I really like your article and it certainly points out a key problem. The only leverage the big 6 have is what we gave them. We need to all work together. The internet and baby boomers create an amazing opportunity but business as usual won’t cut it. – Private comment from a previous post

And I really like comments from people who like my posts. Banding together is nice, ditto for amazing business opportunities that beckon. But I can’t agree with the leverage comment. Think about it.

Leverage overstates what “we” give the Big 6, if “we” means independent Audiologists. They Supply hearing aids; We Demand hearing aids. Our Demand Curve derives from the aggregated Marginal Utility we get from purchasing hearing aids, meaning that–presented with all alternatives–we prefer purchasing hearing aids at specific prices to purchasing our next best choice at those prices.

What are our next best choices? We could choose to quit purchasing hearing aids altogether and subsist on diagnostic testing revenues; we could retire or take up another profession; we could make hearing aids in the back room; we could supersize ourselves to present a united front and negotiate lower Price; we could find other Suppliers from which to purchase.

Personal choices like retirement aside, the problems with other options are bigger than our Price problem, which is why we don’t take them or wish we hadn’t if we do. HearX/HearUSA is a good example of supersizing, banding together and leveraging for amazing business opportunities. Look how that worked out.

Knowing Their Ps from Their Q

The Demand side of the equation where “we” sit does exercise some leverage on Price Takers, so all is not lost. A Price Taker must accept the Price on the Demand Curve that corresponds to optimum production Quantity (where MC = MR). And that, right there, is the whole key: these guys know their Q, but their Ps are moving targets depending on particular demand curves. Economists refer to them synonymously as Price Searchers or Price Takers.

The idea of different Demand Curves was not addressed in Econ 101, except to note that certain factors shift a particular Demand Curve. But now we’re talking about wholly different Demand Curves with different starting points and different slopes. We’re getting away from fantasy theory and into real-life scenarios.

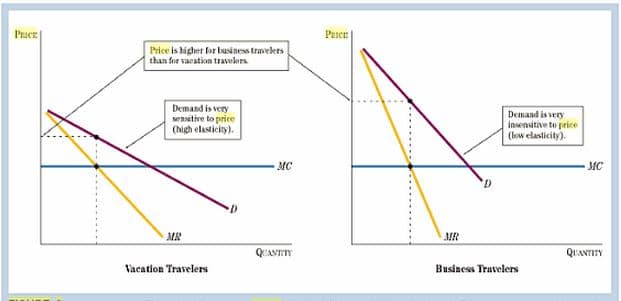

Fig 1 shows Travel Demand Curves for two different customer groups. Business travelers are more concerned about getting there and making the deal; Price is secondary, especially if they are on an expense account.

Fig 1. Consumers with Different Price Elasticities of Demand (from Taylor & Weerapana)

Their Demand Curve reflects this Price Insensitivity: the curve starts at a high price and slopes rapidly downward.{{1}}[[1]]Bear in mind that the slope of the Demand Curve is not the same as elasticity, which is different at every point on the curve. It’s true that a vertical Demand “curve” is perfectly inelastic and a horizonal “curve” is perfectly elastic, but it does not follow that steeply sloping demand curves are always inelastic, or that shallow curves are always inelastic. Slope is dY/dX; elasticity is the percentage change in Y and X. Click here for a very nice explanation with interactive illustrations of the difference between slope and elasticity.[[1]] In contrast, Vacationers’ Demand Curve starts at a lower price point and has a flatter slope: this group is Price Sensitive, prioritizing travel choices by Price — the less money it costs, the further they can go or the longer they can stay.

Airlines know about Fig 1, which is why they offer business and coach class tickets. They are notorious Price Searchers, as you’ve probably noticed while trying to lock in an airfare online that changes by the minute, even if you’re sticking with one class of service. How do airlines do that? What do they know that we don’t? One Word: Elasticity.

Price Elasticity of Demand (PED)

Substitute “Hearing Aid Users” for Vacation Travelers in Fig 1, and “Dispensing Audiologists” for Business Travelers. Last week’s post distinguished those groups:

- Hearing Aid Users are Price Sensitive — the lower the price, the more inclined they are to purchase. If the price is too high, they’ll skip the purchase and figure out a substitute.

- Audiologists are Price Insensitive– they can’t not buy. They buy because they have to.

Like the airlines, the hearing aid manufacturers see one market (hearing aids), two Demand Curves, and two sets of customers. They use a unitless economic measure called Price Elasticity of Demand (PED) to quantify and compare price sensitivities of different customer groups.

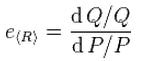

PED is the ratio of % change in Quantity Demanded to % change in Price (Fig 2). For so-called “normal (desirable) goods,” including hearing aids, the % change in demand divided by the % change in price yields a negative number (due to the downward sloping Demand curve). PED = -1 just means that one less hearing aid is purchased for every unit increase in price.

- If Audiologists purchase 5% fewer instruments when hearing aid price goes up 10%, the PED = 10%/-5% =- 2.

- If Hearing Aid Users purchase 50% fewer instruments, the PED = 10%/-50% = -0.2.

We say the Audiologists group has inelastic demand, because price has little effect on demand and PED >1. The Hearing Aid Users has elastic demand because price affects demand substantially and PED < 1.

Foaming at the Mouth

Fig 1 shows the substantial effect of PED on Monopolist Pricing. At optimal Q, where MR =MC, the Price they can command for the inelastic crowd is substantially higher than the Price they’ll get for the elastic crowd. And they will Price twice and get both, because they can.

At present, this is happening through increased vertical distribution of product, where manufacturer-owned or sponsored practices compete in the same market with independents who purchase from that manufacturer. The economic term for this is Price Discrimination and it makes Audiologists foam at the mouth.

Hold up, you inelastic Audiologists! Before you start jumping up and down, don’t forget that Price Discrimination is alive and well in your office, too, if you have a Senior Discount or any number of other ways you entice one group to purchase from you at a different price than another group. Everybody does it. That’s not the issue.

The real issue with Price Discrimination is one we never think about: If our Price is high and the other guy’s Price is low, why don’t we cut a deal in the back room to buy from him instead of the manufacturer? OK, I’m sure some of you have thought of that, but your state licensure and the FDA posed barriers. Sometimes it’s tough to figure out who is protecting whom. On that note, I’ll leave you to ponder a quote from my favorite economic textbook till next time:

Price discrimination based on different price elasticity of demand requires that the firm be able to prevent people who buy at a lower price from selling the item to other people.

photo courtesy of Dr Mark J Perry