The Hearing Disruptions series seeks to cover the rapid changes taking place in hearing healthcare. Today’s post is culled from recent topics presented to the Institute of Medicine’s (IOM) Committee on Accessible and Affordable Hearing Health Care for Adults.

Hearables: Hype and Market Entry

Holly Hosford-Dunn, Ph.D. Presented at the June 30 IOM meeting regarding hearing aid availability.

The solution to breaking market inertia and breaking down device definitions may come from outside the hearing healthcare profession and hearing aid industry in the form of new devices called Hearables, most of which have yet to make it to market. Hearables are basically next generation PSAPs that are “smart” ear level devices, somewhat analogous to Smartphones versus flip phones.

A Wellness Approach Manifest in Technology

Hearables are wellness oriented with the aim of becoming ubiquitous in our lives, like Smartphones. The consumer electronics industry defines Hearables by their potential “bionic” innovative features that enhance hearing, without regard to whether impairment is present or not. They are:

“any device, or combination of innovative devices and software that helps someone hear better.”

Unlike traditional PSAPs, Hearables are differentiated from hearing aids from the outset by their multi-functionality– including apps–and their birth in a retail industry. Bluetooth-like looks are aimed at a younger, more hip, set of consumers with hearing needs that may or may not have much to do with how we traditionally define hearing loss or difficulty.

Like PSAPs, Price and Internet-based distribution channels also differentiate them from hearing aids.

Market Measures Vary Widely for Similar Devices

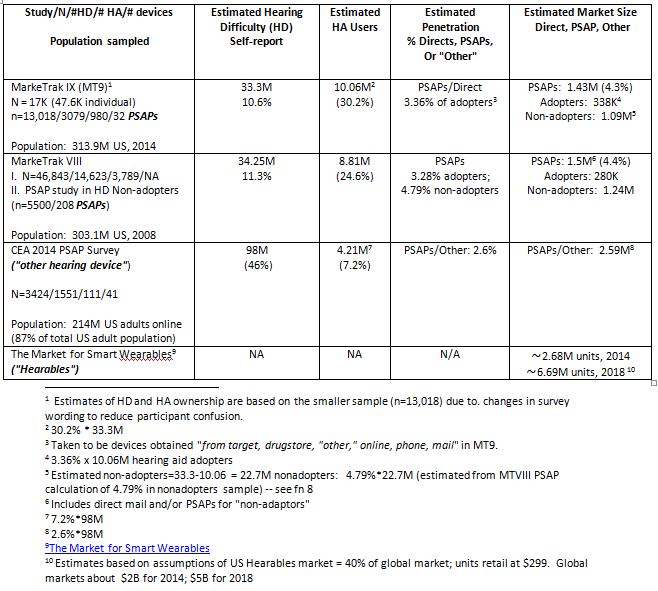

Table 1. Estimates and speculation on the PSAP/Hearables market.

Table 1 data were discussed in part 1 and are revisited today from a Hearables and consumer electronics perspective. The Consumer Electronics Association PSAP survey of 2014 (CEA) estimates a market of over 90M US adults with Hearing Difficulty — more than 3 times the MT estimates.1 ,2 CEA found far lower penetration of hearing aids3 than MT9, suggesting that those adults who responded online comprised a younger sample set with milder hearing difficulty.

Regardless, the CEA survey confirms very low penetration of “other” devices– perhaps 2.6M wearers of PSAPs and Hearables in 2014. That estimate is not out of line with Hearable sales predictions.4

To the extent that any of those calculations, estimates, and samples are valid, we might say that PSAPs are merging into the more general category of Hearables and together they may have added about 1M wearers to the US market in the last year and could add several million more by 2018.

If those numbers hold up or are even in the ballpark, it suggests that the hearing amplifier market penetration is and may remain low, even though the market is unregulated and highly innovative. Next post: report cards for hearing aids and ear amplifiers.

Footnotes

1The challenges inherent in cross-sectional surveys of hearing difficulty and device uptake are reflected by the data reported in MT and CES studies. Besides the usual statistical suspects of sample size, sample population, sample bias, and survey method, the surveys are essential one-offs that rely on self-report and appear to reflect the reach of the industry constructing and conducting each survey.

2MT9 and CES surveys were performed online. Both categorized participants as “HD” or “non HD” based on an initial binary query of Hearing Difficulty.

37.2%*98M

4In his report, Nick Hunn predicts global Hearables sales exceeding $5B by 2018.

Sources

- Abrams H & Kihm J. Introduction to MarkeTrak IX: A new baseline for the hearing aid market. Hearing Review, 2015; 22(6): 11-21

- Consumer Electronics Association. 2014 CEA Personal Sound Amplification Products (PSAPs) Study.

- Hosford-Dunn. H. Hearables series. HearingHealthMatters.org, Feb 3-June 23,

- Hunn N. The market for smart wearable technology: A consumer centric approach. 8/07/2014

- Kochkin S. MarkeTrak VIII: 25-year trends in the hearing health market. Hearing Review. 2009;16(11):12-31.

- Kochkin S. MarkeTrak VIII: Utilization of PSAPs and direct-mail hearing aids by people with hearing impairment. Hearing Review. 2010;17(6):12-16.

- Kochkin S. MarkeTrak VIII: The key influencing factors in hearing aid purchase intent. Hearing Review. 2012; 19(3): 12-25.

feature image courtesy of eugenio pirri