The fraud was corporate, it was accounting, it was deliberate, it was a single rogue operator, it was well hidden, it wasn’t cash, it was US only, it was complicated, it was intelligent, it was “irritating noise.” And now it’s officially over. As they say in the US, Fuhgeddaboudit.

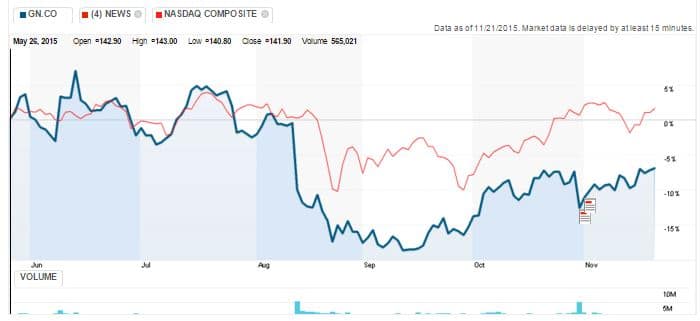

That’s the party line taken in two GN earnings conference calls, August 131 and October 30,2 in which GN top brass fielded questions from financial analysts, in response to announcements made in GN’s Q2 2015 interim report. GN stock dropped after the Q2 report and both conference calls, closing at a 2+ year low on 9/11 and tracking well below the Nasdaq Composite3 since the fraud was made public (Fig 1).

The party line is probably right in the long view: despite the fraud and the grilling by financial analysts, GN stock continued to receive positive ratings until this week, based on growth in the US market, which currently accounts for 42% of GN’s total hearing aid sales.4 In the short view, pending patent decisions, Q4 performance and other issues prompted a downgrade of the stock (to “market perform”) this week by Bernstein research5 .

Hearing Economics covered the tawdry side of the fraud in August and won’t go there again. But, the fancy accounting moves offer Learning and Teaching Moments as we resurrect the long-dormant Accounting 101 series and embark on Accounting 202.

The How of Fraud

Fraud in private practices typically takes the form of straight-forward theft of money, supply pilfering, self-dealing, or cash sales off the books. By contrast, the type of “corporate management fraud” that transpired at Beltone is unfamiliar to most small business owners.

There are various types of management fraud, chief among them is a method that accountants call creating “fictitious or fabricated revenues” to overstate revenues 6. The rest of the world calls it “cooking the books.”

The Cooking Metaphor of Fraud

Cooking the books is more complicated, protracted, and deliberate than impulsively seizing the opportunity to whisk money or supplies out of the building. Cooking, or baking, is a good metaphor. Cakes and corporate fraud succeed only when recipes are followed carefully–using the right ingredients; measuring precisely; mixing properly; patiently monitoring the production in a quiet, controlled environment with an even temperature; generously applying decorative frosting to cover imperfections; displaying the final product on a look-but-don’t-touch pedestal; implying that it tastes as good as it looks.

When crooks commit accounting fraud they also need to know the real story, so they keep two sets of books – one for the fraud numbers and one for the real numbers. When the accounts have been juggled or the books have been cooked, the financial statements of the business are distorted, incorrect, and misleading. Lenders, other creditors, and the owners who have capital invested in the business rely on the company’s financial statements.

Beware the frosting of fictitious or fabricated revenues. Those are sales (or loans) recorded on the books that either didn’t occur or are inflated. They can be made to real or fake customers. This can work in an accrual system because future sales aren’t booked as revenue. Instead, they’re booked as accounts receivable, which appears as an asset on the balance sheet, until they’re collected or expensed to bad debt. Fictitious revenue tends to “hang around” on the balance sheet and should raise eyebrows:

Mysterious accounts receivable on the books that are long overdue are a common sign of a fictitious revenue scheme.

In the first GN conference call, Anders Boyer, GN Store Nord CFO, described the book-cooking mystery this way:

It’s been other receivables, prepayment … it’s a receivable loan. It’s a loan to this dispenser, but there’s no cash involved. It’s just a paper transaction, so no cash involved.

