But ya don’t gotta see an audiologist to hear better, if you do it the Costco Way. That Way is putting pressure on the traditional medical model of hearing aid dispensing, which is under siege from all quarters — Big Boxes, Internet, PSAPs, OTC legislation, Hearables — and is not likely to sustain in its present form and clout for much longer.

In contrast to our venerable but crumbling model, Barclays rates Costco’s business model as”sustainable and defensible,” able to thrive in spite of, and alongside, e-commerce giants like Amazon. True, Barclay’s analysis focuses on food purchasing at Costco (57% of its sales), but we already know that Costco hot dog buyers like to bundle hearing aid and hearing aid battery purchases into their shopping experience. It’s not a stretch to predict sustainability of the Costco hearing aid model as the fortunes of independents decline.

A Perfect Economic Substitute in the US Hearing Aid Market

Substitute goods in economics are “cross elastic,” meaning that Demand for the”substitute” good increases when Price for the “normal” good goes up. The usual example is Coke and Pepsi: people buy more Pepsi when Coke raises its prices. They do so because they benefit economically without experiencing loss of utility (both taste good) by making the trade off. Some goods are substitutes (e.g., store brand colas vs Coke; PSAPs vs hearing aids), other goods approach “perfect” substitutes (e.g., Pepsi vs Coke; Costco hearing aids vs traditionally dispensed hearing aids).

Some, maybe most, of us audiologists will balk at the suggestion that Costco-dispensed hearing aids approach perfect substitution for what we do. Based on our clinical experiences and education, we have a valid view from a Supply side perspective. No doubt the “goods” supplied differ in terms of manner and method of service delivery. Outcomes probably differ as a result of manner and method of fitting, though that has yet to be demonstrated for the comparison under discussion.

Demand Decides What’s a Substitute

But substitutes are only about Demand, not Supply. Regardless of what we informed hearing healthcare professionals believe on the Supply side, the only relevant variable on the Demand side is the consumers’ perception of utility. Outcomes are the key. When consumers compare two goods–hearing aids obtained from “us” versus hearing aids purchased as part of their Costco shopping trips–their conclusions are measured by their purchase decisions. A previous post speculated that:

Costco’s success may be more significant than just taking market share from existing providers by putting pressure on Price. Instead, it’s success (or audiologists’ failure) may be due to a new, frequently-preferred distribution channel for a substitute good which is undifferentiated from traditionally dispensed hearing aids in the minds and wallets of a growing group of consumers.

Achieving a “perfect substitute” in the hearing aid market is tricky, as many articles and commentators have made clear in recent times, and as previous failures (think Songbird) have demonstrated. The tricky part isn’t the instrument itself, it’s the aforementioned professional expertise thought by audiologists to be part and parcel of a successful fitting. Whether that expertise is the exclusive provenance of audiologists is the issue.

The Costco model shows no prejudice on provenance. It hires and/or trains according to state hearing aid licensing requirements and staffs its hearing aid centers accordingly. Likewise, Costco consumers are equally open minded when weighing the utility of hearing aid services delivered elsewhere or at Costco. The Costco hearing aid service providers, be they audiologists or hearing instrument dispensers, are undifferentiated in Costco’s and Costco consumers’ minds.

Costco May be an Economic Perfect Substitute

Low Price for similar hearing devices is the hallmark of Costco hearing aid centers, satisfying the first half of the equation for a qualified substitute. The other variable in the equation is the service/fitting component, comprised mainly of dispensers fitting in- and on-ear devices to adults in the Costco model. Hearing aid dispensers employed by Costco fitting technologically advanced instruments from major manufacturers may be a perfect, or near-perfect economic substitute for stripped-down hearing aid fittings1 because:

- they are licensed to dispensed hearing aids;

- At Costco, they are not tasked with billing out diagnostic services or products to Medicare or other insurers;

- At Costco, they are not tasked with performing cerumen management;

- At Costco, they do not fit children;

- they are Willing to Work for lower wages than audiologists;

- their training is vocational, relatively short and can be done in-house, rather than the 3-4 year graduate training required for audiologists.

Whither Costco Goest, so Goest Us?

Previous posts in Hearing Economics’ Costco series noted Costco’s dual success at growing the US hearing aid market while capturing more market share. Growing the market is a good thing for everybody so long as everybody continues to get a piece of the proverbial pie. It remains up in the air whether Costco’s growing dominance is leaving some of that pie for audiologists, squeezing them out of the market, or absorbing them into the Costco model.

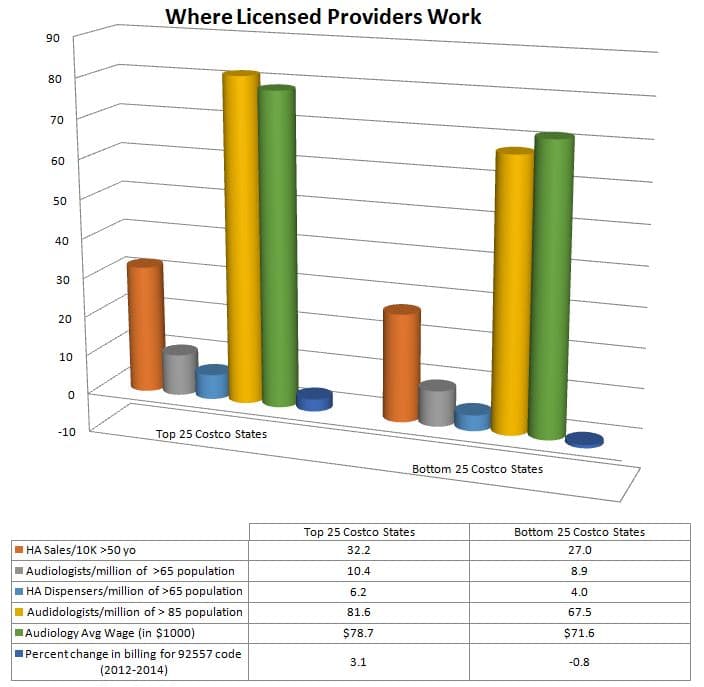

Fig 1. Aggregate data for 25 US states with most Costco presence (“Top”) compared to 25 states with lowest presence (“Bottom”).

