“The biggest news item in this morning’s press release was that GN’s VP of Finance at its Beltone distribution network in the US– who wasn’t identified–has been accused of accounting fraud between 2012 and 2014 and dismissed. The fraud was discovered at the end of June and the matter is under investigation.” (excerpted and paraphrased from 8/13/2015 reporting by Lisa Bedell Clive of Bernstein Research and Bloomberg)

That news broke almost two months ago, on August 13. It was immediately followed by the announcement of Todd Murray’s resignation as President of Beltone and from his many other leadership responsibilities within GN.1 Parent companies GN Resound (US) and GN Nord Store (Denmark) worked to make non-news of these events, issuing assurances that– whatever had happened– it was a “one-off” of little importance to the global bottom line.

Biggest Loser

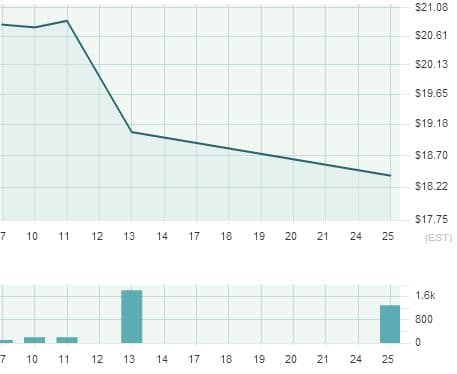

Figure 1. GGNDF stock activity, Aug 11-25, 2015.

Those down the food-chain weren’t buying it (Fig 1). In fact, they were selling it in high volume on August 13 (Fig 1). GN Nord Store A/S (GGNDF ) stock drop 8.6% in the first few days, and 17.5% within the next week, gaining GN the dubious title of “biggest loser in the Stoxx Europe 600 Index.” At the time of writing, the stock is 27% below its high for 2015, making it a good buy (“overweight”) by analysts’ recommendations.

Shareholder activity must be based on intuition because there has been not one more iota of news until this morning, when Lisa Bedell Clive of Bernstein Research published a confidential report with a bit more detail on the fraud mechanism and continued to rate GN stock positively (outperform). 2 Overall, it’s been an odd story so far, leaving many questions and no answers, which makes for a longer-than-usual post or two with lots of qualifying footnotes.

The following are Hearing Economics efforts to answer or at formulate a response to a few of the questions left hanging by the story so far.

Who was the VP? Why Did he Go Unnamed in News Reports?

Fig 2. Happy Beltoners at the 13th Anual Chicago Innovation Awards. ( Todd Murray far left, Paul Giampaolo, far right)

GN and first responders did not identify the VP, but he was named on August 20 by the Danish magazine Finans, though US news sources remain mute. Finans and stateside insiders identified him as Paul Giampaolo.

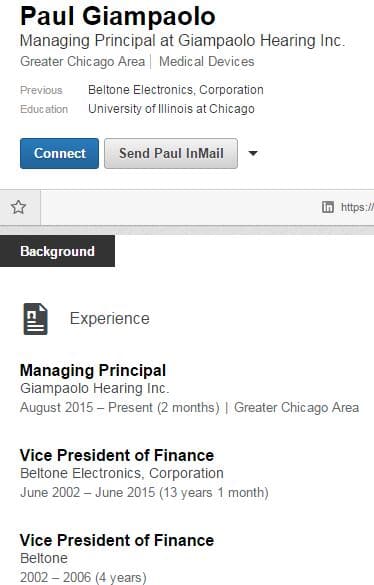

Mr. Giampaolo is shown at far right in Fig 2 — a picture taken in happier times when Beltone top brass accepted the 2014 Collaboration Award at the 13th Annual Chicago Innovations Awards. His Linkedin profile, which has always been in plain sight (Fig 3), self-identifies him as VP of Finance, Beltone Electronics, Inc. for 13 years, 1 month, ending June 2015.

By several accounts, Mr. Giampaolo was well liked, even loved:

“very close to Beltone network owners,” a “go-to guy who could always find a way to get it done.“

Confidential sources say that “it” sometimes meant Beltone “buying a practice and writing off a lot of debt.“

For Instance

(En)forced mergers of strapped dispensing owners with their manufacturer/suppliers have long been a sordid fact of life in our industry. Dispensers, like the rest of the world, are psychological beings who are not immune to positive outcome bias. Over optimistic expectations for future sales by owners can create bad situations in which they are overextended and have severe cash flow problems.

