This past June, Holly Hosford-Dunn and I ran a series in Hearing Economics on the cost of audiology education. A final verdict on our core question: “Is the AuD degree worth the investment?” awaits further discussion and more data as newly minted AuDs enter the marketplace in the next few years.

It’s a complex question that doesn’t have a simple answer.

Over the next few weeks we will be bringing you different perspectives, from academics, students and others.

But first, let’s recap:

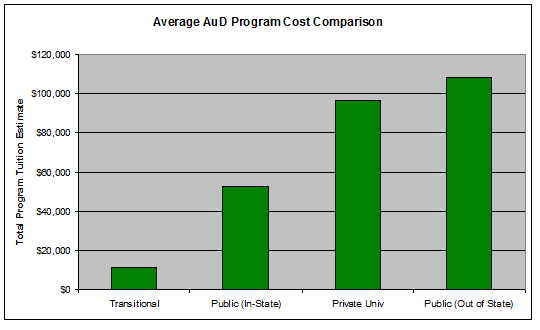

Based upon our random sampling of AuD programs’ cost estimates, here’s what we’ve come up with so far:

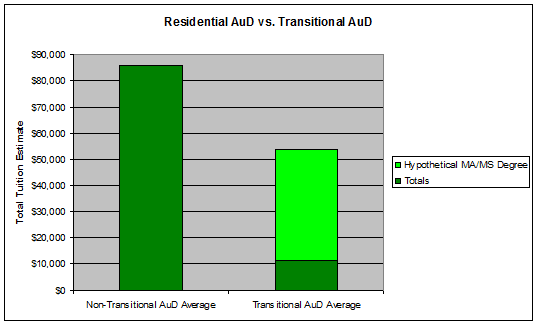

Now, I have to admit, more than a few people who went through a Transitional program called me out on leaving Master’s degree tuition out of our cost estimates. Since the last Audiology Master’s degrees were conferred no later than 2007, using the present-day costs for an MA/MS degree would likely result in a significant overestimate of the total cost (considering the historical trend of tuition rates doubling about every ten years).

For the sake of comparison, however, we have included an estimate for a hypothetical Master’s degree by incorporating an average two years of present-day AuD tuition into our figures:

Even if we add the estimated Master’s degree tuition to our figures, Transitional AuD grads still got the better deal, or rather, the better return on investment. With total costs roughly 60% those of residential AuD students, without question the Transitional AuD grad fared better. But, to further illustrate this point, let’s also look at the typical cost of living for college students.

You can’t live on bread alone

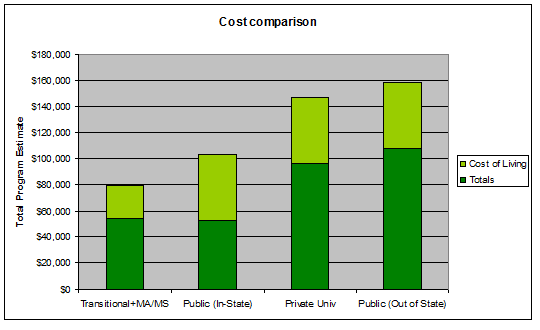

Today, it’s estimated that Cost of Living (COL) for a single person in America is just shy of $13,000 per year, once you account for housing, transportation and food. If you’re able to maintain a pretty conservative college diet of ramen noodles and cheap beer, you may be able to cut this annual cost, but for our example we’ll stick with this number. [Note that we only included COL during the 2 years of full time Master’s program for Transitional estimates vs. 4 years for residential AuD{{1}}[[1]]Since there is still debate over 4th year externs being paid, our figures consider the 4th year externship as a full time student status and, therefore, subject to COL without the ability to earn a full time wage as compared with those earning Transitional AuDs post-Master’s[[1]]]

With COL added to our estimates, it’s fairly safe to assume that a 4-year residential program is going to set you back close to $100K, if not substantially more. However, let’s remember that our tuition estimates do not factor in scholarships or any other financial assistance, so really the ultimate figure a student will have to pay to complete an AuD program will vary substantially based upon those and other factors.

My advice to prospective AuD students: Do your homework!

Now that we can assume an AuD degree today will probably set you back at least $100K, is it really worth the investment in time and money?

We’ll give future guest contributors to Hearing Views a chance to answer that question.

Featured image: American Academy of Audiology Headquarters, Reston, Virginia

This is a timely discussion. Personally, I’d rather see the comparison between current healing arts doctoring students across professions rather than one between masters degreed/transitional students vs Au.D. students.

I recently read an article in Optometric Management (Why Is Student Debt So High? — http://www.optometricmanagement.com/printarticle.aspx?articleID=108780) that discusses the woes of optometry students. Here are a few key points:

1) “Since 2008, the median debt level for a graduating optometrist increased from $152,409 to $177,095.”

2) The average resident tuition at the 21 Schools and Colleges of Optometry in the United States is $27,704, and non-resident annual average tuition is $34,753.

3) Resident optometry students live on $16,569 per year, and non-resident students live on $9,520 annually. The IRS defines the “poverty level” at $11,490/year for a household of one in 2013.

4) “Students in optometry or any professional educational program must minimize their indebtedness, but it is not easy. During the first week of orientation, we discuss debt accumulation and repayment. It is not an easy topic to bring up to a first-year student, but it is very important to their future success. We remind them of indebtedness throughout their curriculum, and we require an individual debt management project to be completed during their fourth year.”

When I was working on my masters degree, I had two kids, worked a part-time job, and was enrolled in a food stamp program because I was living at below poverty then too. I was embarassed to use food stamps, but it helped me care for my family and to get me through school. I also didn’t complain about my financial woes. I simply dealt with the situation at hand and got on with my life. Of course, I used “the system” to get out of the system, and I have paid the system back thousands of times over the years.

I say these things not to diminish the subject of student debt. It is important, and it is getting higher for all students in many professions. One of the outstanding parts of the above article is the mention of the optometry student’s receiving counseling about debt immediately at the start of the program, throughout the program, and a debt management project before graduation. This strikes me as the optometry schools taking an active role in the lives of the students in helping them manage their finances — which likely spills over into the student’s lives after graduation. This would be a great survey topic for someone, i.e., find out how many audiology programs have a specifically designed and require course of counseling and mentoring for audiology students that help them with school debt and financial planning as a student. If this is not available, it should become available.

Larry

Larry,

Considering you are a successful private practice owner and past president of ADA, you do serve as a great example for future AuDs of what can be achieved with hard work, despite the likelihood they may have to take on large levels of debt. And yes, you are right, student loan debt is not foreign to other doctoring professions and the idea of university-led financial counseling for students shouldn’t be a radical idea in audiology now that the doctoral degree has become the norm. However, I have yet to come across a single AuD program that offers or advertises such counseling or creation of a ‘debt management project’ (if anybody out there does, please enlighten me!).

While I’m not trying to pit residential AuD graduates against transitional grads with this information, I feel that when you can visually see the huge financial commitment students are having to make today, it really gives you pause. It makes one think about where we will be in a decade from now and if we don’t start getting creative, at what point will prospective students choose to seek out alternative professions..?

Hopefully our guest editors over the next couple of weeks will be able to add some more perspective to this conversation.