Editor’s Note: It’s easy to see that behemoths like Amazon, which combines online shopping, low prices and speedy delivery are utterly transforming the customer experience. Along with Amazon, however, many smaller companies such as Dollar Shave Club and Stitch Fix are getting in on the action by offering a convenient, hassle-free product at a reasonable price.

What does this rise of web-based subscription-based services portend for hearing healthcare professionals?

No one can predict the future, but we can agree that every customer – no matter what they are buying – likes quality and convenience at a lower-than-expected price. As Thales Teixeira suggests in his insightful book, Unlocking the Customer Value Chain, once customer’s experience a better buying experience with one good or service, they are more likely to embrace this non-traditional buying experience with other completely unrelated goods and services. Take, for example, DoorDash, a food delivery service that makes it easy for customers to get meals from your favorite restaurant delivered straight to your door, it could be a matter of time before an increasingly larger number of customers expect similar convenience when buying health-related products, like hearing aids.

The main point made by Teixiera is that disruptive businesses are always on the lookout for consumer pain points and they will use modern technology (smartphone apps, wi-fi, credit card transactions) to find a gap in the market to create value for customers (and revenue for themselves). For hearing healthcare providers one of the potentially overlooked parts of disruptive innovation is that new companies could make the traditional customer acquisition process more convenient for persons seeking help for their hearing. Arguably, we are already seeing that now with the rise of on-line hearing aid retailers (Listen Lively) and Medicare advantage contractors.

These upstart business models will force audiologists and hearing instrument specialists to adapt their traditional linear business model in which they control the entire value creation process from acquisition to annual follow-up to a more blended approach where hearing care professionals’ partner with other outside companies in the customer acquisition process. And, in return for acquiring new customers, some of the revenue generated from the transaction is, in turn, shared.

Over the next several months, Signal and Noise will be offering some insights from experts on how the customer acquisition process is changing, their opportunities and threats for business managers as well as now the customer acquisition process can be managed more effectively with the right set of KPIs and their associated benchmarks.

First up, Signal and Noise presents some thoughts from managed care experts at TruHearing. Obviously, managed care contracts are a hot-button issue in the profession. As you read this two-part article, however, it’s helpful to think about third party contracts as one tine of a multi-prong customer acquisition strategy that respects the buying behavior of savvy customers looking for hearing healthcare solutions.

–Brian Taylor, AuD, Editor-at-Large

Third-Party Referrals: Do they provide enough financial value?

For the independent provider, the need to maintain a profitable clinic is a daily concern. Even the most successful independents must focus on how to acquire and retain customers, stay competitive, and increase the bottom line. As a result, one of the most important questions to ask when making business decisions is, “How will this affect my clinic’s profitability?”

Third-party referrals have been one of the more controversial topics of debate among providers over the past few years. Are they a positive—and have the potential to increase overall profitability—or a negative because they compete directly with the retail business?

To answer that question, every independent provider needs to be able to calculate the economic value a third-party referral offers their clinic. To do this accurately, it’s important to account for all factors related to profitability rather than only looking at top-line revenue per sale. The most accurate way to do this is to calculate the profit per patient per hour. How to perform this calculation is explored in detail later in this article, but first it’s important to understand today’s consumer mentality and why third-parties are attracting them.

Why Hearing Aid Consumers Go Through Third Parties

The internet has played a major role in creating a hearing aid consumer who is more knowledgeable about hearing aid technology, pricing, and the many avenues available for purchasing them.

Readily available information and online consumer reviews and recommendations often compete directly with the independent provider’s marketing in attracting consumers to a non-traditional path for purchasing hearing aids. Some of these paths include the provider and some do not.

For example, direct-to-consumer options—like iHear Medical, BuyHear and Audicus—exclude hearing care providers altogether. On the other hand, many third-party referral companies—like TruHearing, EPIC, Hearing Care Solutions, and Hear.com, do include providers in the hearing care process.

