by Wayne Staab, PhD

Historically, we think of the U.S. hearing aid market being served primarily by independent dispensers. Following the very early years of hearing aid franchises, sales were made mostly by what we now refer to as independent hearing aid dealers (actually, at one time, called hearing aid audiologists). Over time, audiologists also entered the business of hearing aid sales.

The question to be asked, however is, do these two selling groups, identified as hearing aid dispensers, continue to be independent?

U.S. Hearing Aid Sales

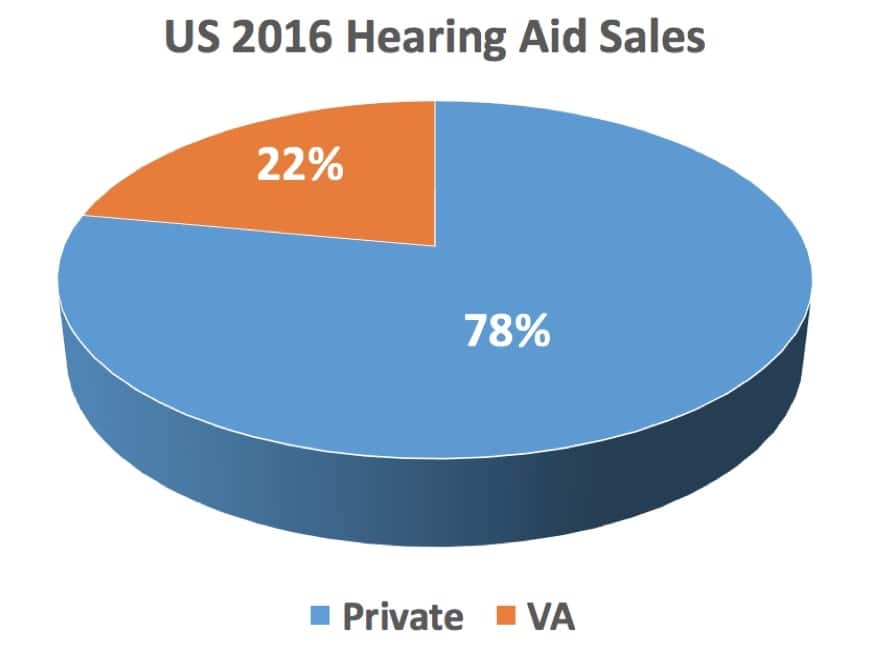

In 2016, the last full year of data, between 3.28 and 3.65 million hearing aids were sold in the U.S.1,2 This consists of 22% sold (roughly 1/5th) through the VA (Veterans Administration) hearing aid program and 78% sold in the private market (Figure 1).2 This percentage is minimally changed with those reported on this site in 2015.

Figure 1. U.S. Hearing aid sales for 2016. (Sources: HIA, Bernstein analysis, author analysis)

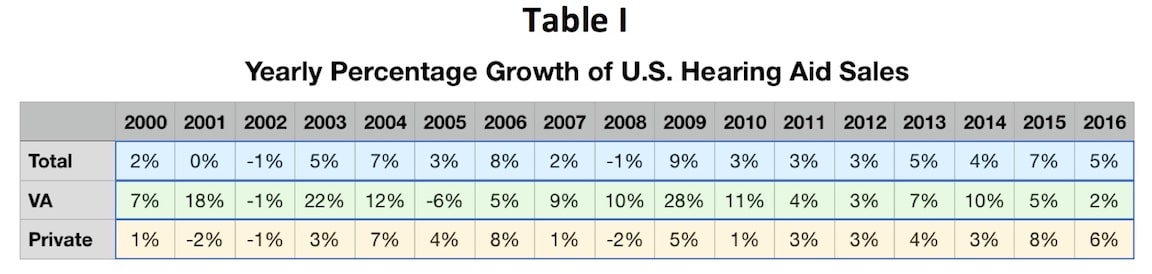

In Table 1, below, the yearly percentage growth of these two sales markets is shown over the past 17 years as reported and estimated by the hearing aid industry.

