Who in the U.S. Hearing Aid Market is Purchasing Hearing Aids?

It is common knowledge that hearing aid manufacturers, especially the Big Six, have been purchasing and operating their own hearing aid sales stores, significantly reducing the numbers operated by independent dispensers. The market consists of both a private (approximately 79%) and public sector (approximately 21%), with the public sector dominated by the Veterans Affairs (VA).

Private Hearing Aid Sales

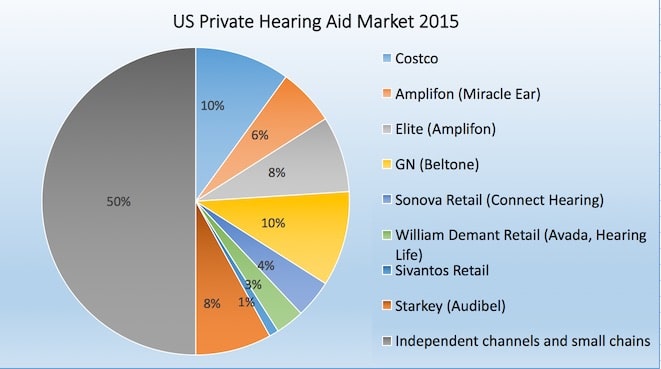

The chart in Figure 1 provides a snapshot of private U.S. hearing aid sales for 2015, based on a variety of published and confidential reports. It is believed that the estimates are fairly accurate. This shows that essentially 50% of U.S. unit sales are directly to manufacturer-owned outlets/franchises, or to a large company-owned store group (i.e., Costco).

Figure 1. Snapshot of private U.S. hearing aid unit sales percentages for 2015.

The gray section (50%) represents unit sales percentages made by independent channels and small chains. This percentage also includes smaller manufacturer-owned stores and insurance or company-paid hearing aid purchases whose sales numbers are unknown. But because they are not represented in the larger company-owned operations, they have been arbitrarily included in the independent channels and small chains category (i.e., Zounds, Wal-Mart, Sam’s Club, PCS drug stores, and other like operations).

Independent Channels and Small Chains

It has been reported that only 39% of dispensers in the U.S. are independent, meaning that they are not part of a hearing aid manufacturer company-owned or franchised operation. However, many in this 39% purchase from one of the Big Six (GN, Sonova, William Demant, Sivantos, Starkey, and now also with Widex – reportedly buying independent hearing aid businesses in the U.S. under the Helix band). These unit sales are not included in the percentages represented by manufacturer-owned office sales.

Manufacturer-owned Outlets/franchises, or Large Company-owned Stores

How many retail outlets do manufacturer-owned, or large box stores have? These numbers are not known exactly, so a best-guess is provided below, with numbers obtained from financial reports and other sources. No numbers are available yet regarding the newly formed EarVenture between IntriCon and the ADA (Academy of Doctors of Audiology), although in excess of 300 ADA members have signed up to offer these products in their practices in the first month{{1}}[[1]]Personal communication with Delain Wright of IntriCon, November 10, 2015[[1]].

| Manufacturer/Company | # Outlets |

|---|---|

| Starkey (Audible) | 1,133* |

| GN (Beltone) | 1,302* |

| Sonova (Connect Hearing) | 473* |

| William Demant (Avada, Hearing Life) | 450* |

| Savants/Siemens (Hear USA) | 180* |

| Costco | 500+ |

| Amplifon (Miracle Ear) | 1,200 |

| Amplifon (Elite)** | 1,600 |

| Zounds | 200 |

| Widex (Helix) | ? |

* Bernstein Report, September 22, 2015.

**Elite is a buying group for independent dispensers.

Outlets – Private

It would be helpful to know how many independent retail hearing aid outlets exist in order to compare company-owned/franchised stores to privately-owned retail store numbers, shown above to exceed 5,000 (Elite numbers were not included in the count).

It has been reported by the U.S. Bureau of Labor Statistics that 6,221 retail businesses exist that sell hearing aids as of July, 2014. This number is much less than the number of licensed audiologists and licensed hearing aid dispensers, because quite often, a single retail business has multiple locations, and often includes multiple individuals licensed to sell hearing aids. This number would exclude those individuals who sell hearing aids, but not through a registered retail hearing aid business. Additionally, not all audiologists or dispensers who are licensed sell hearing aids. This makes the determination of the number of offices selling hearing aids difficult to calculate. With certainty, one cannot use the total number of audiologists and hearing instrument specialists to arrive at the number of retail outlets.

