This is the almost-final Econ 202 post on barriers that exist in the US hearing aid manufacturing and delivery system.1

Parts 1, 2 and 3 addressed regulatory requirements that discourage new entrants; legal and economic definitions of barrier to industry entry/exit; structural and strategic barriers in the hearing aid industry; and specific strategic barriers used by incumbent manufacturers in their competitive response against entry firms.

Today’s finale wonders whether hearing aid industry barriers have much relevance in the coming markets for ear devices.

Barriers May Not Matter

Monopolistic pricing of product (and services) only works if there are no close substitutes. (Karlin & Morduch, 2014).2

“Why scale a barrier if you can go around it?”

That’s the relevant question for competitors, new and incumbent, when considering new product spaces. Likewise, the question applies as new distribution channels run parallel or tangential to traditional hearing aid dispensation; or skip the dispensing part entirely.

The question is especially relevant in the current milieu of divergent definitions by the FDA and CTA of ear level devices and technologies loaded into those devices. The same can be said for its relevance to related social policy discussions ongoing within the FDA, PCAST, and IOM that put downward pressure on Price.

Natural Barriers

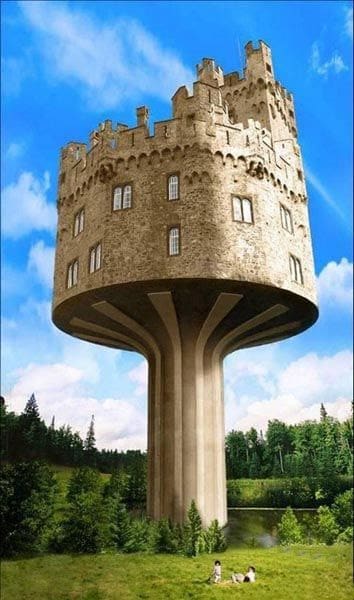

Could our little fortress of manufacturers and dispensers morph into something not too far afield of to what economists call a “natural monopoly”? That’s a situation where the market is too thin to sustain more than one competitor. A common example is the barber shop in a rural town, which can charge whatever it can get to cut hair. The populace and city fathers could bring in another barber to boost competition, but that would cost more than paying the going rate to the incumbent barber shop; plus the quality of hair cuts would probably go down when rates were cut.

True, our situation has more than one barber shop, but the shops all know each other, use the same equipment, swap employees, consolidate shops, and do the same hair cuts. No surprise if they happen to set similar, monopolistic, prices for products and services. And no surprise if the regulators and that 20% of traditional hearing aid consumers decide to maintain status quo if faced with the opportunity cost of subsidizing a shrinking industry that could be in decline.

Dwindling industries typically do not conduce competitive technological innovation. Monopolistic pricing is not a guaranteed boon for incumbents. Price has to cover average total costs of production in the long run–another way of saying that monopolies may not make enough money to maintain, much less fund large R&D programs.

It is possible to reap negative profit with monopolistic pricing and all bets are off if regulators force price down toward marginal cost level. Either way, the technological engine stalls, differentiation disappears, companies face shutdown and exit the market. If the remaining companies or the market become “too small or too limited, [they’ll] just become irrelevant and bypassed.“4

A Market to Ourselves

If 2015 and the 2016 AudiologyNow! exhibit floor are samples of what’s to come, PSAP and Hearable suppliers, big and small, may march past our barriers. For example, Samsung has yet to enter the hearing aid market, despite expectations to the contrary for the last year. In which case, the specialized, sequestered hearing aid industry and licensed distribution channel can stay fortified on The (Capitol) Hill. From there, they can watch from the ramparts as the hoards swarm by, far out of shooting range.

Which is not all bad. Besides peace in the valley and on The Hill, remaining manufacturers and licensed providers would still have their market of old: the static 20% of consumers who want to purchase specialized medical devices through licensed professionals in bricks and mortar settings.

If the 20% holds steady as the aging population grows, it’s sufficient to maintain a few competitors in the market. Even if the percentage declines as the aging population grows, there should still be enough demand in the market to maintain at least a couple technologically innovative competitors.

And that’s not so bad either. Regardless of politics and wallets, most of us can agree that having at least one product and group of experts in the market which offer a high-priced, superior technology, fitting and maintenance solution beats the alternative of a bunch of companies all producing low-cost, similar “basic” hearing aids for self fit as the only solution.

…sometimes a monopoly in a more technologically advanced product is better than a competitive market in an obsolete one. (Taylor, 2010)3

The One Thing That’s NOT a Barrier is Price

This space has spent years aggregating data to demonstrate what should be obvious from any perusal of the Internet or the local paper: hearing aids come at all price points from $399 up, even lower or free with some benefit plans. On the other side of the Demand curve, Consumers who want to drive out of the show room in a Mercedes-level hearing aid have been able to do so for a premium price increase of less than $60/year for the past 20 years.

It may be good politics but it’s bad economics to put the blame on Price.

Accordingly, Hearing Economics will beat this dead horse with a few links from its past, in hopes that somebody is reading this stuff. Notwithstanding stigma as a personal barrier, barriers other than Price are holding back the market, specifically:

- regulatory restrictions on the high end of the Demand curve

- incomplete consumer information on the low end of the Demand curve

- corporate credibility or lack thereof

- absence of price transparency at all points in the Supply chain

In Conclusion

Econ 202, “Barriers in the US hearing aid market”, is over and you’re all encouraged to enjoy your summer vacation. Here are your take-home points.

Price is not a barrier, but other barriers exist which:

- add to the wholesale and retail costs of hearing aids, but none excessively (and none exclusively);

- bestow incumbents with market power, enabling monopolistic pricing and societal costs;

- aren’t big enough to prevent market entry;

- allow incumbents to

- recover start up investment and other fixed costs through sales,

- develop and protect technological innovations through patents and patent protection strategies,

- grow productivity and reduce operating costs through mergers and acquisitions;

- may be of little consequence as technological changes grow the market;

- may protect a few remaining incumbents in a declining market.

PS

Sorry, just kidding about vacation. Class is still in session till we get through next week’s post-script.

Meanwhile, I’m staging a strategic retreat to my bricks & mortar office to dispense high tech hearing aids under my state license to anyone who can scale the barrier to access.

References

1Although this series is limited to the US market, anticompetitive barriers and price effects are in discussion in other countries as well. France recently launched an investigation to see whether storming the hearing aid Bastille is in order to bring down prices.

2Karlin D & Morduch J. Monopolistic competition and oligopoly (Ch 15). Economics (1st Ed, 2014). NY: McGraw-Hill.

3Taylor JB. Monopoly (Ch 10). Principles of Microeconomics (7th ed, 2010). Mason, OH: Southwestern-Cengage Learning.

4Health care companies see scale as the only way to compete. NYTimes, 4/29/16.

This is Part 4 of a 5-part series on barriers. Click for Part 1, Part 2, Part 3, or Part 5.