These figures do not include PSAP (Personal Sound Amplification Products) and other amplification devices used by the hearing-impaired population and which serve essentially as hearing aid devices to assist those with hearing loss, which, if included, would change the percentages, but to what extent, is unknown.3

Most U.S. Hearing Aid Sales Represented by a Handful of Manufacturers

According to the data collected by Bernstein, the so-called “big six” hearing aid manufacturers richly deserve the term, since among them they accounted for 98% of the world market in 2016.

These six companies are GN ReSound, Sivantos, William Demant, Sonova, Starkey, and Widex. Four of these companies (the first four) are public-traded companies, so relatively reliable information about them is available, although not necessarily easily accessible. The last two companies are privately held, and as a result, more detailed data about their sales is limited. These same big six companies are believed to represent a similar high percentage of hearing aids sold in the U.S., but the percentage is not clear, with various unreferenced citations listing this number from 80% to 90%.

Private vs. Independent Sellers of Hearing Aids

This is an important distinction, and necessary to understand how the POS (point of sales) channels contribute to U.S. hearing aid sales.

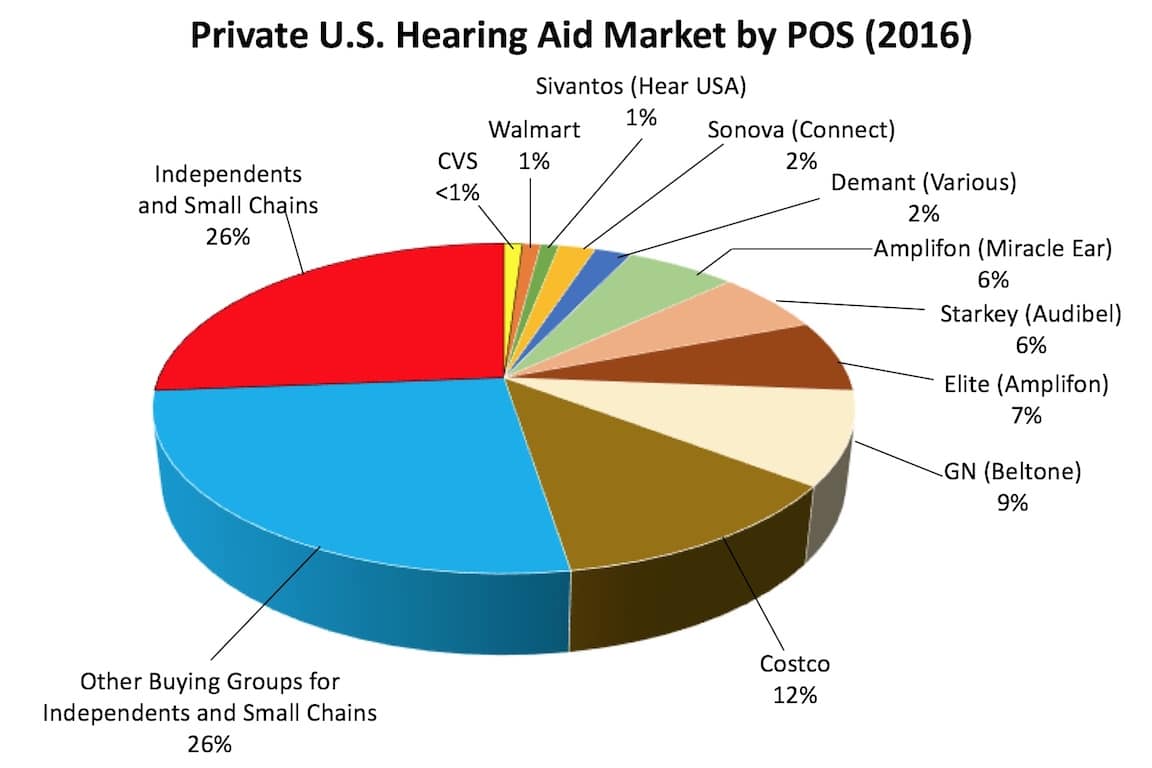

Although Figure 1 provides an interesting general overview, it does not show the market split contributions between the various groups comprising the private market. More specifically, it does not provide a breakdown between actual independent chains and the various buying groups, all of which are covered in the general term “private” market.