The 2013 U.S. Bureau of Labor Statistics indicated the number of audiologists at 13,000, and that 17% were in retail sales (but, retail sales percentage based on 2010 data). Based on those statistics, the number of audiologists selling hearing aids at that time would be about 2,340 – a number that is suspect.

The Bureau of Labor Statistics in 2014 reports 12,250 audiologists – who are able to assess and treat persons with hearing and related disorders. They may (emphasis added) fit hearing aids and provide auditory training, and may perform research related to hearing problems. There was no indication as to what percentage were in retail sales, as was given in 2013, but certainly not all were.

The 2014 U.S. Bureau of Labor Statistics lists the number of hearing aid specialists at 5,570. The hearing aid specialist is defined as one able to select and fit hearing aids for customers, they can administer and interpret tests of hearing, can assess hearing instrument efficacy, take ear impressions, and prepare, design, and modify earmolds. Excludes “Audiologists.” But, again, this gives no indication of the number of outlets.

These numbers might seem to be at odds with a report by Freeman in 2009){{2}}[[2]]Freeman, B., The coming crisis in audiology, Audiology Today, Nov/Dec 2009, pp 43-53[[2]] in which he estimated the number of those licensed to sell hearing aids at about 16,000 licensed audiologists and 8,000 hearing instrument specialists. However, in recent communications with Dr. Freeman in response to the numbers collected by this author{{3}}[[3]]Personal e-mail communication with Barry Freeman, 11/16/2015[[3]], he suggested that the Department of Labor (DOL) number of 12,250 may represent full-time employees (FTE), and based on an AAA 2011 Salary Survey which shows that about 20% of audiologists work part time, the DOL number may not be too far off. The same might be true for hearing instrument specialists as well, where Freeman’s data showed about 8,000, but if FTE are considered, might be closer to the 5,570 reported by the DOL.

In spite of these numbers relating to the number of individuals licensed to sell hearing aids, the number of actual stores through which hearing aids are sold (a retail outlet) remains elusive. Would defining a retail operation help in making this determination? Perhaps, but most likely not, because some hearing aid retail businesses have multiple offices and multiple licensed individuals in the same store.

What is a Retail Operation?

According to the North American Industry Classification System (NAICS), the retail trade sector comprises establishments engaged in retailing merchandise, generally without transformation, and rendering services incidental to the sale of merchandise.

The retailing process is the final step in the distribution of merchandise; retailers are, therefore, organized to sell merchandise in small quantities to the general public. This sector comprises two main types of retailers: store and non-store retailers.

- Store retailers operate fixed point-of-sale locations, located and designed to attract a high volume of walk-in customers. In general, retail stores have extensive displays of merchandise and use mass-media advertising to attract customers. They typically sell merchandise to the general public for personal or household consumption, but some also serve business and institutional clients. In addition to retailing merchandise, some types of store retailers are also engaged in the provision of after-sales services, such as repair and installation.

- Non-store retailers, like store retailers, are organized to serve the general public, but their retailing methods differ. The establishments of this subsector reach customers and market merchandise with methods, such as the broadcasting of “infomercials,” the broadcasting and publishing of direct-response advertising, the publishing of paper and electronic catalogs, door-to-door solicitation, in-home demonstration, selling from portable stalls (street vendors, except food), and distribution through vending machines.

From these definitions, it would appear that ENT clinics, hospitals, and perhaps even some audiology clinics/practices/schools that provide a full scope of audiology services, who have a professional license, but which do not dispense hearing aids, are not included in the retail sales category numbers from the DOL.

The Public Hearing Aid Market

This market is dominated by the Veterans Affairs (VA) and constitutes 21% of U.S. sales. The VA is the largest purchaser of hearing aids in the U.S., and purchases primarily from Sonova, GN, William Demant, and Sivantos (formerly Siemens), with unit volumes in that order. These numbers are not included in the company-owned retail store unit sales percentages to the right side of the pie chart, or anywhere else on the chart because they are not private purchases.

Wayne; This is a good report. May I print it and share this in Seattle next week with the U.S. Commercial Service Staff I am meeting with from more than a dozen countries?

Darroch:

Yes, you may. Make certain that the HHTM references are all shown, as published.