By Amyn Amlani and Holly Hosford-Dunn

There’s a lady who’s sure

All that glitters is gold

And she’s buying a stairway to…[hearing].

We’re recalling the lyrics to Led Zeppelin’s Stairway to Heaven, as an inspiration for our series of posts on pricing. In Part 3 of our series of blogs on pricing that commenced in June, we analyzed retail and wholesale prices to gain a better understanding of market changes over a 12-year span (i.e., 2004 – 2015). Today’s post looks at gross profits, markups and consumer preferences for hearing aids categorized by technology-drive pricing.

Price Functions

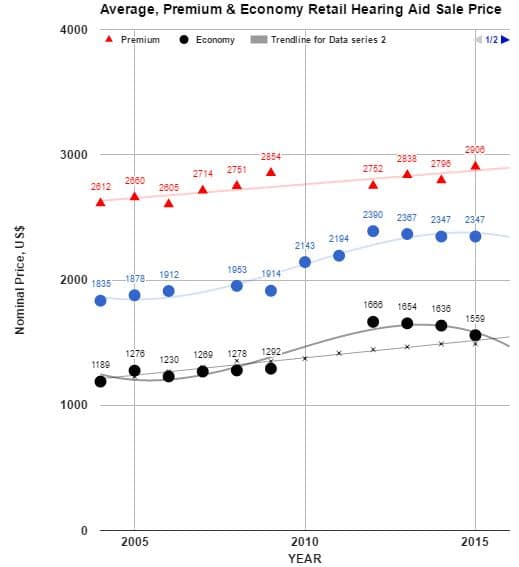

Figure 1. Premium (red), all-aid Average (blue), and economy-line (black) average US price compared to inflation (cpi) since 2004.

Data revealed that the average retail price of premium hearing aids has remained essentially flat, increasing at a rate less than inflation (see Figure 1, taken from Part 3). Further, the average retail price of economy-line hearing aids increased by nearly $400 sometime between 2009 and 2012, and has since declined over the past two years to better align with the rate of inflation (see Figure 1, taken from Part 3).

A question that needs to be asked is:

How do these pricing trends influence dispensing tendencies for the average hearing aid dispensing practice?

Show Me the Money

To answer this question, Tables 1 and 2 display the retail and wholesale prices for premium and economy-line devices, taken from Figures 1 and 3, respectively, in Part 3, for the years 2012 to 2015. We then took the liberty of calculating the gross profit (i.e., retail price – wholesale price) as well as the percentage markup.1

|

Premium Instruments Category |

2012 |

2013 |

2014 |

2015 |

|

Retail Price |

$2752 |

$2838 |

$2796 |

$2906 |

|

Wholesale Price |

$1167 |

$1192 |

$1180 |

$1150 |

|

Gross Profit |

$1585 |

$1646 |

$1616 |

$1756 |

|

Percent Markup |

136% |

138% |

137% |

153% |

Table 1. Tabulation of mean retail and wholesale prices of premium hearing aids for the years 2012 to 2015, along with calculations of gross profit and percent markup per year.

|

Economy Instruments |

2012 |

2013 |

2014 |

2015 |

|

Retail Price |

$1666 |

$1654 |

$1636 |

$1559 |

|

Wholesale Price |

$428 |

$432 |

$453 |

$451 |

|

Gross Profit |

$1238 |

$1222 |

$1183 |

$1108 |

|

Percent Markup |

289% |

283% |

261% |

246% |

Table 2. Tabulation of mean retail and wholesale prices of economy-line hearing aids for the years 2012 to 2015, along with calculations of gross profit and percent markup per year.

The differences in percent markup between product tiers, along with the notion that most Audiologists provide a fixed fee and fixed set of services regardless of technology dispensed, contest the presumption that practitioners are making their living by selling more advanced amplification technology.

One interesting trend to note from this comparison is that the percent markups appear to be gaining momentum for the premium products, as noted by the increase in percent markup in 2015 compared to previous years. Could this be the coming of age where Baby Boomers, who are exceptionally technology driven, are just beginning to enter the market?