The last post in this series promised a rudimentary analysis of the notion that “one way to test that idea is to look at market growth in states with lots of Costcos versus states without Costcos .” Figure 1 is a first stab at it.

For simplicity, the US is divided into two slices of pie: the 25 states with the most Costco stores per capita (“Top”) and the 25 with the least Costcos per capita (“Bottom”). To put Top and Bottom into perspective, there are more than three times as many Costcos in the Top (381) than the Bottom (120) states.2 The Top group averages 8 Costco stores per million residents; Bottom group averages 2 stores per million including six Costco-free states. 3

Aggregate state data are compared between Top and Bottom states for several provider-related variables in Figure 1. In order to fit everything proportionally into the graph to get the visual, the data are not all to the same scale (see legend below graph), but the purpose is served.

A quick glance tells you that every variable is bigger for Top states than for Bottom states. Which means:

- More hearing aids are sold per capita in states where there are more Costcos per capita. An average of 5.2 more hearing aids are fitted for every 10,000 adults 50 and older in Top states than in Bottom states. That may not sound like much, but it adds almost 400,000 aids to the pie in Top states.

- More audiologists work in Top states than Bottom states. There are more audiologists per capita of total state populations (not shown in Figure 1). More importantly, there are 17-21% more audiologists per capita for seniors and oldest old groups in Top states than in Bottom states.

- More hearing instrument dispensers work in Top states than Bottom states. There are fewer dispensers than audiologists in the current labor force, but those out there express a strong preference for the same states that audiologists and Costco prefer. Top states have 55% more dispensers per capita of the senior population than Bottom states.

- Higher annual wages, by about $7K on average, are paid to audiologists in Top states than Bottom states.

- Medicare billing growth in Top states (3.1%) for hearing evaluations (92557 code), compared to negative growth in Bottom states (-0.8%).

This is Not Causality

Which doesn’t mean that Costco is calling the shots. Lots of things could explain Figure 1, beyond the preponderance of Costco centers. Maybe the Top states are wealthier and more heavily populated, luring Costco and hearing service providers. Or maybe it’s the climate, politics, social services, rents, etc. Maybe the aging population is proportionally larger, richer and healthier in Top states than Bottom states. Maybe everybody just likes hot dogs.

The point is that Figure 1 is interesting to look at but doesn’t tell us what’s behind the curtain. Nevertheless, next post will feature more rudimentary stabbing at the perfect substitute idea, along the lines of Figure 1.

Subsequent posts will introduce actual economic modeling of the entire data set to determine probabilities that we’re stabbing the right spots.

Footnotes

1For example, Costco hearing aid centers do not fit CROS/BiCROS instruments.

3 In 2016, Costco had yet to occupy Arkansas, Maine, Mississippi, Rhode Island, West Virginia or Wyoming,

feature image from tumblr

How fascinating and rapidly changing is our economy. Today COSTCO is on top, but in my area, about half a mile away from COSTCO, CVS just built a new superstore. Undoubtedly CVS will jump into the pool with their mini-clinics that are very popular. What does that tell me? Well Rodan will now be battling Godzilla! CVS will accept insurance and we all know how enticing that will be. But wait, Amazon is lurking around the corner perhaps to swallow up both Rodan and Godzilla.

Edited from my published January 19,2017 WSJ letter on PSAPs/OTCs was my self-generated aphorism, appropriate for these times of disruptive innovation in hearing health care distribution models:

“Value-added is a perception, not an assertion!”

Roy, taking your comment a bit further, “perception is reality” always holds true.

Whatever the consumer/patient perceives to be the reality – is the reality we must address…

Bravo Dr. Hosford-Dunn and thank you for your timely and important post. My hope is that this post, and post like this, will, once and for all get audiologists to re-explore their archaic, costly, often inaccessible delivery and pricing model and level of care.

People like Kim and Holly are kind of like the media…out of touch because they don’t have any skin in the game! As a third generation Audiologist my private practice is growing like a weed and so is my Audiologist cousin’s! We are in large markets with Costcos on every corner but people choose us! Why, because our expertise and personal service is worth it!!! Our patients love us and our knowledgeable care they can’t get at Costco! Furthermore if they need something inexpensive we have that too. Don’t believe everything you read folks-people are tired of corporate Americas greed and willing to support local biz as long as you don’t overcharge them…

Dr Herholtz, as a minor correction (which can be verified by bio attached to Hearing Economics), I run a private practice and see patients regularly. It is in a mid-size market with Costcos in abundance. Some people chose my practice, some chose Costco. Same as all free markets. Our efforts in describing Costco are not to influence opinion on value of services; rather they are to provide numerical data which can be used by others, yourself included, to influence as you see fit.