Until recently, hearing aids supposedly weren’t able to be purchased over-the-counter (OTC). Instead, consumers had to have a professional evaluate their hearing loss, set the hearing aid’s performance, and teach proper use. However, recent OTC sales of hearing aid legislation has opened the door to focus on OTC self-fitting of hearing aids.

Why is Self-Fitting of Hearing Aids an Issue?

OTC sales of hearing aids has recently been introduced by legislation at the federal level. The reason is because statistics from the National Institute of Deafness and other Communication Disorders report that of adults 70 years of age and older, and who could benefit from hearing aids, that fewer than 30 percent have ever used one. The key word is “used,” not even “own” or “wear.” In reality, market penetration has been declining for the past two decades or longer, primarily due to increases in the aging population and an inability of the current medical model distribution system to make any significant headways to increase market penetration1.

Many comments have been made by hearing professionals in opposition to OTC (over-the-counter) hearing aid sales, often citing the inability of a hearing-impaired individual to self-fit the product, an activity inherent in OTC sales.

The only problem with such comments is that to the best of knowledge, none of those commenting in opposition to OTC hearing aid sales have ever sold an instrument OTC, have engaged in a self-fit of hearing aids, or conducted a study comparing OTC sales against the traditional medical model. If they had, they may have been in violation of State and Federal regulations, depending on their sales model. So, where did they gain their expertise and knowledge in order to comment with such certainty?

Why Not Ask Those Who Have Such Knowledge?

A review of the Internet shows that many individuals/groups/facilities have been providing OTC hearing aids and or PSAPs (Personal Sound Amplification Products) which are really hearing aids) for a number of years. A non-intensive and rather quick search of the Internet finds at least 50 different businesses selling PSAPs online. Quite a large number are also selling hearing aids online. It is generally implied by hearing professionals that few of such products are sold, and that purchasers have not been satisfied with them. These comments seem to be based generally on anecdotal reports or wishful thinking. These implications may very well be true. But, every audiologist has also heard stories about individuals who have not been satisfied with their premium-priced hearing aids supplied by other hearing professionals. The industry continues to operate on an approximate 25% to 30% return rate on conventional products, somewhat similar to what personal reports are on OTC/PSAP products. One has to wonder where the greatest damage occurs – not being satisfied with a premium-priced hearing aid, or with a much less expensive amplification product? Which of these customers is less likely to try amplification again soon? Might it be the customer who has already taken the best approach and product the industry has to offer, or someone who still has the option of upgrading? What is interesting related to this discussion, is that MarkeTrak VIII reported that nearly half (45.3%) of direct-mail consumers previously tried or owned traditional hearing aids. Additionally, direct-mail consumers wear their hearing aid more than 9 hours a day, the same as traditional hearing aid consumers, but are slightly less likely to place their hearing aid in the drawer (3.0% versus 8.2%).2 The percentage of hearing aid owners who purchased their hearing aid through the mail was 3.28% (280,000 people) in 2010, and 5.1% in 2004.3

A Michigan Ear Institute study on 9 consumers demonstrated that a BTE (behind-the-ear) hearing aid sold by direct mail offered a reasonable low-cost solution to those not wearing hearing aids or amplification devices because of cost concerns. The study found that the hearing aids met the acoustic targets, and that all participants demonstrated user satisfaction scores within the standard range for consumers with mild to moderately-severe hearing loss.4

As reported previously, in a clinical study of 15 consumers in which traditional hearing aids were compared to fixed-format PSAPs, close approximations to real-ear aided responses occurred. Additionally, no significant differences in mean performance for aided speech recognition or field ratings of aided performance were found. Patient satisfaction was lower for the PSAPs, primarily due to fit and comfort of the deep insertion.5

In a preference study of hearing aids versus PSAPs, 20 adult subjects performed as well in this laboratory study as did hearing aids (basic and premium) for everyday noises and music, but not for speech.6

