As part of our series on the influence of price on the hearing aid market, this week’s blog takes a closer look at the connection between price and adoption rates.

Estimates of hearing aid adoption rates were first quantified back in the early 1970s, and are reported periodically as percentages. In 2014, Staab1 provided readers with an overview of differences in how hearing aid adoption was determined, and concluded that the different methods all shared the same message: hearing aid adoption rates have remained relatively unchanged for nearly four decades.

Historical US Adoption Rates

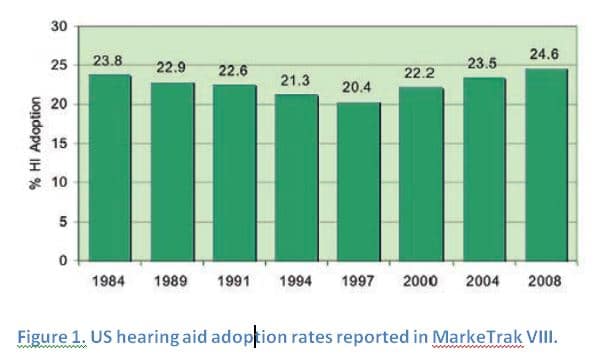

Figure 1, taken from MarkeTrak VIII,2 displays US hearing aid adoption rates between 1984 and 2008. The reader will note that over the 24-year span (i.e., 1984 to 2008), the percentage of adoption in hearing aid technology is essentially flat, ranging between 20.4% (in 1997) and 24.6% (in 2008).

Figure 1, taken from MarkeTrak VIII,2 displays US hearing aid adoption rates between 1984 and 2008. The reader will note that over the 24-year span (i.e., 1984 to 2008), the percentage of adoption in hearing aid technology is essentially flat, ranging between 20.4% (in 1997) and 24.6% (in 2008).

It should be noted that the data in Figure 1 includes devices obtained in the private market, as well as the Veteran’s Administration (VA) and via the Internet. Furthermore, note that overall, US adoption rates have not increased markedly after 1996, when the first generation of fully digital devices was introduced. This outcome suggests that technology alone is not a primary factor in growing the market.

One could disagree with our earlier statement regarding the US adoption rate and point to the recent MarkeTrak 9 report that indicates a 30.2% adoption rate,3 which, as the first author noted previously,4 differs in methodology (i.e., responses surveyed online) from the previous eight MarkeTrak surveys (i.e., responses surveyed using paper/pencil). The differences in dissemination, as well as modifications to questions, have muddied comparisons between MarkeTrak 9 and its predecessors. Regardless of differences in research design, we acknowledge for this blog, at least, that the present US hearing aid adoption rate is 30.2%.

The next question, then, becomes, “If the adoption rate in the US market is 30.2%, how does that compare to hearing aid markets globally?”

Global Adoption Rates

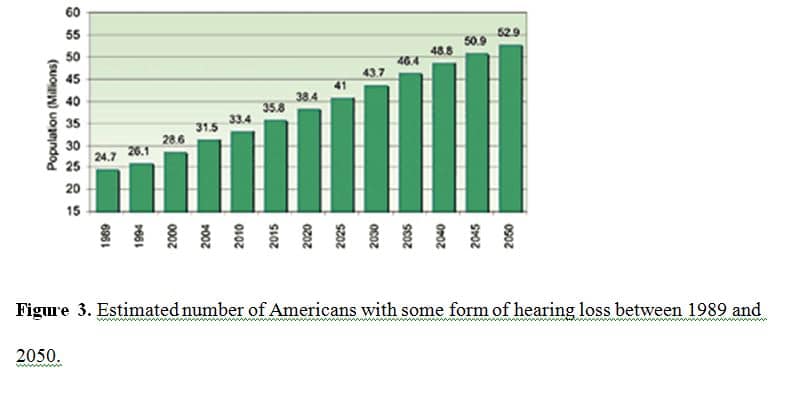

Figure 2, reported in MarkeTrak 93, illustrates global demand for hearing aids. This comparison among countries in Figure 2 is valid because the same methodology was used during data collection in each instance. Countries with the highest percent of hearing aid adoption were Norway (42.5%), the United Kingdom (41.1%), and Switzerland (38.8%), while Japan (14.1%) had the lowest adoption rate.

