The Independent Hearing Aid Dispenser

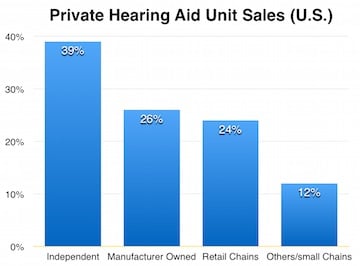

Last week’s post reported on the evolving hearing aid retail landscape, and specifically that of the independent dispenser. Most notably, the emergence of chain retail (such as Costco), the growth of hearing aid manufacturer company owned stores, and the VA has contributed to the 10% decline in independent hearing aid dispensers since 2004, with independents currently selling an estimated 39% of the market unit sales, down from 49% in 2004{{1}}[[1]]The long view: the future of the U.S. hearing aid market. Who gains, who loses, from the slow death of independents, Sanford C. Bernstein & Co., LLC, June 8, 2015[[1]].

Last week’s post reported on the evolving hearing aid retail landscape, and specifically that of the independent dispenser. Most notably, the emergence of chain retail (such as Costco), the growth of hearing aid manufacturer company owned stores, and the VA has contributed to the 10% decline in independent hearing aid dispensers since 2004, with independents currently selling an estimated 39% of the market unit sales, down from 49% in 2004{{1}}[[1]]The long view: the future of the U.S. hearing aid market. Who gains, who loses, from the slow death of independents, Sanford C. Bernstein & Co., LLC, June 8, 2015[[1]].

The U.S. Hearing Aid Market

It is estimated that the U.S. unit hearing aid market is about 78%* private with the balance coming from the VA (Veterans’ Administration). The division would be slightly greater in favor of the private market if the wholesale value of the hearing aids sold were considered, rather than looking at unit sales (for example, the VA ASP – average selling price is lower than the private market).

Regardless, unit sales drives the market, not the wholesale cost. Hearing aid private unit sales has been growing at about 3-4% per year{{2}}[[2]]Hearing aid sales up 11% in first quarter 2015, The Hearing Review, April 15, 2015[[2]], but most believe it should be growing at a significantly higher rate if the needs of the hearing impaired to be helped by amplification is to occur.

But, where will the growth occur? If independents are decreasing, surely one of the other groups is taking up the slack. But who is gaining in the private hearing aid retail market?

Who is Included in the Private Hearing Aid Retail Market?

The private hearing aid market comprises the following entities:

- Independent hearing aid dispensers (estimated at 39% of unit sales – Bernstein, 2015). These are businesses with a single store, or with few retail outlets, owner-operated, and usually run from the store, or from one of the stores if the owner has many. The retailer owns the business and runs it from the ground up, assessing all the store’s needs, including staffing, marketing, merchandising, sales, etc.

This category includes small chains of independents such as Sound Point, Hearing Unlimited, Pattillo Balance and Hearing, and others – with other small chains having generally eight stores or less.

- Hearing aid manufacturer-owned or supplied stores (primarily of the Big Six) and estimated at about 25%* of unit sales. These companies sell their product under the following names:

- Widex alone does not have company-owned stores

- GN ReSound – Beltone

- Starkey – Audibel (independently owned and operated)

- Sonova – Connect Hearing

- William Demant – Avada, Hearing Life

- Sivantos/Siemens – HearUSA

- Retail chains (Amplifon, Costco, store-within-store, etc.) – collectively estimated at 20%* of unit sales

- Buying groups are not percentage projected because their unit sales are generally included in the one of the other hearing aid purchasing categories.

- Direct online/mail order retail

- Pure play Internet retail (Lloyds, Hearing Help Express, etc.)

- Mixed Internet retailers (Audicus, America Hears, Hearsource, etc.)

- Referral Internet retailers (require significant interaction with audiologists).

No estimate of unit sales is available for these categories, but whatever it is, it will take from the previous percentages. This percentage is thought to be low at this time, but it is anyone’s guess what it is, or its direction.

No estimate of unit sales is available for these categories, but whatever it is, it will take from the previous percentages. This percentage is thought to be low at this time, but it is anyone’s guess what it is, or its direction.