Conversely, the percent markup shows a downward trend for economy-line hearing aids. One could reason that this trend is the market’s response to the expected growth and availability of Hearables. A second response to the reduction in price appears to stem from the market’s response to the April 2014 Costco/Phonak relationship, as changes in market structure tend lag behind by, at least, a period of two quarters (i.e., 6 months).2

Square Pegs and Round Holes

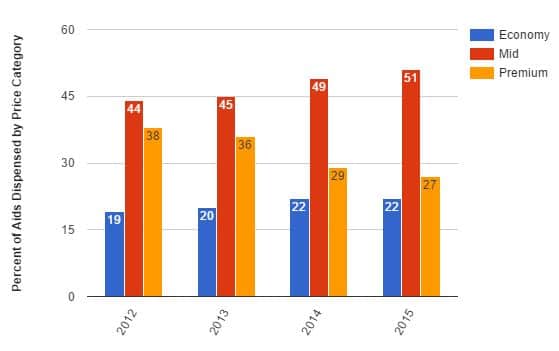

We took the liberty of an additional assessment of industry data. Specifically, Figure 2, illustrates the percentage of units dispensed, or purchased by consumers, by technology level.

In 2012, premium devices (in orange) represented 38% of the market, while economy-line devices (in blue) made up 19% of the units dispensed/purchased. The remaining 44% of devices dispensed for this calendar year, therefore, were mid-level devices (in red).

In the short period between 2012 and 2015, mid-level devices (in red) have continued to climb, increasing by an additional 7%, (from 44% to 51%,), and economy-line devices (in blue) have also increased by an additional 3% (from 19% to 22%). Increases to both these tiers also means that premium devices have decreased, falling in market share by 11% in four short years.

The negative trend for the premium devices cannot be blamed on manufacturers, as wholesale prices have fluctuated by less than $50 over this time period. We also do not believe that the $150 increase in retail price (i.e., a 16% increase in percent markup) was sufficient to cause an 11% decrease in demand. Economy- and mid-line devices increased by 3% and 7%, respectively, with no large-scale changes in wholesale price either. While prices (and percent markup) decreased, the market did not increase substantially, which was expected given the inelastic demand function.

One could also argue that market share increases for a given technology level are based on consumer trends and satisfaction with devices. If this argument holds true, then the next question that must be asked in a future post is:

Why is consumer preference for lower-technologies increasing while preference for premium technology decreasing?

Fittingly, Stairway to Heaven lyrics seem to fit the bill by sharing our viewpoint and wrapping up today’s post:

“Yes, there are two paths you can go by

But in the long run

There’s still time to change the hearing aids you’re wearing (or fitting)”

Footnotes and References

-

Percent Markup = [(retail price-wholesale price)/wholesale price)] x 100

-

Amlani AM & DeSilva DG. (2005). Effects of economy and FDA intervention on the hearing aid industry. American Journal of Audiology, 14, 71-79.

This is Part 7 of the 2016 Hearing Aid Price Series update. Click here for Part 1, Part 2, Part 3, Part 4, Part 5, and Part 6.

Co-editor Amyn M. Amlani, Ph.D., is Professor and Chair of the consortium program in Audiology & Speech Pathology between the University of Arkansas for Medical Sciences and the University of Arkansas at Little Rock.

Dr. Amlani holds the B.A. degree in Communication Disorders from the University of the Pacific, the M.S. degree in Audiology from Purdue University, and the Ph.D. degree in Audiology/Psychoacoustics (minor in Marketing and Supply Chain Management) from Michigan State University. His research interests include the influence of hearing aid technology on speech and music; economic and marketing trends within the hearing aid industry; and playing bass guitar in various heavy metal cover bands. Email: AMAmlani@uams.edu

A first thought about consumer preference for lower technology may somehow include the quickness with which new products enter the scene–products without documentation of noticeable patient benefit. Further, one needs to consider the increase in third party payments for instruments, as well as the limited expansion of a less affluent buyer population (maybe those outreach, educational things do work).

Every hearing aid in my opinion should be a behind-the-ear model, with telecoils that have been installed and programmed. You would be surprise how many telecoils are not even turned on because the hearing health provider did not know how or thought it was not important. They should have manual volume controls and directional microphones that lower the background noise in a noisy environment. Noise reduction is not recommended since voices are noise. If both ears have a hearing loss then each ear should wear a hearing aid. Proper fitting by a hearing aid provider is necessary so start looking for one just like you do when shopping for an automobile. Join Hearing Loss Association of America (HLAA) a non-profit organization that provides information, education, support and advocacy for people who realize they are losing their hearing and have no where to turn.

http://www.hearingloss.org Do not try to hide your hearing loss with a tiny hearing aid because the people you work already know or they think you are not as smart as you once were.