The countries with the highest adoption rates (i.e., Norway, UK, and Switzerland) were not surprising given that hearing aids are fully (Norway, Switzerland) or primarily (UK) subsidized by their governments. Thus, the US adoption rate of 30.2% is remarkable, particularly given that the overwhelming majority of hearing aids are not subsidized by the government or underwritten by insurance plans.

MarkeTrak 9 findings suggest that restructuring the present US hearing aid model to one that is federally subsidized would increase the adoption rate to roughly 43%, equivalent to the adoption rate in Norway. The reasoning and calculations follow:

MarkeTrak 9 findings suggest that restructuring the present US hearing aid model to one that is federally subsidized would increase the adoption rate to roughly 43%, equivalent to the adoption rate in Norway. The reasoning and calculations follow:

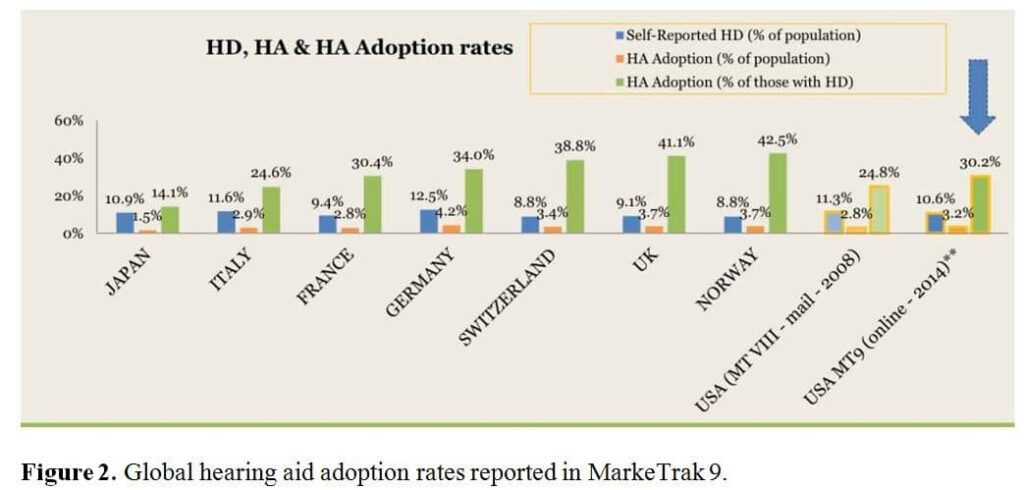

- Of the estimated 36.32 million Americans with some form of hearing loss (Figure 35), 30.2%, or 10.97 million Americans (36.32 x 30.2%) have adopted amplification technology;

- When we extrapolated the demand function (changes in units sold when prices are increased or decreased) from the MarkeTrak 9 data, the demand function yields a coefficient of 0.427. Stated differently, the coefficient means that if hearing aids were fully subsidized (i.e., free), then only 43 out of 100 listeners would be willing to be fit with this technology.

- When we apply the value of .427 (42.7%) to the 36.32 million Americans who exhibit some form of hearing loss, the estimated number of hearing aid users would increase by 4.54 million, or from 10.97 million to 15.51 million.

Price as a Barrier to Adoption Rate

One might ask, “Is price a barrier to hearing aid adoption?” Based on the data presented thus far, the answer is yes. In capitalistic market, the estimated number of hearing aid users is 10.97 million, which could increase drastically to 15.51 million when devices are federally subsidized.

This example is best illustrated by looking at Norway, which has the highest adoption rate globally. Their model requires no monetary investment on the part of the patient to adopt amplification, where 42.5% of the population opts to obtain this technology.

Is Federally Subsiding of Hearing Aids the Way to Go?

The answer is no. If we look at the Norwegian adoption rate, a secondary argument could be that 57.5% of the population who could benefit from amplification, are unwilling to adopt this technology, despite that there is no cost to the end user.

Now, let’s look at the US market. The problem with the data in Figure 3 is that it encompasses listeners with all forms of hearing loss, including those that are medically treatable (i.e., conductive component), those best treated with treatment strategies other than traditional amplification (e.g., bone-anchored devices, cochlear implant candidates), and individuals with milder hearing difficulties who do not want/need amplification.

