Real Price at retail isn’t rising in general and is actually falling for Premium products. Something similar but even more dramatic is happening on the wholesale level.

So concluded last week’s post and is the jumping off place today.

Average Wholesale Price Functions

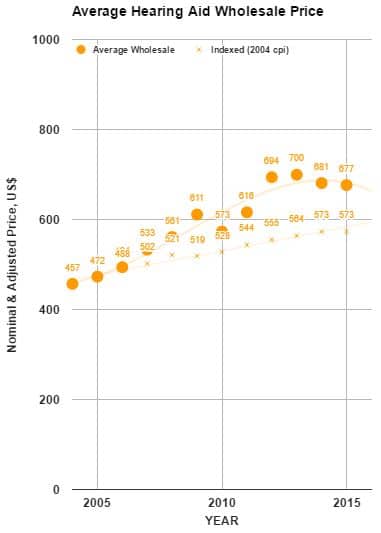

Average wholesale Price of hearing aids increased faster than inflation1 for the last decade ($18/year, double the cpi rise of $9/year ), as shown in Fig 1. As a result, today’s dispensers face invoices that average $104 more per instrument than in 2004.

Fig 1 is busy with dots, x’s, and numbers but readers can glance at the trend lines to get the gist. Values are included for those who wish to compare real-to-nominal dollars, year-in or year-over-year.

Mirroring the nominal retail Price function (previous retail post), average wholesale dipped during the Great Recession, peaked around 2012, and declined in recent years. The mirroring of retail and wholesale functions raises thoughts:

- Wholesale pricing, on average, may align with inflation at the consumer level in coming years, same as predicted for retail ASP.

- Mirroring of retail and wholesale price functions suggest that Price for services bundled into retail may be close to a constant. We’ll talk about that in a later post.

It’s reasonable to speculate that average wholesale pricing is pulled up by premium-priced products as they debut in the market. This is based on the long-held–and rational–assumption that the hearing aid industry strategically ties Price to successive technological innovations.

At the same time, it’s reasonable to expect that successive technological advances come with successively lower sticker prices, which would at least lower the rate at which average Price increases. Historically, our industry has seen both effects as product differentiation has blossomed since 1994.

A look at the Price numbers for premium instruments shows that much of this speculation–rational and historic though it may be–is off base.

Premium Wholesale Price Functions

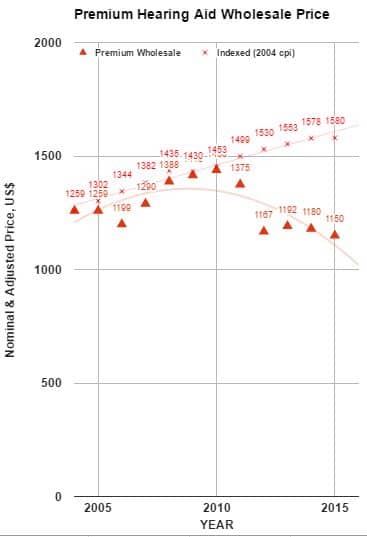

Price functions for Premium products (Fig 2) aren’t behaving like average Price functions in Fig 1. The differences are obvious, but it doesn’t hurt to point them out:

First, they’re going in opposite directions:

- Real Price is going up, as you’d expect for an inflation adjusted function–by about $23/year.

- Nominal Price is going down at a rate of-$9/year.

Second thing, real (indexed) Price is above nominal Price since 2010, opposite of Average Price functions in Fig 1. In other words, wholesale premium pricing tracked inflation at the consumer level through 2010 and has fallen off every year since.

- As a result, today’s dispensers face invoices that average $430 less per premium instrument than in 2004

Finally, the Premium price function doesn’t reflect the 2009-2013 drop-then-peak configurations seen in retail and wholesale average Price functions.

Premium product Pricing is not behaving like the rest of the hearing aid market. One certainty is that the Premium category is not pulling up the ASP seen in Figure 1. Almost certainly the Premium plummet since 2010 accounts for at least some of the ASP declines seen since 2013.

The surprise is that the Premium plummet hasn’t brought ASP down below inflation-adjusted values, so that the functions in Figs 1 and 2 look more similar. Either Premium product accounts for a very small portion of the US market or mid level and Economy instruments are going up in Price.

