Corporate management fraud ranks among the FBI’s highest criminal priorities.

So concluded last week’s post on the Beltone accounting fraud. Sad to say, large-scale corporate fraud is thriving in the healthcare sector, on a scale that dwarfs the paltry $22M (US) Beltone write-down by GN Resound.

In the US alone, the FBI ended 2011 in pursuit of 726 corporate fraud cases, a portion of which were financial statement fraud. Despite grinding challenges, absence of immediate gratification, and boring accounting trails, that type of fraud occurs with sufficient regularity to merit national laws and pursuit by criminal justice systems in a variety of countries.

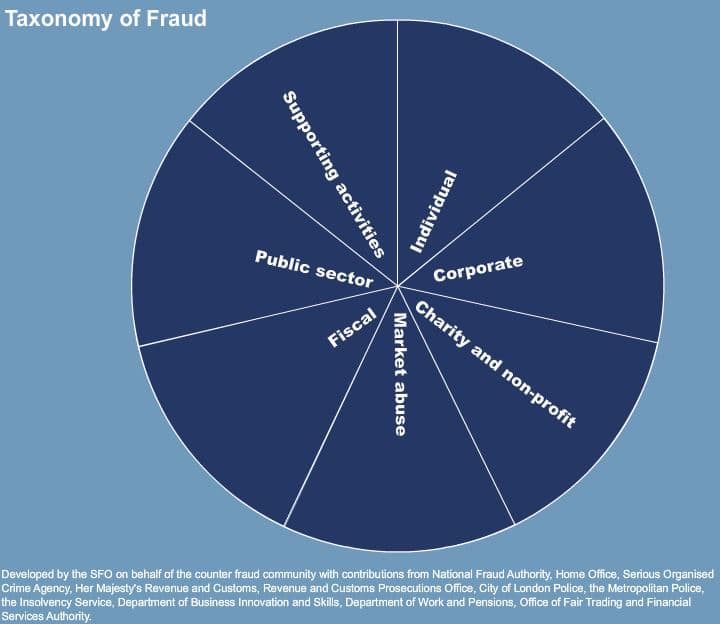

The Pie Charts of Fraud

Fig 1. Taxonomy of fraud according to the Serious Fraud Office (SFO), an independent office within the criminal justice system of the United Kingdom (UK).

In the UK, frauds are defined, categorized, and pursued by the government in an orderly manner with attendant pie charts (Figs 1 and 2). The Serious Fraud Office (SFO) calls it fraud if any of three independent but inter-related criteria are met:

- deception (“knowingly mak(ing) false representation”)

- failure to disclose information

- abuse of a position

The SFO’s pie charts are wonderful in their simplicity and comprehension (click the link to get to a pie chart, then click in the pie chart to explore). Once in the pie charts, you can click on “Corporate” (see Fig 1) to see an extended pie chart breakdown (see Fig 2). You can click on categories and get boxed definitions. As examples:

- click “Insurance Specific Frauds” to get the definition and make the connection to the fraudulent billing scheme described in this week’s Hearing News post;

- click “Corporate Services Frauds” to learn that these are “frauds committed against companies by employees or professional(s) (e.g., accountants, lawyers …)

- click “False Accounting” and up pops the definition: Alteration or presentation of company accounts so that they do not reflect the true value or financial activities of the company… including … overstating of assets … Undertaken for a variety of reasons, including … to report unrealistic profits and/or to inflate the share price.

Financial Statement Fraud in the US

Along with criminal investigations by the US Justice Department, the US Securities and Exchange Commission (SEC) investigates corporate fraud and enforces legal (usually civil) actions. SEC activity manifests in Accounting and Auditing Enforcement Releases (AAERs) during and at the end of investigations. From its inception in 1982 to 2014, the SEC has issued 3588 AAERs detailing effects of accounting/auditing misconduct on the financial statements of 1383 corporations.

Here are a few statistics culled in the final year of an eight-year Deloitte study2 of 1501 financial statement fraud AAERs in the SEC database:

- Financial frauds lasted 7 years before detection, on average, by 2008. Each year showed a “steady increase” in fraud duration.

