Jason: Widex is not publicly owned, nor i Austrian CI manufacturer Med-El.

Also, back in 2010, Sydney-based Cochlear Pty was looking to buy Siemens.

Thanks Dan. I missed two small points of clarification. 2010 huh? Hardly relevant today. I wonder how many people realize that Widex is snapping up practices, and owns Helix though. And I’m really surprised more people aren’t fuming about another “S” company being in the largest Costco on the planet (Korea). It is my understanding that the only reason they’re NOT in the box store is that they lost the contract to Phonak due to price and technology.

I was just at a seminar where they shamelessly tried to paint themselves as the good guy. Nobody bought it.

Did KKR algo get the hearing aids business unit from Panasonic? I recall reading a press release earlier this year about the transfer of the businesses to KKR and it said that the hearing aids and ultrasound diagnostics businesses were not being transfered.

Good question and one I have not seen addressed in print. The press release announcin final inking of the deal said this: “KKR and Panasonic now own 80% and 20%, respectively, of Panasonic Healthcare through Panasonic Healthcare Holdings Co., Ltd.” (Read more at https://www.stockhouse.com/news/press-releases/2014/03/31/kkr-completes-panasonic-healthcare-share-purchase#8A4ggxBWtEkBZtTi.99) but did not carve hearing aids out of the deal. The Panasonic website shows hearing aids on the Products and Solutions page — scroll down to the bottom to see “Healthcare” section and “Home/Personal Use” products.

Whether KKR’s 80% includes hearing aids is not stated. Whether KKR wants to be in the US hearing aid business is unknown, at least to me.

Readers are encouraged to improve what’s known by sending in information. Thanks, Daniel for your comment and question.

Thank you for your response, Holly. I actually found the official press release from the transfer of shares from the KKR/Panasonic deal:

https://panasonic.co.jp/corp/news/official.data/data.dir/2013/09/en130927-5/en130927-5.pdf

Page 2 of the document says: “…the ultrasound diagnostic device and hearing aid businesses, which are not being transferred as part of The Transfer.”

So it looks like Panasonic sold the entire Healthcare unit BUT hearing aids and ultrasonic diagnostics. The reasons behind it is still unclear for me. Would be interesting to find out.

Wow, thanks so much for making the news more complete and correct, Daniel. This is why blogging is so great — many heads are better than one.

Panasonic didn’t have much market share for hearing aids in the US, so KKR probably wasn’t interested, or not much anyway. I don’t have global numbers but what I’ve seen suggests that Panasonic has a significantly bigger share of the hearing aid market in Japan, so perhaps it made sense for Panasonic to retain that small portion of business? I am only speculating here and would love for someone who actually knows to fill us in.

Thanks again for finding the link and sharing it with me and our readers.