March Phonak-Costco Madness ushered in urgency to the health of hearing healthcare providers. March Mayhem was foreshadowed for 3 years in Hearing Economics posts, starting with resurrection of 1990s prognostications of professional schizophrenia and bimodalism stemming from creative destruction.

March Phonak-Costco Madness ushered in urgency to the health of hearing healthcare providers. March Mayhem was foreshadowed for 3 years in Hearing Economics posts, starting with resurrection of 1990s prognostications of professional schizophrenia and bimodalism stemming from creative destruction.

And lo, it came to pass as disruptive technologies and economics came among us and we were sore afraid.

Otherwise, March was a pretty good month.

Professionals expressed solidarity and calls to action. Membership organizations stayed on the sidelines except to admonish members not to talk Price at rallies. The proverbial Elephant in the Room (see February Hearing Economics), went unacknowledged:

Who we are depends on who you ask: we see ourselves as professionals who provide hearing health services. Consumers mainly see us as retail sellers of hearing aid devices.

Today’s post is a contrarian economic peek at the Elephant, checking out our healthcare and retail roots as part of the ongoing Pricing series.

Our Brethren

Retail establishments and private health care practices are usually unique models. But they share one important distinction: both are small business endeavors. From that perspective, it’s useful to look at them separately first and then compare them to our own activities in order to gain an understanding of how dispensing audiologists fit or differ from a combined retail/healthcare model. Comparing typical costs is one way to do that.

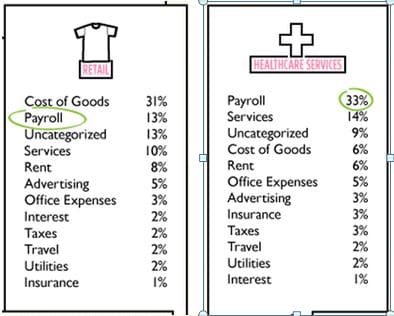

Figure 1 summarizes cost categories for two small business models based on an aggregate analysis of small businesses by Intuit. The results are straightforward, drawing a clear line between the two industries:

- Retail’s biggest expense (31%) is Cost of Goods (COG), followed by payroll and services (23%).

- Healthcare’s biggest expenses are payroll expenses and services (47%).

- COG distinguishes Retail (very high, 31%) from Healthcare (very low, 6%).

- Payroll distinguishes Healthcare (high, 33%) from Retail (low, 13%).

- All other expenses are comparable and do not distinguish one industry from another.

How Do We Compare?

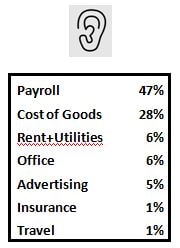

Hearing Economics made up an Intuit-like table for dispensing Audiologists (Fig 2) to facilitate comparison to Retail and Healthcare Services. Data are aggregated from a previous post. As usual, data are limited to a small sample of practices thought to be representative. More data is welcome, as are improvements/corrections in the analysis. Feel free to help out here.

Items that jump out:

- We are a Healthcare Industry by payroll standards. Human resources is our biggest expense category (47%) by far.

- We are a Retail Industry by Cost of Goods standards (28%). Our COG is about 5 times higher than COG in healthcare services.

- We are a pretty good fit to a combination of Retail and Healthcare industries, at least in terms of how we structure our businesses.

But We Knew This in Our Hearts

The comparisons yield expected results, if we and our membership organization are willing to look in the mirror. The comparisons serve to underscore the bimodal aspect of what we do, a point that is known if not popularly acknowledged. It is not a new point. That we are a combination of Retail and Healthcare comes as no surprise to the US Office of Management and Budget, which has classified us as both for many years.

The rough comparisons above are not apples to apples nor do they need to be. We can speculate on differences that distinguish us slightly, without changing the bimodal aspect of what we do.

For instance, our payroll costs are quite a bit higher than the average Healthcare Industry number in Fig 1 (47% vs 31%). This is explained in part because hearing healthcare “payroll” includes other employee costs (e.g., retirement plans, taxes, services) which are broken out separately by Intuit in Figure 1.

Nevertheless, Human Resources consume almost half of income for Audiologists and Healthcare Services. An educated guess is that some of this difference is that the proportion of licensed professionals to clerical employees is higher in our profession than other healthcare environments. If anyone has data on this, please share.

We Are What We Do

Mechanistically, knowing What we are answers the question of Who we are. But knowing What and Who only begs perplexing Why questions that straddle the bimodal divide:

- Why do we chose to bundle our COG with our services when they are clearly differentiated in our cost structure?

- In our businesses, payroll and COG are separate line items. Why do we find it so difficult to maintain their separation when thinking about setting Price(s)?

- Why do we present consumers with a single Price when those same consumers easily differentiate between tangible products and services in the two industry models shown in Figure 1?

- Consumers don’t purchase computers from their local healthcare facility and they don’t purchase chest x-rays from Radio Shack. They understand the difference between Goods and Services, the assign value to both, they consume either as needed. Given the opportunity, they would (eventually) understand the difference between a hearing aid and hearing services and assign value to both.

Answering the Why questions means acknowledging the Elephant in the Room. I think we’re getting close. He’s sure getting heavy.

(Editor’s note: This is Part 19 in the multi-year Hearing Aid Pricing series. Click here for Part 18 or Part 20).

photo courtesy of lean blog, ahighherself, cafepress, bird-flower-fish