A 2014 study comparing traditional and direct-mail hearing aid use reported that consumers are willing to make trade-offs in benefit for substantial reductions in price, even though benefit might be less.7 This study has the largest, and essentially only, database that reports on consumer positions over time, and used the customer database (all data and actions anonymous ID# and blinded) of Hearing Help Express of DeKalb, IL, but not conducted by Hearing Help. The database consisted of all customers for 39 months. A 6-page MarkeTrak-type survey was mailed to random customers (sample size of 2,332 and 16% return rate). Customers had been self-fitted, selecting gain, preferred hearing aid style, features, price, and making their own ear impressions if the selection process took them to more severe hearing level requirements. The did have unlimited access to licensed hearing aid dispensers for recommendations, if needed. This was mostly phone contact. Customer comparisons of this population were made to various MarkeTrak data of consumers who purchased their hearing aids via the traditional hearing professional hearing aid distribution system. Interestingly, in the Hearing Help Express population, almost half (45.3%) were previous traditional hearing aid users. 5.6% had previously tried (purchased/tried) OTC hearing aids, and about one-fifth (18.8%) were previous customers of other direct-mail firms. The direct-mail consumer had been a hearing aid user significantly longer than the traditional hearing aid user (14.2 versus 9.6 years).

The out-of-pocket cost per hearing aid to the direct-mail consumer was $299 compared to $1,500 for the traditional user (after 3rd party pay and VA aid costs had been deducted for the latter). Data suggested that the direct-mail owner was slightly less likely to place their hearing aid in the drawer (3% versus 8.2%), more likely to recommend hearing aids to others (91% versus 82%), and have greater brand loyalty. Because these percentages did not meet the study 10 percentage point criterion difference, they should be reviewed in that light. Additionally, overall satisfaction and perceived benefit by consumers were nearly equivalent, with direct-mail consumers rating their hearing aid significantly higher on value (79% versus 65%). Other scores on listening and sound quality were somewhat similar between the groups, but both groups rated poor performance in noisy situations at a rate of about 30%. The most spectacular hearing handicap reduction experiences were related to traditional customers.

A couple of findings require restating and consideration relative to this post’s discussion of OTC hearing aid sales:

- Almost half (45.3%) of direct-mail consumers had previously tried or owned traditional hearing aids. Does this speak to a disconnect in the current traditional delivery system?

- Direct-mail consumers were slightly less likely to place their hearing aids in the drawer (3.0% versus 8.2%). Could this be that the expectation was higher with traditional and more-costly hearing aids (speculation only)?

- About half of non-adopters with serious hearing loss indicated that they would purchase a hearing aid within the next 2 years if the hearing aid was priced under $500.8

OTC/PSAP Sales

As to the number of PSAPs (or similarly-sold amplification products) that have been sold, there are no numbers available – not even good estimates. Few of the companies are willing to provide their sales numbers and/or revenues, consistent with the practices of most non-public companies. But, a cursory investigation suggests that the numbers may be much higher than might be generalized.

MarkeTrak 83 estimated that 1.45 million individuals might be wearing PSAPs. This compared to 10 million owners of hearing aids. In identifying PSAPs, a liberal definition was used. As added information, the average income of those purchasing PSAPs was about $10,000 lower than those purchasing from hearing aid retailers. This survey asked people if they had personal sound amplifiers, using this definition: “a device that amplifies sound that was not fit by a hearing care professional”.

One of the first audiologists to sell PSAPs via mail was Michael Nehr. Tragically, his activity cost him his business, his freedom, and nearly $10m in legal fees before being vindicated in a court of law. Michael sold one of the first non-hearing aid PSAPs, Crystal Ear. Although he always wanted to sell these through the professional channel, he met resistance from that community. As a result, he started selling Crystal Ear through the mail. Michael admitted the surprising response of the public to an amplifier sold through ads in publications like Reader’s Digest and Smithsonian Magazine. Never were these sold as hearing aids and there was enough interest for the company to sell 20,000 per month in the late 1990s and early into 2000. This was at a time when only 1.5-1.8 million hearing aids were sold in the U.S., not counting an additional 240,000 Crystal Ear’s.

Additional insight into the number of OTC/PSAP unit sales comes from a CNN Moneyline news feature as reported by The Hearing Review, in which CNN reported that Telebrands, the marketers of Whisper XL, sold over 400,000 units in the April-November period of the year the news feature occurred (1994). If true, Whisper XL, during that time period, would have accounted for approximately 21.5% of the U.S. hearing instruments market. The product sold for less than $30 and was sold without involvement by hearing care professionals.9 Multiple such products have become available, and with many having substantial advanced technology. Most of the better products now carry a higher cost, reflecting their improvement, but still ranging in cost from about $50 to $500, with an average price at about $200.