The manufacturer/supplier ends up having to do something to recoup, intervening in order to have some degree of control of downstream distribution (c.f. p 58 of the 2014 GN Annual Report .3 Someone in the supplier’s management group who knows the business owners and understands their P&Ls is necessary and important, first to keep the owners from falling into the traps described above, second to intervene and restructure if payables overwhelm the business.

As insiders tell it, Giampaolo was well versed in the operations and needs of owners in the Beltone network and he was a deft and delicate enforcer when the need arose. And therein may lie the simplest answer to the question of why GN declined to identify its own Beltone VP of Finance by name.

Other Reasons for GN Vaguery

GN may have considered a number of good reasons to not name names as well as isolate and minimize damages, over and above any desires to shield a likable, reliable guy who might know where skeletons were buried.

- Nothing good could come to the corporation from calling out one of the brethren of the close-knit Beltone network owners, especially if there was even a remote possibility that the fraud included some in the downstream supply chain who might be too big to fail (more on that later).

- Those in the know have raised the possibility of a lawsuit for wrongful dismissal, a la Starkey at present.

- Creditors and investors could sue if they suffered losses, filing lawsuits against the corporation and individuals responsible for corporate oversight. Competent leaders are not expected to be mislead. Consequently, liability for failure to detect the fraud could extent to top management executives, board members, and independent auditors.

Why was the President Called Out?

But one name did get named on August 13. That was Beltone President Todd Murray (see Fig 2), who left untarnished but unemployed that day with GN’s best wishes for his future endeavors. Murray served for over 10 years as Beltone President and is now replaced in the interim by Rich Swanson, the COO of GN Resound A/S and formerly the VP of Finance of GN Resound US.

Granted, it’s hard to fire your president without naming him, but the same logic would seemingly apply to a well-known vice-president, too, so the question of “Why Todd” stands. By all accounts, Murray is and was well liked and respected in industry circles. Recapping HHTM’s news item at the time, one industry insider (but outsider to GN and Beltone) expressed the sentiment of many who were “caught off guard”, “aghast” and “dismayed”:

“I find it odd that the (alleged) crook’s name is nowhere to be found, but no one seems to have any problem with plastering Todd’s name and resignation news everywhere.”

Within GN, the view seems to have differed slightly, or at least been more informed:

“The way they were accounting for certain revenues, I’m not surprised when Todd went.”

That, and Murray’s standing in the industry, may have been higher than it was within the “collegial, tight” Beltone network. The following dark comment dredged from within that almost-impenetrable network says more about the Organization than it does the Man:

“If it doesn’t accept you as president, you’re in trouble.”

Who, When and How was the Fraud Discovered?

When?

GN says the fraud was not discovered until the second fiscal quarter (Q2/2015), maybe not until the end of June. The 2014 Annual Report bore no foreboding from the independent auditors report, nor did the GN Interim Q1 Report report anything amiss.

Nevertheless, it seems likely that somebody, somewhere within GN discovered the fraud near the end of Q1, rather than than in the second fiscal quarter, and that somebody, somewhere within Beltone gave Giampaolo an advance heads up and a running start. These speculations on the part of Hearing Economics hinge on the Linkedin profile (Fig 3) which show him as Managing Principal of Giampaolo Hearing Aids, Inc. That Illinois company came into being when it was registered in the state on April 3, 2015, just 3 days into Q2. As of this writing, the company appears to be running out of a home address in a Chicago suburb.

How?

You’d hope that company’s Audit Committee played a hand, given its assigned task of

“assist[ing] the board of directors in relation to internal accounting and financial control systems, the integrity of the company’s financial reports and engagements with external auditors.“

If so, the Audit Committee upped its game quite a bit since weighing in on page 42 of GN’s 2014 Annual Report that “there is no need to establish an internal audit function at this time.“

Or, taken from pages 42 and 43 of the same report, maybe the fraud was teased out by:

- GN’s Whistleblower Reporting System working as designed to “ensure that allegations of illegal or unethical conduct are reported and addressed fast.“

- GN’s new compliance software system, implemented in 2014, and designed to “identify, assess and minimize risks related to business ethics and compliance.“

Who?

