At the turn of the century, the American Academy of Audiology launched its “Ask an Audiologist” branding campaign. The marketing goals were to familiarize the US public with the profession of audiology and make it a household term, figuratively ensconced in the medicine cabinet next to the box of Band-Aids®. Just as consumers reach for Band-Aids® to fix “owies”, they would reach for Audiologists® to fix broken communications1:

Q: “Why are you mumbling?” “I’m not! Why can’t you hear me?”

A: “Ask an Audiologist.®“

Implicit in the branding was the assumption that consumer behavior would go beyond finding and asking audiologists to answer their questions. Campaign success hinged on consumers preferring to purchase the services and products of audiologists over all other available choices.

In Economic-speak, consumers had to “Demand an Audiologist” to shift the Demand curve for hearing healthcare services in our direction. That’s a catchy, to-the-point slogan that Hearing Economics offers free of charge (not trademarked) to audiology membership organizations to help step up their branding efforts in these interesting times. But it may not be a realistic slogan, in view of the labor force data described below, which predict a labor shortage.

Ask an Audiologist, if You Can Find One

Windmill & Freeman published a seminal paper in 2013 which projected large growth in consumer demand for hearing services over the next 30 years, with audiologists in increasingly high demand. The audiology community embraced this news with enthusiasm. Less discussed, but of far more importance, were the comprehensive analyses and alarming statistics on the audiology work force presented by the authors in their article.

Put simply, Windmill & Freeman reported that it was getting harder for consumers to find an audiologist to ask. Specifically:

- The annual number of audiology graduates dropped about 40% from 1995 through 2011

- In the same period, 140 audiology Master’s programs transformed into 75 AuD programs without increasing enrollment/program or graduation/program rates2

- 40% of master’s-level audiologists voluntarily dropped out of the work force “at some point after graduation”3

- Annual work force attrition exceeded work force growth, due to retirements and voluntary drop outs

- Work force projections call for an increase of 24,000-32,000 audiologists by 2041, assuming a constant ratio of audiologists to >65 year old population with hearing loss and no more than 1%/year increase in technological efficiency

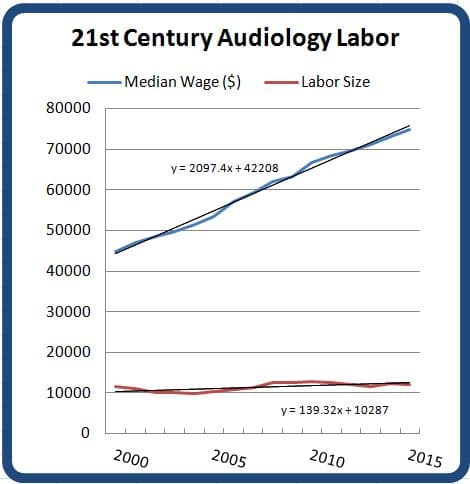

Figure 1. Changes in audiologist median wage and work force for 15 years. (Source OES databases, Bureau of Labor Statistics).

Faced with shrinking Supply and expanding Demand, Windmill & Freeman weighed an array of contributory variables (e.g., age, job satisfaction, gender effects, medical hardship, primary/secondary income, degree level, limited training program capacity). Their conclusions were specific:

- Increase entry into the work force by 50%, “beginning immediately”

- Reduce attrition rate to 20%

So, did those things happen?

A Good Audiologist is Hard to Find

No, it seems those things did not happen.

Figure 1 summarizes the labor market for audiologists for much of the time period surveyed by Windmill & Freeman, and for four years following their 2011 data end point. Although data and assumptions differ, the estimates are close4 and there’s no disagreement on the trend: growth in the audiology labor force –at best an additional 139 workers per year for the last 15 years–is hard to detect or absent in some years (red function, Fig 1). Over the last eight years, the audiology labor force decreased by 3.3%. In the last four years, it rose to a steady state — just 0.1% more audiologists were working in 2015 than in 2012.

From an economic viewpoint, Windmill & Freeman’s recommendations advocate for finding ways to make audiology the preferred career choice of more people entering or already in the work force so that current and future Supply can meet projected increases in Demand. This can’t happen unless opportunity costs (time, money, other variables noted by Windmill & Freeman) of choosing audiology over other professions are reduced.

Increasing income is a primary means of reducing opportunity costs. This has been done consistently for audiologists over the last 15 years. In that time frame, audiologists realized about $2100/year increase in median wage (blue function, Fig 1). Yet, a quick glance at the two functions in Fig 1 tells us that this is not enough to attract and keep an audiology workforce.

How much would be enough? Is this even about money?

Those questions are too big to tackle in a single post of reasonable length. Come back next week for more graphs and discussion of this crucial topic.

References

Bureau of Labor Statistics. Occupational employment statistics, OES databases (2000 through May 2015). United States Department of Labor.

Windmill IM & Freeman BA. Demand for audiology services: 30-yr projections and impact on academic programs. JAAA 24:407-416 (2013).

Footnotes

1Just kidding about the ®. I don’t think audiologists are trademarked but you’d think somebody would’ve figured out how to do that.

2Freeman, B. Personal communication.

3Attrition rate based on data from the Council of Academic Programs in CSD annual data going back to the 1980s. Freeman, B. Personal communication.

4For example, Windmill & Freeman’s analysis estimates 11,200 FTE audiologists in the “current” workforce, taken to mean the time of publication. Their estimate is within 3% of BLS 2013 data (11,550).

feature image courtesy of elifestyle manila