Part II of “Trimming the Sails” by Dr. Christopher Schweitzer continues as a provocative treatise relating to directions and thoughts as to why hearing aid market penetration fails to meet desired goals. Dr. Schweitzer is Director of HEAR 4-U International; Chief of Auditory Sciences at Able Planet, Inc.; and Senior Audiologist, Family Hearing Centers in Colorado. This series’ content is longer than normal, and for this we apologize to our readers. However, breaking it into smaller posts distracts from the continuity. As with all work published by guests, the presentation content reflects that of the author, and not necessarily that of HHTM (Hearing Health and Technology Matters). Wayne Staab, Section Editor

By Christopher Schweitzer, Ph.D.

Bifurcated, Blurry, and Blended Markets

The personal amplification market, largely consisting of hearing aids, has consistently defied simple description. Although they are classified as “medical” devices by government fiat, consumers have invariably approached them as communication assistance tools, which they factually are. While numerous studies, and impassioned industry reports, have lamented the previously mentioned dismal ratio of hearing aid purchasers relative to the reported universe of individuals with measured and/or self-reported hearing impairment, the resistance barrier is realistically more than a matter of simple economics.

Some carefully conducted surveys have also suggested an apparent disconnect between measured hearing impairment and the assumption of a need for help in this country, as well as in Europe1. That clearly aligns with the author’s many years of daily experience in a dispensing practice and having invested in the full range of marketing enticements. Many “tested but not treated” clients genuinely do not feel an urgency to seek “treatment” with amplification. However, it is also clear that for many hearing aid technology candidates there are other subtle, but significant contributing non-financial cost factors that impede purchase.

Accessibility is clearly among them. The relative scarcity of professional hearing offices creates an inertial drag onto the decision process. Accessibility to services relates to one of the non-financial costs that work into the calculus of value. The inconvenience of travel across town or to a distance greater than 10 miles adds to the net cost paid by the consumer. But perhaps even more notable, is what might be labeled as an aversion to the medicalization of the “treatment” for the stress of hearing impairment. The “medical model” of hearing aid delivery conveys an assignment of “disability” to the receipt of hearing aids, whether real or imagined, intended or unjustified. A measurable, but mild, hearing impairment for many individuals simply implies a situational stress, a nuisance at worst, and in many (easy listening) situations, forgettable. Hence, large members of this segment of the universe are disinclined to view themselves as medically disabled by their hearing profile, whether obtained under clinical conditions or via “spousal diagnosis.” Generally, those same individuals may admit to an occasional need for clarity enhancements, but identification with disability does not sit well with many active adults.

Calculus of Value

It is worth exploring further the notion of cost and value. There are costs to obtaining amplification products (CtO). These include dollars invested, plus the time to travel to appointments, and the effort of re-organizing one’s life activities and personal identity as to the need for hearing aids as mentioned previously. These can be summarized as CtO = $+T+E. On the opposite of the calculus is the Cost to Abstain (CtA). These are fairly well understood as to include: Lost Earnings (equal to or exceeding $12,000 per year2, Lost Time (time of developmental stimulation for children; quality communication time with families for adults with later developing hearing problems); and Lost Experience of ongoing stimulation, social interaction, relationship maintenance, and vital cognitive fitness exercise experience that is shown to clearly suffer with hearing loss3. Hence, it might be reasonably assumed that CtA needs to exceed CtO for a purchase trigger to be pulled.

While those with mild hearing loss who trivialize it are commonly accused of engaging in “denial,” the fact remains that audiological impairment may not manifest for many as a problem except under limited and specific situations, namely noisy backgrounds and higher pitched soft target voices. The value calculus then needs to include the costs referenced above to get to V = I/C, where “Improvement” divided by (all) Cost yields net Value4.

These considerations strongly argue in favor of part-time non-customized hearing products, analogous to turning up the treble or the volume on a car radio. “For the moment, I need a little adjustment in the received acoustic signal, to pull a voice up from the ambient competition, or confidently take in the acoustic details of the news broadcast.” Enter the PSAP. (HHTM has numerous references to value issues. The reader is encouraged to type “value” into the search box for additional perceptions).