However, not all third-party companies attract the same types of consumers or operate in the same manner. Some use online direct-to-consumer marketing practices to generate leads, which are then funneled to the providers within their network. Others operate using a managed-care model by partnering with insurers to offer their services to members in the form of a benefit or discount. In both cases, providers are paid a professional fee—which varies by company—for dispensing hearing aids to these third-party referrals.

The reasons consumers choose to go through third-parties are fairly simple – they believe their insurer, or the online channel is a trusted source, they are attracted by the promise of saving money and believe they will receive the best overall value.

Comparing Profit from a Retail Patient versus a Third-party Referral

Historically, average selling price (ASP) and total number of hearing aids sold have been strong indicators of the financial health of a retail clinic. However, this is no longer accurate because competitive market pressures have compressed margins on hearing aid sales and because not all hearing aid sales are out-of-pocket.

Today, many providers work with a mix of hearing aid buyers – third-party referrals for which a professional fitting fee is paid to the provider and those patients who pay out-of-pocket. These market changes have made it necessary for providers to calculate profit in a new way – profit per patient per hour.

Providers who know their profit per patient per hour, will be able to utilize this data to make informed financial decisions to maintain a successful clinic.

For example, to determine if third-party referrals are a good financial fit for their practice, the financial impact of offering free hearing tests or whether to shift their business to a medical model, where patients are charged for value-based services, rather than continuing to focus on the income from the sale of a consumer product.

Gathering the Right Data to Measure Profit Accurately

It’s important to note that calculating profit per patient per hour is not the same calculation or the same numerical value as how much profit your clinic needs to keep its doors open.

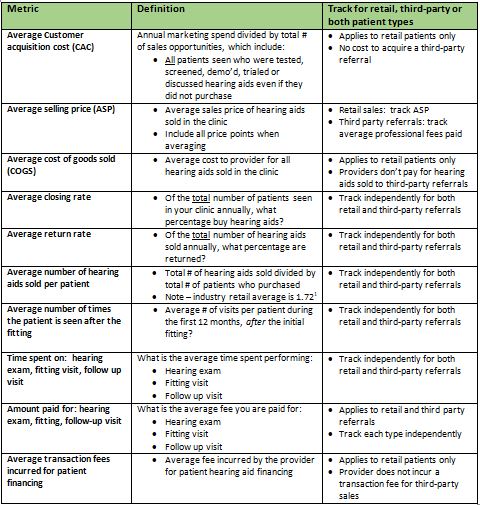

To calculate profit from retail patients and from third-party referrals, all factors which influence profitability must be measured and tracked independently for each type of patient. This is because not all metrics apply to both types of patients. For example, there is no customer acquisition cost or cost of goods for third-party referrals but there is for retail patients.

It’s important to keep in mind that these metrics will be different for each third-party referral company therefore, profit per patient per hour must be calculated independently for each company as well.

A closer look at what data points must be measured and whether they influence retail profitability, third-party referral profitability or both are shown in Table 1 below.

As Table 1 indicates, a multitude of factors influence profitability. Although it’s not expected that the profit from a third-party referral will be greater than from a retail sale in the first year, many providers who have performed this calculation have been surprised that the profit margin was much closer than expected. Knowing their specific clinic’s data further supported their decision to accept third-party referrals.

Calculating Profit per Patient per Hour

Once the data outlined in Table 1 is gathered, the profit per patient, per hour, calculation can be completed. Providers are encouraged to contact their business or financial advisor for assistance with performing the calculation.

Alternatively, for providers who wish to perform the calculations on their own, TruHearing has developed a simple- to-use tool, the TruHearing Financial Calculator. A short video demonstration of the calculator and how one provider uses it in his clinics can be viewed on YouTube here.3

Considerations for Third-party Managed Care Referrals

The amount of profit generated by a third-party managed care referral weighs heavily in the decision to accept them. Here are some additional considerations specific to third-party managed care referrals.

Expanding Hearing Aid Benefits:

For the 2018 benefit year, 73% of Medicare Advantage enrollees nationwide chose a Medicare Advantage plan that offered a hearing aid benefit. This is an increase from 65% in 2017 and 47% in 2015. The number of insurers partnering with a third-party company to administer their benefits increases each year. These factors make accepting these referrals an increasingly important decision for providers to make.