The other surprise, self evident from Figure 2, is that the hearing aid industry as a whole hasn’t used technological advances as a Price leveraging strategy since 2010. Which is not to say that Premium Price is low because it is not. But it is to repeat what’s shown in Figure 2: dispensers pay over $400 less in real dollars and $100 less in nominal dollars to order top technology today, compared to 2005.

All of which leads to speculation that Economy instruments have a lot of ‘splaining to do.

Premium Wholesale Price Functions

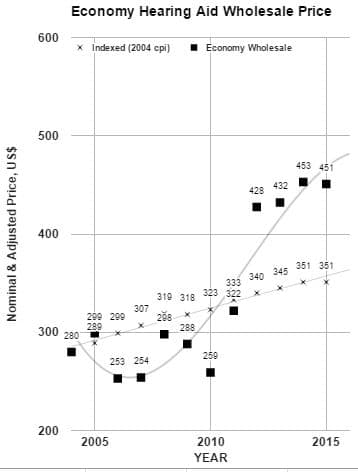

Caveat: Fig 3 looks more extreme than it should in comparison to Figs 1 and 2. That’s because the Y-axis is foreshortened to enable readers to see numeric labels for both functions. Notwithstanding, the direction and relationship of the Economy Price functions suggests that this category, too, has a mind of its own.

Upward Direction after a Muddled Start

- Wholesale Price was hard to pin down in the early years, due to difficulties defining what belonged in the category and a dearth of measurement tools.

- Price hit its stride around 2008, going down with the rest of the market in 2010 after the Great Recession.

- Price began rising in 2011, similar to ASP in Fig 1 and Retail in past posts.

- Unlike other functions, the Economy Price function didn’t peak. It has continued to rise at least through 2014.

Relationship to CPI

- On average since 2005, Economy Price has jumped ahead of inflation, rising an average of $14/year, compared to just $5/year in cpi adjusted dollars. That is so even though nominal Price was below cpi for six of those years. Economy pricing has come back fast and hard since 2010.

- As a result in real dollars, today’s dispensers face invoices that average $100 more per instrument than in 2004.

- The Wholesale pricing trajectory doesn’t look as though it will be aligning with the cpi anytime soon.

Conclusions and Speculation

In a nutshell from this post and last post: Price range across hearing aid types has contracted by almost 30%, converging on the ASP function in Fig 1. ASP has increased by $115 in inflation-adjusted dollars since 2004. On the boundaries, Economy aids are up $100, Premiums are down $430 for the same time period.

It may not be sensible, but the plausible conclusions are that average wholesale cost of instruments today’s market is goosed up by Economy aids and pushed down by Premium instruments. Further, Economy and mid-level instruments account for most of the wholesale transactions in today’s market. Go figure.

Next week’s post gives sources and calculation methods for retail and wholesale numbers in the 2016 Price series. Future posts will look at markup for services and explore questions such as “Why have prices gone down for most advanced instruments?”; “What explanations are there to explain manufacturers’ current pricing strategies?”; and “What is the point of talking about Price when it’s all based on estimates and speculation?”

References & Footnotes

1CPI adjusted functions in the figures are intended to give readers a sense of inflation effects on the value of the US dollar by year, not to measure how wholesale hearing aid prices compare to the wholesale “basket of goods.” We can’t do the latter because we don’t have data for some of the variables needed to calculate PPI (producer price index) for hearing aids in the US market.

This is Part 4 of the 2016 Hearing Aid Price Series update. Click here for Part 1, Part 2 and Part 3.

*title image courtesy nuvonium

Co-editor Amyn M. Amlani, Ph.D., is Professor and Chair of the consortium program in Audiology & Speech Pathology between the University of Arkansas for Medical Sciences and the University of Arkansas at Little Rock. Dr. Amlani holds the B.A. degree in Communication Disorders from the University of the Pacific, the M.S. degree in Audiology from Purdue University, and the Ph.D. degree in Audiology/Psychoacoustics (minor in Marketing and Supply Chain Management) from Michigan State University. His research interests include the influence of hearing aid technology on speech and music; economic and marketing trends within the hearing aid industry; and playing bass guitar in various heavy metal cover bands. Email: [email protected]