Projected Directions of Independent Retail Dispensers

Independent hearing aid retailers face pressures similar to other industries:

- Growth of large national chains, or other volume players that use aggressive and innovative marketing strategies to attract consumers to their venue

- Online purchasing resulting in increased consumer comfort related to product selection, free shipping, and ease of purchasing and returns.

- Focus on materials experience rather than on personal experience.

Independent retail is projected to continue to decline unless a way can be found to reverse the trend. Chain retail (store within store) is projected upward, but manufacturer-owned retail is projected to remain at about the same percentage as currently, primarily because many of the small retail chains have already been purchased.

The contribution of small chains to the independent retail market is welcome, but not without a caveat. For example, as small chains grow, they are likely to become the purchase target of larger businesses. In the case of hearing aids, of being a purchase target by a larger, non-independent company, such as one of the hearing aid manufacturers. It is a fact that many current hearing aid manufacturer-owned stores resulted from purchases of both large and small chains of independents.

So, the real losers, at this time, appear to be the independent hearing aid dispensers.

Problems Moving Forward for Independents

- Because of their small scale, independent hearing aid dispensers have little bargaining power with manufacturers who supply them with product, and as a result, find it difficult to negotiate large discounts. Because of this, they may find that competing in market changes is more difficult.

- The growth of independent dispensers is on the decline, regardless of the discipline of ownership (audiologist or dispenser), and shows no evidence of reversing the trend.

- ASP (average selling price) is highest with independents. This is because their operating costs tend to be higher, and must be covered. This can put independents at a disadvantage because of no bargaining power to discount hearing aid purchase price from manufacturers.

- Struggling offices most likely will not survive.

*Percentage estimates are from Bernstein, 2015, with permission.

Wayne, you are right on with this article! AuDNet has been saying this for 10 years now. Independent practitioners will soon be extinct since they have to pay over twice what Costco and large groups pay for hearing aids. This makes the independent practitioner have to charge $1000 -2000 more for their hearing aids in order to pay for their higher cost of goods, while still maintaining a profit. Some in the industry say that patients will pay $1000-2000 more for a set of hearing aids if you provide better service (Value). I have been in private practice since 1982, and I can tell you that this is not true. Even in a high end area where I have one of my offices, a large number of patients go to Costco because of price. Remember, that “Value” is price plus benefit. So, if you are trying to give the patient a better “Value Experience”, part of that Value is Price. Traditional Buying Groups are not the answer, since they get a large discount from manufacturers, but only pass on a small part of the discount to the buying group members, while keeping a large part of the discount as profit. AuDNet is the only true Group Purchasing Organization (GPO) that keeps 3% of the manufacturer discount to run the business, while giving the GPO members 97% of the manufacturer negotiated discount. In my opinion as one of the AuDNet owners, this is the only answer we have to get a lower cost of goods for independents and allow them to compete on Superior Service, and not on price. 97% of hospitals belong to GPOs because hospitals “Get It” that you need to belong to a large group that buys a large amount of product in order to get the lowest price. However, hospitals understand that they need to join GPOs that pass on 97% of the discount (as mandated by law in order to be a GPO), and not buying groups that keep a large percentage of the discount as profit for the buying group instead passing on the discount to the buying group members.

With respect to Starkey and Audibel – a correction/clarification. It is a common misconception that individuals have about Audibel and Starkey. Audibel professionals have offices that are independently owned and operated – not owned by Starkey Hearing Technologies. They sell Audibel brand hearing aids, manufactured by Starkey Hearing Technologies.

With respect to Starkey and Audibel – a correction/clarification. It is a common misconception that individuals have about Audibel and Starkey. Audibel professionals have offices that are independently owned and operated – not owned by Starkey Hearing Technologies. They sell Audibel brand hearing aids, manufactured by Starkey Hearing Technologies.

Interesting article, Wayne. Just a comment about VA sales. Remember that these figures probably include the Department of Defense (DoD) as well as the Public Health Service for the Bureau of Indian Affairs. Also, just a minor correction – VA changed its name to Veterans Affairs in 1989. Veterans Health Administration (VHA) is that part of VA that purchases hearing aids to eligible veterans. Thanks.

John McDermott

August 20, 2015 7:45 pm

– See more at: http://www.hearingreview.com/2015/08/blog-independent-hearing-aid-dispenser/#sthash.PS4oaEZG.dpuf