CEA (Consumer Electronics Association)10 estimated that hearables (very conceivably another form of OTC/PSAP) were estimated to be $50 billion dollars global market by 2018. This is separate from what is called the traditional hearing aid market.

Preferred Purchase Locations for OTC/PSAP products

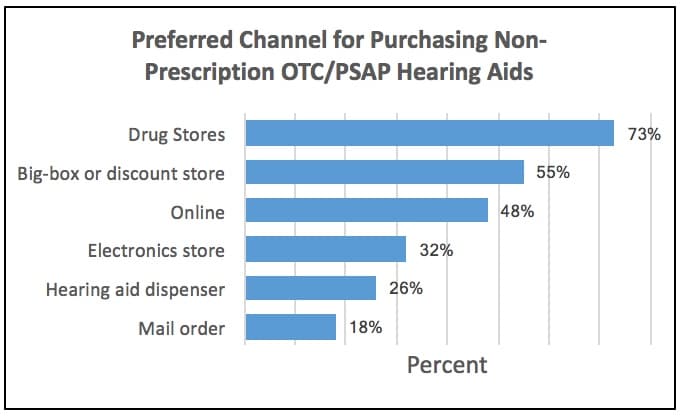

Among those that do not currently own a PSAP, over a third of those either diagnosed with hearing loss, or with a lot or some hearing difficulty (39% each), are interested or very interested in purchasing a non-prescription option to hear better.10 Where they would prefer to purchase such non-prescription products is shown in Figure 1.

Figure 1. Preferred channel for purchasing non-prescription PSAPs (author comment placing PSAPs in the same category as OTE products). Base: Online U.S. adults with some degree of hearing loss who do not own a PSAP but are interested/very interested in purchasing one (n=334). Hearing aid dispenser is traditional or audiologist. Question: If you were to purchase a non-prescription or ‘over the counter’ device for yourself to help you hear better, where would you be willing to purchase that device?

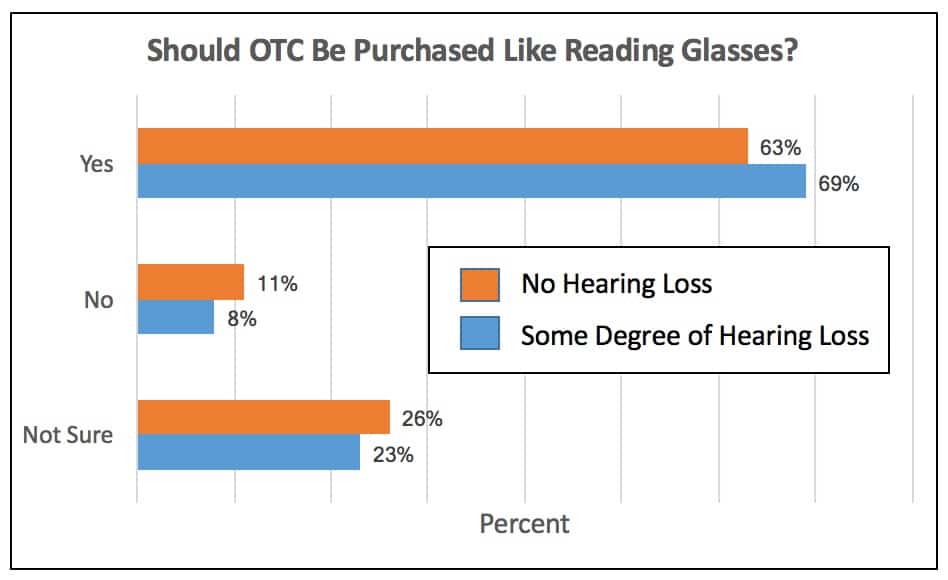

Over two-thirds (69%) of adult Americans with hearing difficulty, equating to a sizable 68 million people, feel they should be able to buy hearing assistance products the same way they purchase reading glasses, while 63% of those without hearing loss feel the same. Furthermore, just a tenth are opposed to the idea, and a quarter are not sure how they feel about it (Figure 2).5 Hearing professionals argue that no comparison can be made with OTC hearing aids and reading glasses. Because there is no evidence one way or the other, time will tell, with the consumer being the judge.

