Numbers aren’t my love and I’m no accountant, but I did stay at a Holiday Inn Express once. That, plus owning a variety of Audiology practices, forced me to learn basic accounting. All of us in private practice must clear the accounting hurdle. We can’t really know if our businesses are succeeding or failing without a working knowledge of basic accounting. We can’t even think about selling our practices unless we know accounting.

Accounting is not Economics

Think of Economics–the usual domain of this column– like a documentary on Animal Kingdom. It goes out into the wild and uses a long lens and time frame to track behaviors of Audiologists, dispensers, manufacturers, distribution channels, consumers, etc. In contrast, Accounting tracks smaller, closer to the bone, in discrete, small time frames. Think of it like a personal diary of a practice’s functionality and viability, with snapshots pasted in the pages.

Here’s an accounting article and tutorial by Jay Goltz which I hope you’ll click, read, and clip. I’ve summarized and personalized it for Audiology by substituting a dispensing practice for the hair salon example used in the tutorials. If you don’t think your practice is like a hair salon, think again. We’re all alike when it comes to those of us crazy enough to start and run small businesses. We have more guts than money — a “Goltz nugget” borrowed for today’s title.

Mantras for the Accounting-Challenged

Goltz is an inspirational speaker and writes as I imagine he speaks– in sound bites that could fit on a coffee cup. That’s a complement — they are tough, common sense observations of what it’s like to run a small business. Here are a few “Goltz nuggets” which hit hot buttons such as sunk costs, cash flow, fiduciary duty and theory of the firm:{{1}}[[1]]These are direct quotes. Goltz writes better than I do so I elect not to ruin his nuggets by rephrasing them into my own, lesser words, I elect to preserve them through selective plagiarism.[[1]]

-

Don’t even think of using the “I am not a numbers person” excuses.

-

Owners do not have the luxury of pleading ignorance to one part of the business, whether it’s accounting, management or marketing.

-

Just because you made money doesn’t mean it is going to be in your checking account.

-

The income statement shows whether you are making money. The balance sheet shows where the money and debt are.

-

Even if you paid more than you should have for your practice, get over it. They asked for the price, and you paid it. You were not cheated. It is a waste of thought and energy.

-

Entrepreneurship, first and foremost, is about accepting responsibility.

Contemplate These Truths, Find Your Essential Self

And there you have it. Read them, understand them, achieve success. Namaste.

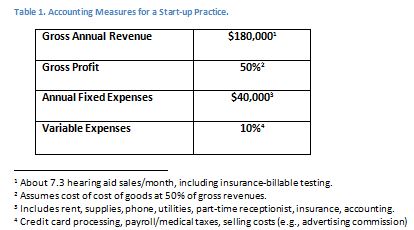

Or, we can skip downward facing dog and do Goltz’s example, adjusted for Audiologists (Table 1) and footnoted to explain my assumptions.

I open or purchase a practice which generates $180K in year 1, as shown in the Table.

Gross Profit is what’s left after I pay the hearing aid manufacturers, before I factor in other costs. The ratio of Cost of Goods to Total Revenue, expressed in percent, is my Gross Profit. It’s about 50%.

Gross Margin (GM) factors in variable costs. Variable expenses ran about 10% of total revenues: I paid credit card processing fees, payroll, did a little local advertising, but did not pay any commission on sales. Subtract 10% variable expenses from 50% Gross Profit to arrive at GM = 40%.

And don’t forget Fixed Expenses (FE), which are there regardless of whether revenue is generated or not. Thankfully, those were low for this tiny practice — just $40K in year 1, which covered my rent, insurance, accounting, utilities, taxes, loan payments, etc.

Now we can go to work and do a simple calculation to arrive at the break-even point (BEP). It’s simply Fixed Costs divided by Gross Margin.

BEP = FC/GM = $40K/40% = $100,000

In other words, I broke even and made money. With gross revenue of $180K, my profit was $80K*40% = $32K.{{1}}[[1]]Goltz does not factor in owner’s wages. If those are paid, BEP naturally goes up and profit goes down.[[1]]

Show Me the Money

At the end of the year, I haven’t paid myself, there’s no money in the bank, and I think my practice has failed. I think it’s time to bail. But I can’t help wondering where the $32K profit is hiding. Cash flow is the culprit. As Goltz’s nugget says, profit is on the P&L, cash flow is on the Balance Sheet. Profit and Cash Flow are not the same. They’re not even on the same page.

I repaid $24K on equipment loans. I paid $4K in interest on those loans. I paid $8K in federal and state income taxes. That adds up to $32K profit that flowed out in cash. Future profits will pay off the loans, eliminate interest payments, and allow me to aim more of the cash flow toward my personal bank account.

It’s not time to bail, it’s time to keep doing what I’ve been doing until I benefit from running a profitable practice — probably about 3 years in this case. Now can you see why basic accounting is imperative for successful business owners? It may save your business and it will definitely save your sanity.

If nothing else, this should quiet the hoards clamoring for the blood of profit-crazed audiologists. Imagine their surprise when they break in and discover we’re out of money but full of guts. Hang in there!

photo courtesy of Ad Week