by Amyn M Amlani, PhD

In hearing healthcare, price continues to be a hot-button topic of discussion among consumers, providers, advocacy groups, legislators, professional organizations, and manufacturers of consumer electronic products and traditional hearing aids.

The fundamental issue is that consumers and their supporters believe the costs associated with and the value received in treating impaired hearing are misaligned. This disparity is one reason that impaired listeners do not adopt or delay adopting amplification technology, despite its positive effects on improved quality of life. However, rather than focusing its value-proposition of enhanced service delivery, the supply-side of the market is hedging a bet that reduced retail prices will entice a marked uptick in impaired listeners purchasing amplification technology.

Don’t believe me? Then consider, at a minimum, the continued acquisition of independent practices by hearing aid manufacturers to create large-scale vertically integrated retail, competitive outlets as a means to compete on price with large-scale Big Box retailers. Also, consider the forthcoming direct-to-consumer (DTC) supply of over-the-counter (OTC) devices that will be available directly—and at lower retail prices than most traditional hearing aids—to impaired listeners with milder hearing losses without the need to interact with a licensed professional.

These examples of market competition based on reduced price is known as the “Race to the Bottom.”

The examples of competition, based on price, support the evolving transition of hearing healthcare from a predominately provider-based market segment—predicated on professional interaction that, in theory, substantiated a high retail cost—to a multi-segmented, retail model within the healthcare space.

The purpose of this blog is to share the developing retail segmentation occurring in the market. In Parts 2 and 3 on this topic, the reader will be informed on how profitability is affected in these segments.

Market Segmentation in Hearing Healthcare

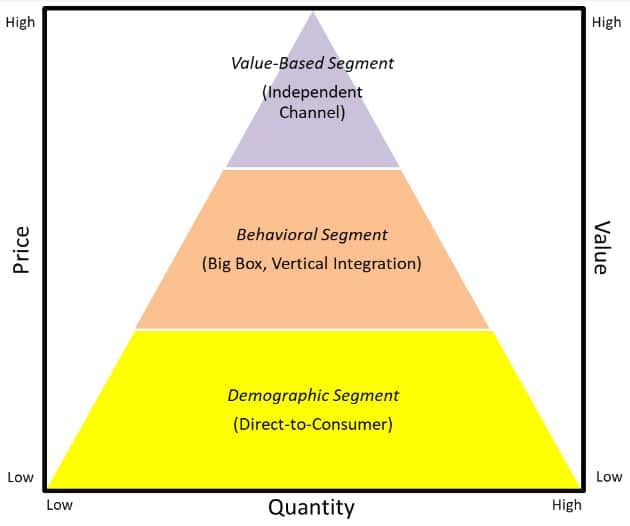

Below, Figure 1 displays the pyramid-shaped segmentation taking form in the hearing healthcare space.

Demographic Segment

The base of the market, or the Demographic Segment, will consist primarily of DTC products; namely, OTCs and PSAPs (i.e., personal sound amplification products).

Here, products are marketed and distributed directly to consumers based primarily on price (e.g., < $1000) and degree of hearing difficulty (i.e., mild-to-moderate), with little to no professional support. A priori estimates indicate that a large number of individuals with mild-to-moderate hearing difficulty will resort to these products in lieu of traditional hearing aids.

For practice’s that engage in the dispensing of DTC products, profitability in this segmentation will be minimal, at best, because of the practice’s inability to capitalize on retail markups associated with the product itself. A practice’s opportunity to supplement or recoup profits in this segment is available through itemized professional service offerings, such as verification, validation, and communication training.

Behavioral Segment

The middle and largest segment of the market, as seen in Figure 1, is the Behavioral Segment. This segment consists of traditional products and associated services delivered to listeners mainly through retail outlets (e.g., Big Box, vertical integrated chains).

This segment is considered “behavioral” given the average listener’s purchasing behaviors related to product and service acquisition that stems primarily on price. The Costco Model is considered the gold standard in this market segment.

The behavioral segment appears to be steadily growing, as some practices in the independent channel have elected to delve into reducing their cost of goods (COGS) in order to lower retail prices. The ability of an independent practice to offer products and services at lower retail prices is often viewed positively, as practice’s feel the need to remain competitive with Big Box and manufacturer-owned retail chains. This perception is not without fault. Specifically, participation in this segment—or in the demographic segment—is a threat to a practice’s brand and its profit.

Competing on price creates a brand image associated with terms such as “discounted,” “bargain,” “cheap”, and “economical.” None of these terms is correlated with the perceived value expected in a doctoring profession.

As we’ll see in the next month’s blog (i.e., Part 2), practices that participate in reducing retail pricing could be limiting their profit opportunities and, perhaps, more importantly, making themselves vulnerable to being cannibalized by the demographic segment. (Note: A similar outcome is expected for those practices whose revenue stream is heavily dependent on third-party reimbursement. A third installment (i.e, Part 3), in early 2020, will dive into the proverbial weeds on this matter.)

Simply stated, being cheap and being good do not go together, and reversing this perception is a monumental task.

**Note: The reader should note that the commentary in this blog is not directed to practices that negotiate lower COGs and offer products and services at non-reduced retail prices, while providing the highest level of patient care.**

Value-Based Segment

At the top of the pyramid resides the independent channel (Figure 1). Note that this segment—called the Value-based Segment—is the smallest of the three discussed and has seen a considerable decline in growth over years due to manufacturer acquisition (i.e., vertical integration) of independent practices and a declining pipeline of graduates interested in becoming independent practice owners.

While this segment is by no means immune from being cannibalized, it is the segment in the market that is considered to provide the greatest value to the consumer with respect to service delivery. As such, most practices in the value-based segment do not attempt to compete on price. In fact, value-based practices tend to command higher-than-average retail prices for amplification technology and associated professional services.

In many cases, these practices also offer expanded diagnostic and treatment services in areas such as balance, tinnitus, and central auditory processing.

Summary

The market for hearing healthcare is evolving into a multi-segmented, retail-based market. The evolving market is predicated on increasing affordability and access through a reduction in retail price (i.e., the base and behavioral segments in Figure 1), with the expectation that a prolific number of impaired listeners will utilize amplification products.

Practices that intend to compete on price, instead of service delivery, are enrolling themselves in the race to the bottom. This race is fraught with risk associated with a diminished brand and an increased likelihood of reduced or cannibalized profit opportunities. We will expound on these concepts over the next several months.

Dr. Amlani,

Your article on hearing aid pricing (part one) was an excellent read!!!

Thank you for taking the time, effort and energy to writing this informative article in an easy to follow format.

I came across this article by chance scanning LinkedIn- My only concern is I may miss the next two parts. If at all possible please add me to your contact list and email part 2 and part 3 when they are available. Please!!!

In advance, thank you!

Roy Binder H.A.S., BC-HIS, A.C.A.

Founder and President

The Ear Man Inc.

Mobile Hearing Aid Service

http://Www.TheEarMan.com