Figure 2. Support for non-prescription hearing assistance products. Base: Online U.S. adults with some degree of hearing loss (n=1,554); Online U.S. adults with no hearing loss (n=1,870). Question: Do you think consumers should be allowed to buy hearing assistance products the way they can now buy reading glasses (e.g., through the mail or at a local drug store)?

The Hearing Aid Market is Already Being Disrupted

Internet sales, PSAPs, and mail order of hearing aids have been active for several years (especially some mail order for more than 40 years). Published customer satisfaction comments are most generally positive. This is expected because none of these companies are interested in publishing negative comments. But, this is true also for any of the hearing professional sites.

Big Box stores have had a significant impact in changing where consumers go to purchase hearing aids for a lower cost (for example, Costco with an 11% of the 37% independent hearing aid market share),11 although they have been “sanctioned” by the Hearing Industries Association (HIA) as being an acceptable distribution system because they include the “…professional care inherent to successful adoption of hearing aids.” HIA goes on to say that OTC sales of hearing aids (implying self-fit, which is a main part of OTC sales) is a bad decision because “no studies have indicated that people can accurately self-diagnosis either the cause or extent of their hearing loss.”12 That statement is just as true as saying that no studies have indicated that people cannot accurately self-diagnose the extent of their hearing loss. The significance of requiring an audiometric evaluation has not been shown to improve a person’s performance with hearing aids. And, to the best of knowledge, diagnoses of hearing loss remains under the realm of the physician. The argument of the significance/insignificance of the audiogram to determine hearing level for successful hearing aid fitting has been discussed already in previous posts.

Summary

Marketing is satisfying consumer needs. Selling is satisfying our needs. It seems that many consumers are expressing what they are interested in, and we, the hearing professionals keep telling them what we think is good for them. In the long run, the consumer will win, one way or the other. The signals of what to consider are blaring, and a substantial population of consumers are interested in an OTC hearing aid delivery system. A marketer would realize that such a market has a rather large potential and would find ways to service this market segment. Continuing to beat a floundering horse in a race is a certain pathway to failure.

More on the OTC sales of hearing aids in future posts.

References

- Freeman B. The coming crisis in audiology. Audiology Today. Nov/Dec 2009:46-53.

- Kochkin S. (2014). A comparison of consumer satisfaction, subjective benefit, and quality of life changes associated with traditional and direct-mail hearing aid use. Hearing Review, January.

- Kochkin S. MarkeTrak VIII: Utilization of PSAPs and Direct-Mail Hearing Aids by People with Hearing Impairment. The Hearing Review, June 2010; Volume 17, Number 6: Pages 12, 14, 15, & 16.

- Hearing Review. Small Study Presented at AAO-HNSF Positively Evaluates OTC Device. October 2, 2012. /all-news/20680-clarificationsmall-study-presented-at-aao-hnsf-positively-evaluates-otc-device.

- Walden TC, Walden BE, Cord MT. (2002). Performance of traditional versus fixed-format hearing aids for precipitously sloping high-frequency hearing loss. J Am Acad Audiol. 2002;13:356-366.

- Xu, J., Johnson, J., Cox, R., and Breitbart, D. (2015). Laboratory Comparison of PSAPs and Hearing Aids. American Auditory Society, Scottsdale, AZ, March, 2015.

- Kochkin S. MarkeTrak VIII: 25 year trends in the hearing health market. Hearing Review. 2009;16(11):12-31.

- Kochkin S. MarkeTrak VIII: The key influencing factors in hearing aid purchase intent. Hearing Review. 2012;19(3):12-25.

- The Hearing Review. (1995). Page 14.

- Consumer Electronics Association. (2014). Personal sound amplification products: a study of consumer attitudes and behavior. CEA Market Research Report, August, 2014.

- Staab W. (2015). Independent hearing aid dispenser directions, July 28, 2014. https://hearinghealthmatters.org/waynesworld/dispensing-systems/costco/

- HIA News Release: Senators Introduce OTC Legislation, December 6, 2016 at 10:23 AM. HIS supports efforts to expand hearing aid use but cautions against “do it yourself” approach.

I want to make sure that I take good care of my ears. It makes sense that a hearing aid would be important! I’ll make sure that I get a professional to prescribe me the proper hearing aid.