Cooking Alone is Hard

Unlike plain-vanilla theft of goods or money, management fraud is manifest by paper transactions and reporting. That means somebody’s got to enter, monitor, and adjust a burgeoning number of accounting entries–not for a day, but forever, or until the fraud is discovered. That somebody has to embrace presenteeism wholeheartedly, in addition to being really smart, reliable, compulsive, secure in his/her position, and motivated to succeed. No wonder such people find their way to top management. The Beltone case was no different, as Anders Boyer made clear in the first conference call:

It’s pretty intelligent, I would say, and complicated accounting fraud that has been made. It’s many, many transactions.

Cooking the books can’t happen without the assistance of a knowledgeable (albeit dishonest) accountant who is given free rein to work undisturbed and unsupervised. Of course the accountant could mastermind it, given sufficient time, resources, privacy, great organizational skills, good health, great memory, and single-minded motivation. That’s not the typical scenario.

Corporate structure and scrutiny in well-managed companies purposefully limits individual freedom and enticement, especially for those in charge of the money. In such environments, corporate fraud is hard to do without some aiding and abetting, or at least shielding, by others in the organization. Hence the term “management fraud” usually implies perpetrator(s) in top corporate positions colluding with the intention of deliberately misleading investors, most often by accounting manipulations and inflated company financial statements.

Uncooking is Harder

Detangling revenues and assets at GN posed a daunting task, perhaps not worth the effort of meticulously deconstructing the fraud, and better handled as a “one-off” accounting write-down. Anders Boyer described the morass on the first conference call:

… to exactly allocate when these fictitious assets were created …going down to a quarter — I think that would require man years of investigations to get there. … it’s literally thousands of transactions where it’s difficult to see when did that specific transaction actually, at the end of the day, benefit the P&L.

Accordingly, GN Resound skipped the man years, finalized its investigation and moved on, taking a one-time loss on the books. It concluded that the Beltone fraud was the work of one man, their VP of Finance for many years.

Just because that’s not the typical scenario for this type of fraud does not mean it’s not so in this case. The VP may well have run his own shop and burned the midnight oil to keep up with those two sets of books–a full time job on its own. As Anders Hedegaard, GN Store Nord CEO, made clear in the first conference call, the Herculean effort and panoramic vision of that single individual did not fail to impress:

The former VP of Finance was a well-respected person in the organization. So, as such, everybody was surprised, not only that it happened but also the magnitude.

The Why of Fraud

Small business owners are probably asking themselves two obvious and logical questions at this point, both hinging on motive:

- “Why suffer sleep deprivation and drive yourself crazy keeping two sets of books if you don’t own the company and you’re not even pocketing the money?”

- Good question. Answer to follow in the next Accounting 202 post.

- “Corporate fraud is rare since it’s so challenging and offers no immediate gratification, right?”

- Another good question. Quick Answer: Wrong.

Sneak peek: You’d be surprised. Corporate management fraud ranks among the FBI’s highest criminal priorities. More of this in the next Accounting 202 post.

References and Footnotes

1 Edited Transcript of GN.CO earnings conference call or presentation 13-Aug-15 12:00pm GMT

2 Edited Transcript of GN.CO earnings conference call or presentation 30-Oct-15 1:00pm GMT

3 Considered a good proxy for market tech segments of the market.

4 Hearing Aids: October U.S. Growth at 5% in Private Market and 3% for VA. GN Takes #2 Position in VA with 20.3% Share. Bernstein Research (confidential industry report by Lisa Bedell Clive), November 10, 2015.

5 Bernstein Research (confidential industry report by Lisa Bedell Clive), November 25, 2015. GN Store Nord: Downgrade To Market-Perform On Potential Patent Case Loss and Limited Margin Expansion Beyond 2016.

6 Other means of overstating revenues are recognizing revenue prematurely or understating sales returns .

feature image courtesy of investopedia; cake image from pink cake box