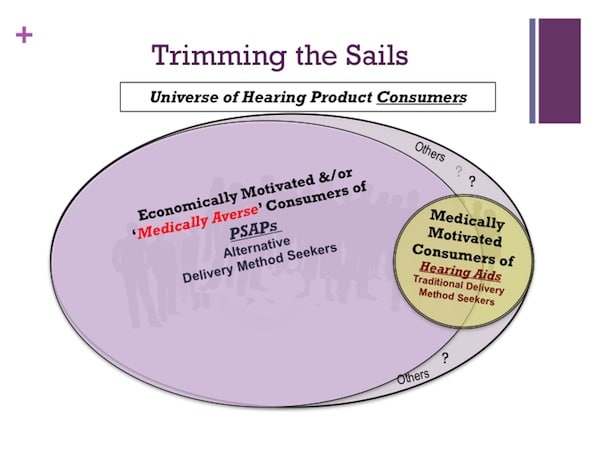

Figure 1 provides a conceptual interpretation of present market segmentation largely divided among those comfortable with the medical model of delivery and those here termed “medically averse.” It is, of course, speculative and non-empirical, but perhaps merits discussion. This model notes correctly that a relatively small portion of the universe of amplification candidates are engaged in the medical model delivery channel as opposed to the much larger segment who may avoid this channel of service/delivery model. Consumer advocacy groups, such as the Hearing Loss Association of American and AARP, have long argued for less expensive and more accessible hearing help products. Presumably, sufficient pressure from consumers and manufacturers of low-cost amplifiers contributed to the FDA’s 2009 Guidance Document 5 essentially detailing the appropriate boundaries that grant Personal Sound Amplification Products permission into the consumer market.

Figure 1. Conceptual illustration of the segmented (and blurred) market of candidates for the purchase of amplification products including a larger portion who are ‘medically averse’ to seek hearing aids (see text).

Figure 1 also suggests that a greater portion of the candidate population has a suspected aversion to a medical identification with hearing assistance. This population is arguably more naturally aligned with products like PSAPs that do not carry a “medical” designation and the accessibility barriers of dispensing in a facility with the trappings of a medically oriented office. It is assumed that some non-distinct blend of economic and medical-averse properties motivate the larger portion of the universe of potential hearing product consumers to abstain from purchasing conventional hearing aids through professional delivery channels. Those individuals are believed to be increasingly attracted to low-cost alternatives (i.e., PSAPs) free from the constraints and encumbrances of medical model dispensing attendant to hearing aids. Able Planet, for example, discovered a vigorous interest in these products with sales of several thousand in the first two weeks of a launch in late 2012, and continued growth since. Presumably, some individuals do not fit the categorization of the two larger segments of the figure. Hence, a region of “others” is included in the Figure.

Returning to the uncertainty of an unambiguous “need” for hearing aids when measurable hearing loss is manifest (the presumed low penetration ratio that has long perplexed industry professionals and manufacturers), it may be instructive to consider Figure 2. This is a variation of work by Schweitzer and Jessee6 from studies of early versions of “open fit” technologies. It models hearing aid use as a dynamic ratio of Benefit to Annoyance with an unspecified curvilinear association with degree of hearing loss. In the simplest of terms, the greater the hearing loss, the greater the assumed benefit, and the less likely consumers are to complain of sound quality, occlusion effect, physical discomfort and so forth. Hence, motivation is clearly a component in the long process of moving from detection to acquisition of electronic assistance in the form of hearing aids or non-prescription alternatives, such as PSAPs. Tolerance for annoyance has some individual variance, of course, but the net benefit must exceed the net annoyance.

For consumers who do enter the standard medical dispensing channel, slightly more than 20% return the product7, presumably because the Benefit-to-Annoyance ratio was not met. As the figure suggests, as the severity of a hearing deficit increases, the motivation to ignore “ear-itations” (change the batteries, clean the device, put up with itching, physical pressure, etc.) intensifies. The “facilitation” provided by the same device for those with mild periodic, situational hearing stresses are generally insufficient fuel for the motivational fire.

References and Footnotes

1Hougaard S. & Ruf, S. (2011). EuroTrak I: A consumer survey about hearing aids in Germany, France, and the UK. Hearing Review.18(2)12-28.

2Kochkin, S. (2007). The Impact of Untreated Hearing Loss on Household Income. Better Hearing Institute publication, May.

3Lin FR, Metter EJ, O’Brien RJ, Resnick SM, Zonderman A, Ferrucci L. (2011) Hearing loss and incident dementia. Arch Neurol. Feb;68(2):214-20.

4Coughlin, D. (2012). Understand and Use the Value Formula. Dan Coughlin’s Business Leadership Blog (December 7). http://practicalbusinessleadership.com/2012/12/07/understand-and-use-the-value-formula/

5Regulatory Requirements for Hearing Aid Devices and Personal Sound Amplification Products: Guidance for Industry and FDA Staff (2009, February 25).

6Schweitzer, HC & Jessee, S. (2006). The Value Proposition of Open Fit Hearing Aids. Hearing Review 13(10) 10-19.

7HIA: Hearing Aid Sales Up 2.9% in 2012. Hearing Review Interactive Edition