Hearing Economics is forever asking Why–usually more than 5 times– especially when it comes to the Why of hearing aid prices. The Pricing series has asked the Whys of manufacturing costs, retail Price, and wholesale pricing for different dispensing models. The Why of “markup” shows that net profit–the true markup–is well below $100/hearing aid.

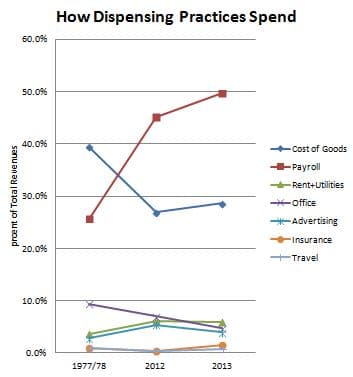

That prompts a host of “Why do we do what we do?” questions that are good fodder for future posts. The Why of tiny profit is due in part to the many and substantial costs bundled into hearing aid Price (Fig 1). But the Why of bundling is hard to unbundle, in part because it forces us to confront existential Who questions.

Better Hearing, Wrapped in a Bundle, Surrounded by Mystery

Dispensing Audiologists sell a bundled product that consists of a tangible good (hearing aid) on the one hand and professional services on the other hand. It’s estimated that 80% of every sale goes to hearing aid manufacturers for the tangible good and to staff for service-related time and expertise (Fig 1). Thus, we sell two completely different, but integrally related, things under a single price tag and have little left to show for it at the end of the day.

Licensed professionals know this and take it for granted. But most consumers neither know this nor take it for granted. Who we are depends on who you ask: we see ourselves as professionals who provide hearing health services. Consumers mainly see us as retail sellers of hearing aid devices.

Functionally, bundling health goods with licensed services puts us in the company of orthodontists and surgeons who insert/remove pace maker, hips, knees, etc. Except that, unlike braces and hips, consumers can get the good and skip the professional services by purchasing hearing devices through unbundled, unlicensed sources. In that regard, we’re more like optometrists versus “cheater” eye glasses at Walgreens.There are other analogies and I’m sure readers can take issue with those I’ve chosen, but the point to be made is that when it comes to the Who question, we are neither fish nor fowl, and the bundling further obscures our identify.

Split Personalities

A 2012 post opined on our bimodal self, split into retail and health service industries according to Sectors 44 and 62 of the US Government’s system of of classifying and tracking US businesses by goods and services (G&S) provided. Here’s the relevant portion of that post:

The US Office of Management and Budget parses hearing healthcare services and goods into different economic sectors, which makes dispensing audiologists a mongrel group with one foot in the Retail Sector and one in Health Services. According to the 2007 North American Industry Classification System (NAICS), “hearing testing services by offices of audiologists” falls in Sector 62, the Health Care and Social Assistance Sector. Sector 62 is characterized by

“…services … delivered by trained professionals. All industries in the sector share this commonality of process, namely, labor inputs of health practitioners … with the requisite expertise. Many of the industries in the sector are defined based on the educational degree held by the practitioners included in the industry.”

and our more specific classification of 621340 is defined, for hearing purposes, as:

“… diagnosing and treating … hearing problems. These practitioners operate private or group practices in their own offices (e.g., centers, clinics) or in the facilities of others, such as hospitals or HMO medical centers.”

So far, so good. But once audiologists (or others) elect to “treat” with tangible products such as hearing aids, they wander into Sector 44, the Retail Trade Sector, in the good company of other healthcare providers such as pharmacists. When our transactions include hearing aids, there is no doubt that we belong in Sector 44, as we are

“engaged in retailing merchandise, generally without transformation, and rendering services incidental to the sale of merchandise” and are “organized to sell merchandise in small quantities to the general public….[and] engaged in the provision of after-sales services, such as repair.”

Whither Goeth Us?

Whither Goeth Us?

Next post in this series will compare our bimodal selves to our purer Retail and Health Services brethren in hopes of figuring out which way we roll. Meanwhile, our annoying split personality thing keeps popping up like Dexter arguing with his Dark Passenger:

- Our service selves are getting busier as the years go by and the hearing aids get more advanced, at least based on rising proportion of expenses going to service versus falling proportion of expenses for Cost of Goods (Fig 1). You’d think that means more expertise and time are required to properly fit and program today’s advanced technologies, right? Maybe not… read on.

- Our mortal selves are headed for extinction according to some market analysts. Here’s a good comment in that vein to last week’s post:

- “The reality is that convenience and cost are the major players here. Purchasing hearing aids at one third of the price and the ability to adjust them yourself from the comfort of your home for people with mild to moderate loss is gaining popularity by the truck load. As technology improves and is refined the need for audiologist’s will diminish overtime.”

- Or maybe our selves are in short Supply, as Kevin Liebe suggested recently by forecasting the creation of Audiology alter egos (quasiologists) to meet Demand. As if our dual selves situation isn’t bad enough, now there will be three of us in the room arguing about bundling.

- Or maybe Economics will triumph and all three of our selves, bundled or not, will snuggle up in our rightful place in the Market universe:

- In the end game, market forces will likely prevail that do not exclude Audiologists from any part of the Demand curve, but they do suggest that “huge” market growth will [occur] in environments where Price will ultimately dictate terms of employment. Stakeholders will [try] to adjust the market through regulations, licensure, Scope of Practice, and price floors. Those efforts will doubtless be countered by increasing availability of lower priced, direct-sale “audio devices,” thus maintaining and promulgating the bimodal distribution of sales.

The decision to bundle or unbundle may ultimately boil down to asking each consumer/customer/patient what they want. Those who want Better Hearing will likely want a bundled product. Those who want cheap and DIY will go unbundled. Those who want their insurance to pay will get whatever insurance offers, with bundled/unbundled packaging of the insurer’s choosing. Something for everybody, even quasiologists. How existential is that?

(Editor’s note: This is Part 15 in the multi-year Hearing Aid Pricing series. Click here for Part 14 or Part 16).

“Icon made by Freepik from Flaticon.com”; dexter image from reddit