To show this breakdown, Figure 2 provides a 2016 split of the U.S. private market.2 This takes into consideration the manufacturers’ own retail (when the manufacturer owns the store and thus employs the sales people), or in the case of Beltone or Miracle Ear where it is a clear franchise situation. While the latter two are considered independent, they are to be viewed as separate from a pure independent. For the buying groups like Amplifon’s Elite, GN’s Audigy, Demant’s American Hearing Aid Associates, these would be considered independent, although they should still be seen as separate from a pure independent.

As a result of these differentiations, and based on referenced calculations, only 26% of the market consists of true, largely unaffiliated independents. And, even within this largely unaffiliated independent group, even they are captive to a large extent, because many of their purchasing agreements include loans, etc. that lock them in with one of the manufacturers. The difference is that they still run their own business.

Figure 2. The U.S. private hearing aid market by split of unit sales by POS (point of sale).* Sources: Corporate Reports, HIA, Bernstein analysis4, Staab (author) analysis.5 The percentage does not equal 100% (adds to 99%) due to rounding calculations.

What Defines an Independent Hearing Aid Retailer?

Many individuals may think that they operate independently. But, in addition to, and reiterating descriptions provided in an earlier report, the following points are to be considered when defining independent retail sales in general:

- Completely responsible for his or her own business

- Makes all the decisions for the store

- Not accountable to shareholders

- Every business decision rests on the owner

- If independent of another, it is separated and not connected, so the first one is not affected or influenced by the second

- The business relies solely on its unique name and reputation (i.e., does not “wear” a regionally or nationally recognized brand name)

- Full decision making function for the business is held by the local owner(s), including the name, signage, brand, appearance, purchasing, etc.

- The business is solely responsible for paying its own rent, marketing, and other expenses

- It is not a vendor (i.e., does not sell wholesale)

- And, perhaps the best indicator: when the owner lays awake at night wondering how the next payroll will be made

Major Drawback to Being Independent

Prices charged are likely to be higher than those charged at a retail chain or store. This generally results in being unable to order in bulk, and as a result, cannot offer bulk discounts to compete.

*A number of financial research firms in the United States and abroad follow the hearing industry on behalf of their clients. These include individual investors as well as institutional investors such as pension and hedge fund managers.

References:

- Industry News. (2017). US hearing aid unit sales increased by 8.7% in 2016. The Hearing Review, January 16, 2017.

- Bernstein. (2017). Hearing aids: private market sees strong November with +9% growth (+4% YTD). VA posts +1% volume growth (+1% YTD). December 14, 2017.

- Staab, W. (2015). The independent hearing aid dispenser, Hearing Health and Technology Matters, July 21, 2015. https://hearinghealthmatters.org/waynesworld/2015/the-independent-hearing-aid-dispenser/.

- Sanford C. Bernstein. Founded in 1967, Bernstein is a leading sell-side Wall Street research firm.

- Staab, W. (2015). Independent hearing aid dispenser directions. (2015). Hearing Health and Technology Matters, July 28, 2015. Independent hearing aid dispenser directions. (2015). Hearing Health and Technology Matters.

Wayne Staab, PhD, is an internationally recognized authority on hearing aids. His professional career has included University teaching, hearing clinic work, hearing aid company management and sales, and extensive work with engineering in developing and bringing new technology and products to the discipline of hearing. Dr. Staab is the Founding Editor of Wayne’s World and served as the Editor-In-Chief of HHTM from 2015 to 2017.

Wayne Staab, PhD, is an internationally recognized authority on hearing aids. His professional career has included University teaching, hearing clinic work, hearing aid company management and sales, and extensive work with engineering in developing and bringing new technology and products to the discipline of hearing. Dr. Staab is the Founding Editor of Wayne’s World and served as the Editor-In-Chief of HHTM from 2015 to 2017.

Wayne,

I appreciate your contributions to the industry and your well-rounded perspective. Thanks.