The independent, outside auditors are paid to comb the books and detect fraud. Ernst & Young gave GN a clean bill of health on page 110 of the 2014 Annual Report.4 They (or possibly their replacement?) will do better in the 2015 annual report.

Besides the annual outside audit, and notwithstanding the Audit Committee’s opinion that an internal audit function was unnecessary, the question remains of who within GN Nord Store A/S was responsible for overseeing US subsidiaries such as Beltone? There are probably quite a few, but here are two who fit the bill, based on their education, skills, and present job descriptions.

- Anders Boyer (Fig 4) CFO of GN Store Nord A/S, has served GN in executive management positions since 2007. His GN salary exceeded $1.12M(US) last year. He has a Masters degree in Finance and Accounting. He serves on the executive board of

- Carsten Krosgaard Thomsen (Fig 5) sits on the big boards at GN Nord A/S — Netcomm A/S and ReSound A/S (2014 compensation was just over $100K US). He is the CFO of a number of companies, chief among them global IT company NNIT A/S. He holds a Masters degree in Economics with special competencies that include “Extensive expertise within finance, accounting, auditing, risk management,” according to the GN 2014 Annual Report.

Two other persons of note are Morten Toft and Michael Bjergby (Figs 6 & 7). Toft, a specialist in M&As and corporate finance, was appointed GN VP of Global Finance in 2015. Bjergby– formerly GN Store Nord Director of Investor Relations and Treasury–was coincidentally promoted in August to GN Store Nord VP of Finance for some global markets and for Distributor Markets. 6

Bjergby, too, holds a Masters in Economics and hopefully that came in handy in what must have been a fast learning curve for him. With no more than 13 days in the new job, Bjerby was one of four corporate representatives on the GN.CO earning conference call convened on August 13 to address financial investment analysts who pressed GN on its corporate health and the Beltone fraud in particular.

More to Come

Future posts will continue looking at Beltone and fraud, reporting updated information as it comes out and considering questions such as these:

- What kind of fraud was it?

- How much was involved?

- Who was involved?

- What’s a “one-off”?

- How long did this go undetected?

- What is Beltone these days and how does it fit (or not) into the GN corporate culture?

- Is any of this important? (Spoiler alert: the answer is an unequivocal YES)

References and Footnotes

1 Mr. Murray was also President of GN Hearing Care Corporation North America and President of GN Hearing Care Canada.

2 GN Store Nord: Real Risks or Red Herrings? Key Takeaways From Our Strategic Decisions Conference. Bernstein Research, Oct 6, 2015.

3 “Loans to and Investments in dispensers GN Store Nord grants loans to dispensers and acquires ownership interests in dispensers. At December 31, 2014 the carrying amount in non-current assets of loans to dispensers was DKK 814 million (2013: DKK 529 million), ownership interests in dispensers was DKK 182 million (2013: DKK 134 million). In addition supply agreements with dispensers amount to DKK 128 million (2013: DKK 96 million). The agreements are typically complex and cover several aspects of the relationship between the parties. Management assesses the recognition and classification of income and expenses for each of these agreements, including whether the agreement has an embedded supply agreement or represent a discount on future sales.”

4 “In our opinion, the consolidated financial statements and the parent company financial statements give a true and fair view of the Group’s and the parent company’s financial position at December 31, 2014.“

5 Pandora is a global jewelry manufacturer and distributor.

6 It’s unclear who Mr. Toft and Mr. Bjerby replaced or if the positions existed prior to their appointments. Better informed readers are asked to improve this post with information in this regard.

Interesting. I once sent Todd Murray a hundred dollar bottle of Irish whiskey while dealing with GN ReSound, and trying to resolve a billing issue where they never had my bill right.

I did it along with a personal card and a photo of a pair of their dots, in an on the rocks glass, hoping to illicit a conversation regarding an ongoing problem with doing business with them.

It’s the only time in my life I’ve known of anyone in such a position to not only fail to initiate a requested conversation with a paying customer, but even fail to recognize, or acknowledge receipt of an expensive gift.

Can’t help but feel Karma is very much at play for Todd and company here.

Dan……..

Why did GN pay 393,000 for Beltone knowing that just 2 years before it was purchased by J W Childs for 155,000? After Childs took over they lost almost 1/2 of their dispensers, in spite of that they sold it for 238,000 more than they paid.