To remove the artifact of these outlying populations, Amlani & DeSilva6 utilized a regression model that assessed the practical estimate of individuals in the market for amplification. When the regression model is applied to the example used in this blog, the number of individuals adopting federally funded hearing aids is estimated at a mere 0.84 million. Thus, the number of hearing aid users would increase slightly from 10.97 million to 11.81 million.

Again, this model assumes devices that are provided at no cost to the consumer. This mild change in adoption rate suggests that subsidizing hearing aids does not appear to be the answer to increasing hearing aid use.

How to Improve the US Adoption Rate

Improving the US adoption rate is predicated on increasing the demand function for hearing aids. When MarkeTrak 9 was released, the demand function in the hearing aid industry was roughly 0.43. If the demand function is increased by .05, or from .43 to .48, and we apply the regression model, the estimated number of individuals utilizing hearing aids increases by 1.36 million, or from 10.97 million to 12.33 million.

Conversely, if the demand function is reduced by .05 from .43 to .38, and we apply the regression model, the estimated number of individuals utilizing hearing aids increases by a mere 0.33 million, or from 10.97 million to 11.00 million. Stated simply, increasing adoption rates is dependent on increasing the market increasing the demand function (i.e., to a value closer to 1.0).

Summary

Increasing our market potential and improving hearing aid adoption rates are not based on price per se, but rather, based on improving the demand function. Improving the demand function will require the profession and industry to reassess:

- The existing service delivery model (i.e., direct access);

- The manner in which standard of care is provided (e.g., itemizing, performing real-ear measures);

- Increasing and/or creating reimbursement for rehabilitation/counseling efforts;

- Revamping educational training programs,; and

- Increasing the number of suppliers of amplification technology (e.g., availability of hearables).

References

- Staab, W. (2014, Dec 9). Hearing aid market penetration. HearingHealthMatters.org,

- Kochkin S. (2009). MarkeTrak VIII: 25-year trends in the hearing health market. Hearing Review, 16, 12, 14, 16, 18-20, 22-24, 26, 28, 30-31.

- Abrams HB, Kihm J. (2015) An introduction to Martekrak IX: A new baseline for the hearing aid market. Hearing Review, 22, 16.

- Amlani AM. (2015, June 2). Assessing the Validity of MarkeTrak IX Adoption Rates. HearingHealthMatters.org

- Kochkin S. (2005). MarkeTrakVII: Hearing loss population tops 31 million. Hearing Review, 16-29.

- Amlani AM & DeSilva DG. (2005). Effects of economy and FDA intervention on the hearing aid industry. American Journal of Audiology, 14, 71-79.

This is Part 6 of the 2016 Hearing Aid Price Series update. Click here for Part 1, Part 2, Part 3, Part 4 and Part 5.

Co-editor Amyn M. Amlani, Ph.D., is Professor and Chair of the consortium program in Audiology & Speech Pathology between the University of Arkansas for Medical Sciences and the University of Arkansas at Little Rock. Dr. Amlani holds the B.A. degree in Communication Disorders from the University of the Pacific, the M.S. degree in Audiology from Purdue University, and the Ph.D. degree in Audiology/Psychoacoustics (minor in Marketing and Supply Chain Management) from Michigan State University. His research interests include the influence of hearing aid technology on speech and music; economic and marketing trends within the hearing aid industry; and playing bass guitar in various heavy metal cover bands. Email: [email protected]

feature image courtesy of Leapup Marketing

I chuckled when I read, “Adoption is not based on price, per se.”

I was at Sam’s today. Their top of the line hearing aids were $3,200 per pair and with all the bells and whistles. I imagine it is the same at Costco. My audiologist quoted me $7,200 for new hearing aids last month. I bought the same new hearing aids on Ebay for $1050. Of course, I have to have to have them programmed by my Audiologist, which she will do a la carte. No factory guarantee, but there are numerous sites online that say they will repair them when needed. I double checked with 3 of them before I purchased the new HAs. I know many seniors who are in dire need of HAs, but cannot afford them. The mark up on HAs seems to be enormous in light of what I see on Ebay. Everyone should check it out. I would think that the future will belong to the Big Box stores or Ebay as Audiologist stop bundling in an effort to compete. Where am I wrong?