- 81% of the AAERs in 2008 implicated company officers, “individually or along with the company itself,” in the alleged frauds. 44% of the individuals were CFOs, CAOs, or Controllers

- Revenue recognition fraud was the most common scheme (33%). More than 20% of those recorded fictitious revenues.

Financial Statement Fraud in US Healthcare

The granddaddy of healthcare fraud is HealthSouth, a global, publicly-traded company. For 7 years, HealthSouth’s top management convinced Wall Street that its income was 60% higher than actual. The fraud was detected and the SEC prosecuted top management in 20033 on grounds of:

“knowingly falsifying accounting records and designing fictitious entries to overstate cash … and … total assets. … At the conclusion of the investigation, it seemed that everyone in the organization was aware of the massive fraud—except the auditors.”

The anatomy of the fraud went like this, as described in Dutta (2013)4:

- The corporate office cooked the books by several methods. Chief among them was creation of a fictitious “contractual adjustments account” to house fake revenue on the financial statement.

- Total assets were overstated by over $8B(US) over the 7-year period of the fraud.

- Accountants created over 2 million false accounting entries to overstate corporate income.

- A wide swathe of employees collectively called the “family” met quarterly at “family meetings” to cook and collude.

Comparative Anatomy of Fraud at HealthSouth and Beltone

Paralleling the HealthSouth bullet list, the skeletal outline of the Beltone fraud as reported by GN Resound traces similar lines:

- The books were cooked at Beltone US headquarters by:

“making fictitious accounting transactions … to book fictitious revenue and park it as an asset5 on the balance sheet.“6

- Assets/revenue were overstated by about $22.5M(US) over three years (2012-2014), about 7% of estimated $322M(US)Beltone sales7 for the three year period.

- One accountant, apparently acting on his own, created upwards of 5600 false accounting entries to overstate corporate income, if HealthSouth’s profile is representative of what’s needed to keep accounts well cooked.

- The Beltone organization operated like “a family … in which monthly metrics are shared within… but never outside,” according to a high placed industry executive, discouraging scrutiny from auditors and other outsiders.

The Recipe Was Right

And there you have it, Beltone mirroring HealthSouth’s really big fraud on a tiny scale: a tightly knit, closed-mouth family affair with cooked books containing fictitious and overstated revenues, fake assets, inflated net income8–all paper transactions, all funneled onto the books via “a number of different pathways,” all done at the home office, all requiring at least one accountant.

No wonder GN Resound, itself an outsider, was caught off guard. It’s a wonder they caught it so quickly. You can appreciate the sentiments and resolve expressed by Anders Hedegaard, GN Resound CEO, in the October 30th earnings conference call:

“we are searching for a new President of Beltone … And the new President of Beltone will be reporting directly into me.”

As to why such frauds are promulgated, that has to wait for a future Accounting 202 post. Ditto for other fascinating questions that may or may not get posts, having to do with the nature of Beltone itself – a mysterious entity for sure – and how on earth it became a GN Resound minion (or not).

References and Footnotes

1 Paraphrased from the SFO website in bulleted examples.

2 Deloitte Forensic Center. Ten Things About Financial Statement Fraud. A review of SEC enforcement releases 2000-2008). 3rd Ed, updated through 2008.

3 One of the first SEC prosecutions under the Sarbanes-Oxley Act of 2002.

4 Dutta SK. (2013). The challenges in forensic accounting (chapter 1) in Statistical Techniques for Forensic Accounting: Understanding the Theory and Application of Data Analysis. Upper Saddle River, NJ: F.T. Press.

5 The overstating of revenue would in most cases also overstate accounts receivables and hence would also overstate assets.

6 Paraphrased from a quote by GN management to financial analysts, Bernstein confidential industry report, August 16, 2015.

7 Calculated from GN annual reported revenues for 2012-2014, of which the Beltone fraud was reported to constitute 1%).

8 On the P&L, net income is what remains after expenses are subtracted from revenue; overstated revenues will always produce overstated net income.

feature image courtesy of think advisor