Competitive Advantage:

Third-party referrals are only sent to in-network providers, giving those providers a competitive advantage.

Access to Referrals:

In order to maintain access to plan members, a growing number of plans require providers be in-network with the third-party company administering the hearing care benefits. For providers located in an area where a third-party managed care company has contracted with large plans in their area, this may play a significant role in the decision to accept these referrals.

High Purchase Rate:

A hearing aid benefit offers consumers a compelling factor in the decision to purchase hearing aids2. Consumers value controlling out-of-pocket costs while utilizing the insurance they’re already paying for.

First Time Users:

When plans notify members of their benefit, referrals increase. Many of these are first time users seeking to utilize their hearing aid benefit.

Save Time and Money:

With no customer acquisition cost, no time and resources spent on insurance verification and for many no time spent on claims submissions, third-party managed care referrals save providers and their staff time and money.

Not All Third-party Managed Care Referral Companies are the Same

As more third-party managed care companies emerge, providers must also consider that not all operate in the same manner, making some companies easier to work with than others. These differences, in addition to profit potential, should weigh in on the decision of which third-party companies to partner with.

Here are a few considerations which impact provider and staff time and resources:

- Timeliness of provider payments

- Service visit requirements and charges

- Appointment scheduling process

- Patient preparedness prior to appointment

- Ordering process

- Insurance verification

- Billing/claims process

For a more in-depth look at managed care, its expansion in the hearing industry and how consumers are driving change, read “Managed Care: Threat or Opportunity” published in The Hearing Review, January 2018.

References:

- Karl Strom, 4MyBiz/Hearing Review, May 2016. The Hearing Review: Introduction to MT9, May 15, 2015.

- “An Introduction to MarkeTrak IX: A New Baseline for the Hearing Aid Market.” Abrams, Harvey B., PhD; and Jan Kihm, MS. Hearing Review. June 2015

- Providers can contact TruHearing Provider Outreach for a copy of the financial calculator at 855.286.0550 or [email protected].

About the Authors

Austin Singleton, AuD, is the Vice President of Provider Relations and Audiological Director at TruHearing. Dr. Singleton has a strong understanding of the provider’s perspective through his experience running private practices in Illinois, working in hospital and ENT settings and currently serving patients in an audiology practice. He is fluent in American Sign Language and has worked at the Utah School for the deaf and Blind. With expertise in Medicare Advantage programs, Dr. Singleton has presented nationally on topics of managed care, issues impacting the hearing industry and the financial benefits of 3rd party referrals for audiologists in clinical practice.

Austin Singleton, AuD, is the Vice President of Provider Relations and Audiological Director at TruHearing. Dr. Singleton has a strong understanding of the provider’s perspective through his experience running private practices in Illinois, working in hospital and ENT settings and currently serving patients in an audiology practice. He is fluent in American Sign Language and has worked at the Utah School for the deaf and Blind. With expertise in Medicare Advantage programs, Dr. Singleton has presented nationally on topics of managed care, issues impacting the hearing industry and the financial benefits of 3rd party referrals for audiologists in clinical practice.

Patty Greene, M.A., is an audiologist with more than 28 years of experience in the hearing care industry. As TruHearing’s Director of Provider Engagement, Patty is responsible for helping providers successfully utilize TruHearing programs and services through provider communications and education. She has presented nationally on topics of Managed Care, current trends and consumer impact on the hearing industry, and marketing. Previously, she has held positions in sales, marketing and training with leading hearing aid manufacturers as well as having managed her own private audiology practice.

Patty Greene, M.A., is an audiologist with more than 28 years of experience in the hearing care industry. As TruHearing’s Director of Provider Engagement, Patty is responsible for helping providers successfully utilize TruHearing programs and services through provider communications and education. She has presented nationally on topics of Managed Care, current trends and consumer impact on the hearing industry, and marketing. Previously, she has held positions in sales, marketing and training with leading hearing aid manufacturers as well as having managed her own private audiology practice.